What is a Gift Letter form?

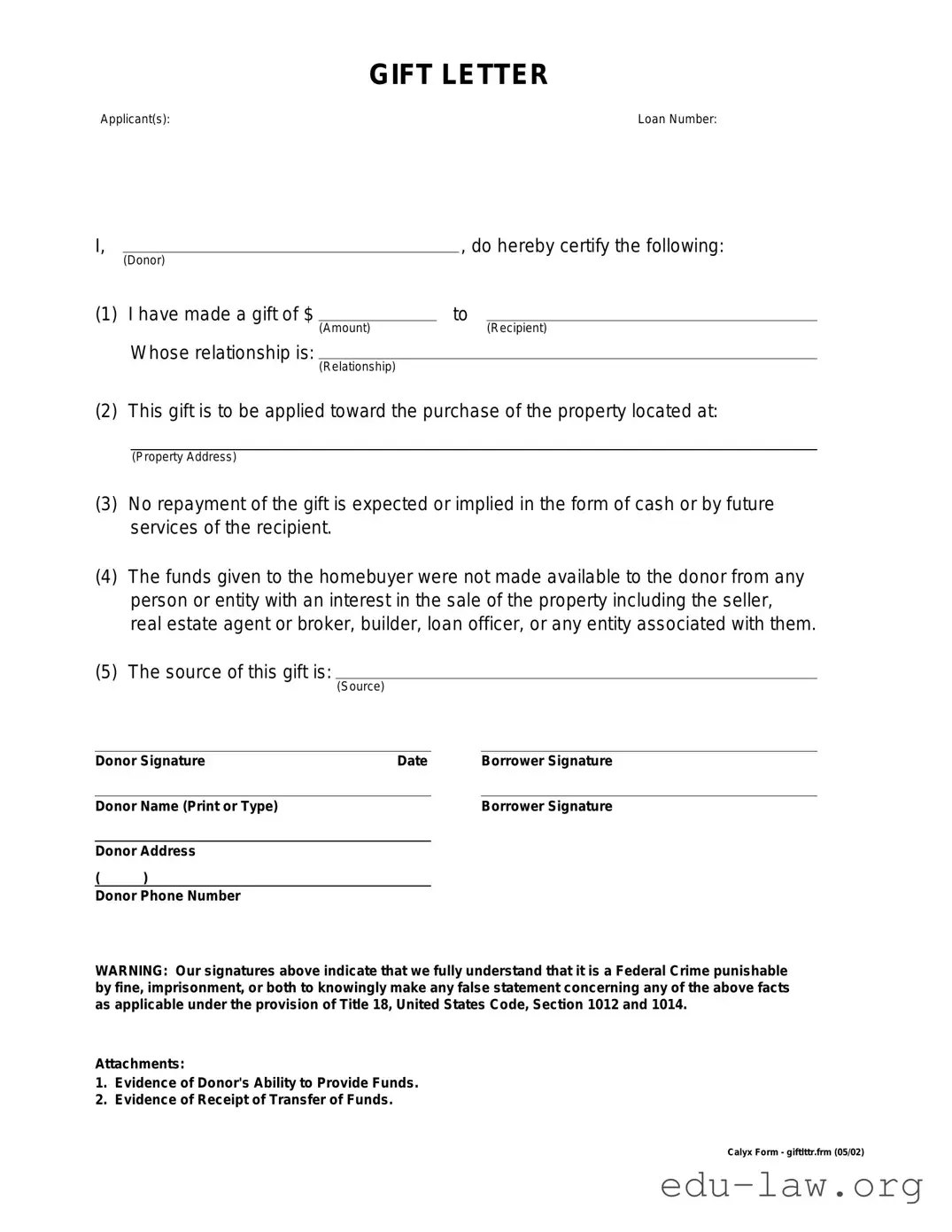

A Gift Letter form is a document that outlines a financial gift given to a borrower, typically to assist with a home purchase. This letter serves to clarify the nature of the gift, confirming that it does not need to be repaid. Lenders often require this form to ensure that the funds are indeed a gift and not a loan, as loans will affect a borrower's debt-to-income ratio. The form includes details about the donor, the amount gifted, and a statement affirming that the money is a gift, with no expectation of repayment.

Who needs to complete a Gift Letter form?

Anyone receiving a financial gift to help with a home purchase may need to complete a Gift Letter form. This includes first-time homebuyers who might be receiving assistance from family members or friends. In some cases, lenders will have specific requirements regarding the documentation of gifts. Therefore, if a borrower plans to use gifted funds as part of their down payment, both the donor and the recipient will typically need to fill out and sign the form to ensure clarity and compliance with lending policies.

What information is required on a Gift Letter form?

Generally, a Gift Letter form should include several key pieces of information. This includes the donor's name, address, and relationship to the borrower. It must also specify the amount of the gift and the date the funds were given. Additionally, the donor should declare that the funds do not require repayment, which helps the lender understand that the financial support is genuine and not a disguised loan. Some forms may also request identification details or proof of the financial gift.

How does a Gift Letter form impact the mortgage application process?

A Gift Letter form can play a crucial role in the mortgage application process. It assures lenders that the funds being used for a down payment are a legitimate gift, which can help borrowers qualify for loans. By confirming that the giver does not expect repayment, the form addresses the lender's concerns about the borrower's overall financial health. This can lead to a smoother approval process, potentially making it easier for individuals and families to secure financing for their homes.