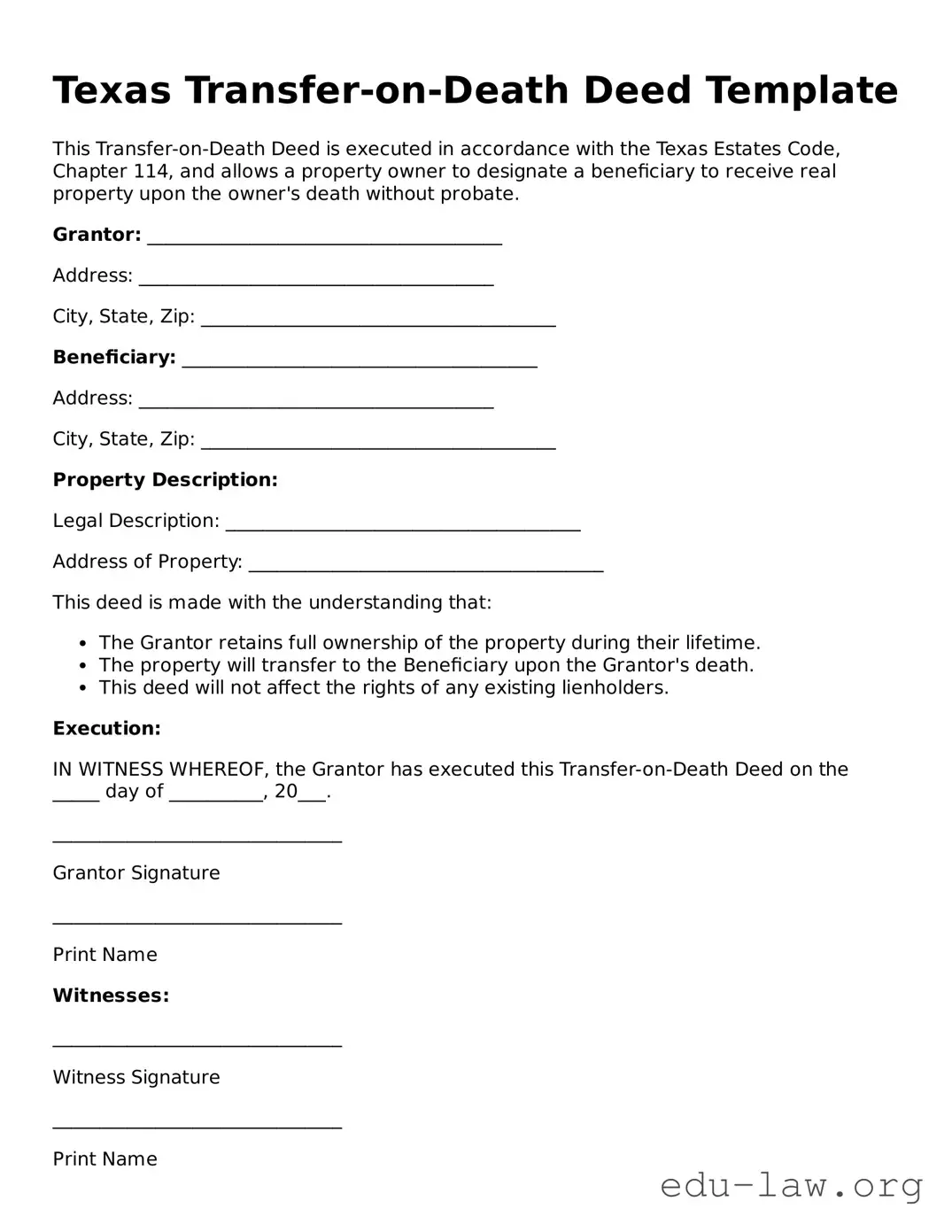

Texas Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with the Texas Estates Code, Chapter 114, and allows a property owner to designate a beneficiary to receive real property upon the owner's death without probate.

Grantor: ______________________________________

Address: ______________________________________

City, State, Zip: ______________________________________

Beneficiary: ______________________________________

Address: ______________________________________

City, State, Zip: ______________________________________

Property Description:

Legal Description: ______________________________________

Address of Property: ______________________________________

This deed is made with the understanding that:

- The Grantor retains full ownership of the property during their lifetime.

- The property will transfer to the Beneficiary upon the Grantor's death.

- This deed will not affect the rights of any existing lienholders.

Execution:

IN WITNESS WHEREOF, the Grantor has executed this Transfer-on-Death Deed on the _____ day of __________, 20___.

_______________________________

Grantor Signature

_______________________________

Print Name

Witnesses:

_______________________________

Witness Signature

_______________________________

Print Name

_______________________________

Witness Signature

_______________________________

Print Name

Notarization:

STATE OF TEXAS

COUNTY OF ______________________

Subscribed and sworn to before me this _____ day of __________, 20___.

_______________________________

Notary Public in and for the State of Texas

My Commission Expires: _______________