What is a Vehicle Repayment Agreement form?

The Vehicle Repayment Agreement form is a document used when an individual or entity agrees to repay a loan taken out for vehicle financing. This form outlines the terms of the repayment, including payment amounts, due dates, and consequences of default. It serves to protect both the lender's and borrower's interests by clearly detailing the obligations of each party.

Who needs to complete a Vehicle Repayment Agreement form?

Anyone who is financing a vehicle through a loan or lease may need to complete this form. This typically includes individual buyers, dealers, or financing companies. The agreement formalizes the obligation to repay the loan and secures the lender's interest in the vehicle until repayment is completed.

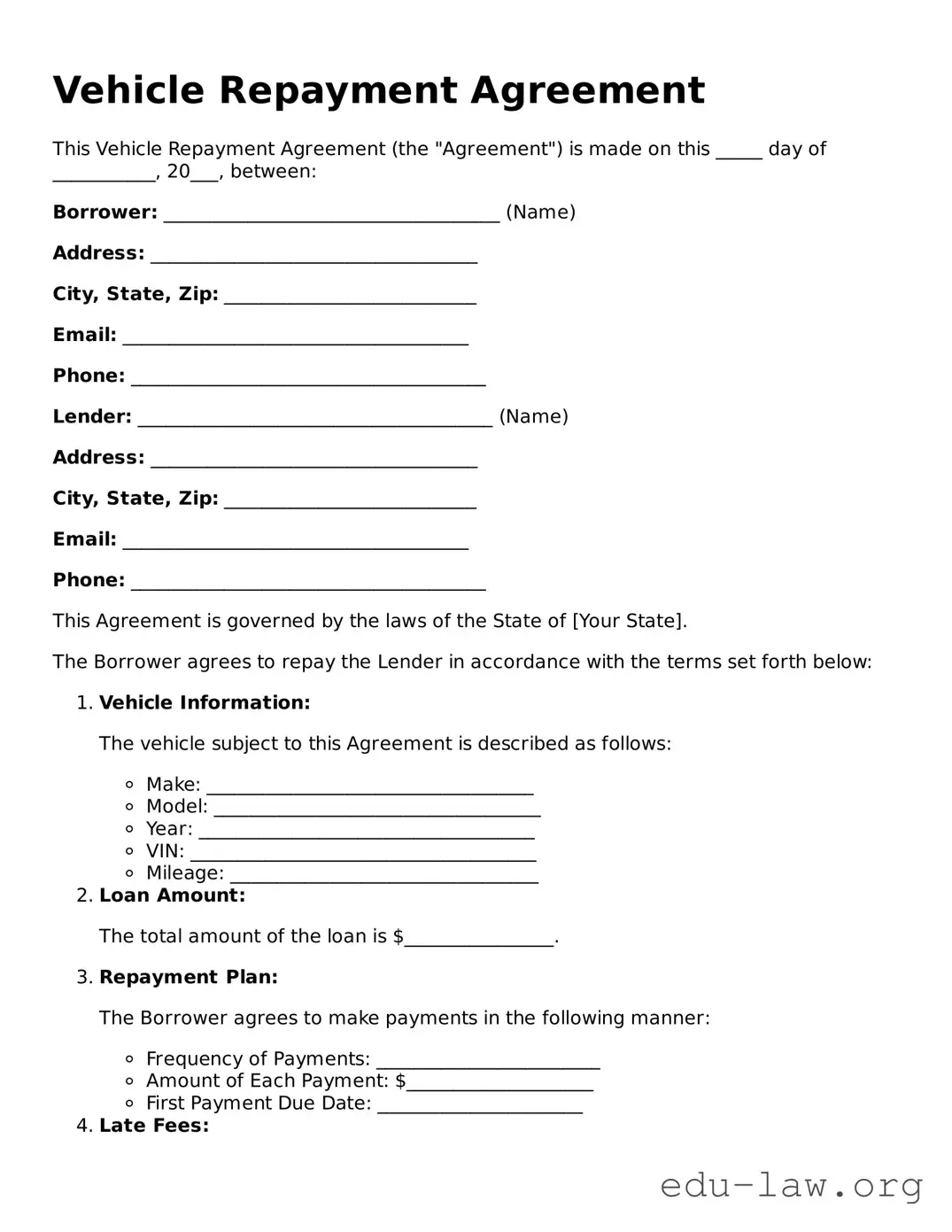

What information is typically required on the form?

A Vehicle Repayment Agreement form generally requires personal information about the borrower, details about the vehicle such as the make, model, and identification number, as well as the terms of the loan. Payment schedules, interest rates, and any additional fees associated with the loan should also be documented.

Are there any specific terms that should be included in the form?

Yes, key terms should include the total loan amount, repayment schedule (including the frequency of payments), interest rates, and any late fees. It's important to clearly outline what happens in the event of a default, as well as any warranties or guarantees regarding the vehicle.

Can the terms of the agreement be negotiated?

Absolutely. Before signing the Vehicle Repayment Agreement, borrowers can negotiate terms with the lender. This may include price adjustments, payment schedules, and fees. It is advisable to reach a mutual understanding that works for both parties before finalizing the agreement.

What happens if I default on the repayment?

If a borrower defaults on the repayment, the lender typically has the right to take action according to the terms of the agreement. This may involve repossession of the vehicle, additional fees, or legal action. The specifics will be clearly outlined in the agreement, advising borrowers of the potential consequences of non-payment.

Is a Vehicle Repayment Agreement necessary for all vehicle loans?

While not all lenders may require a formal agreement, it is strongly recommended. Having a documented agreement protects both parties and provides clarity regarding obligations. It can be particularly important for larger loans or when securing financing from private entities.

Do I need a lawyer to review the Vehicle Repayment Agreement?

While it's not strictly necessary to have a lawyer review the agreement, consulting with one may be beneficial. A lawyer can help ensure that the terms are fair, legal, and in your best interest. It's particularly wise to seek legal advice if any part of the agreement seems unclear or if the amounts are significantly high.

What should I do if I have questions about the form?

If you have questions about the Vehicle Repayment Agreement form or the terms contained within it, it’s advisable to consult with the lender directly. They can provide clarification and answer specific questions related to the agreement. Additionally, reaching out to a legal advisor can ensure a full understanding of your rights and obligations.

Can I amend the agreement after it has been signed?

Amending the Vehicle Repayment Agreement after signing is possible, but it usually requires consent from both parties. Any changes should be documented in writing and signed by both borrower and lender to ensure enforceability. Verbal agreements may not hold up in dispute situations, so written documentation is essential.