What is a Texas Tractor Bill of Sale?

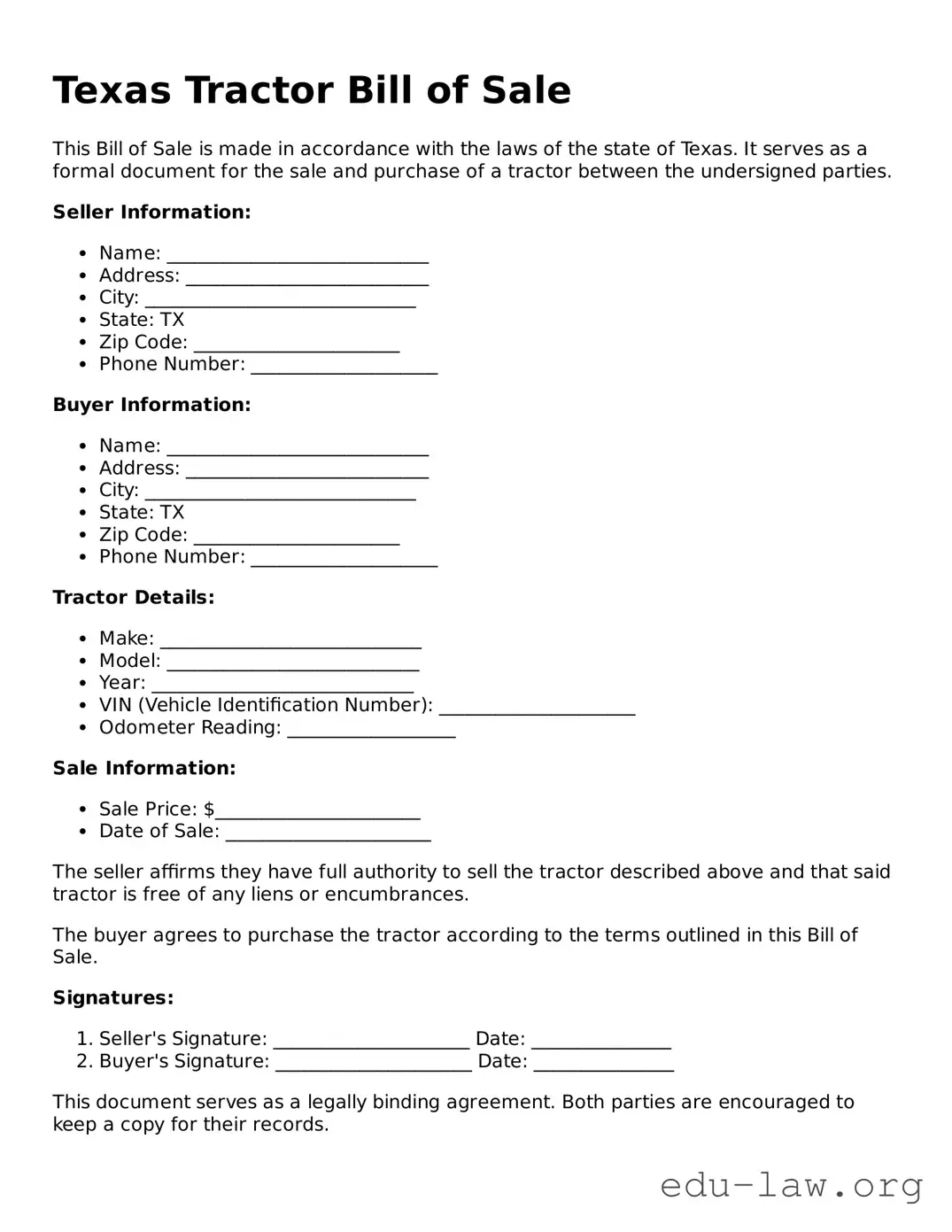

A Texas Tractor Bill of Sale is a legal document that records the sale of a tractor in the state of Texas. This form captures essential details about the transaction, including the names and addresses of the buyer and seller, the purchase price, and the tractor’s description. The document serves as proof of the transfer of ownership and is important for both parties involved.

Why do I need a Bill of Sale for my tractor?

A Bill of Sale is crucial for several reasons. It provides a written record of the transaction, which can protect both the buyer and the seller in case of disputes. The document also helps with registering your tractor with the appropriate authorities and may be required when obtaining insurance. A Bill of Sale ensures that all necessary details about the sale are documented clearly.

How do I fill out a Texas Tractor Bill of Sale?

Filling out the Texas Tractor Bill of Sale is straightforward. Start by entering the date of the transaction. Then, provide the names and addresses of both the seller and the buyer. Include a detailed description of the tractor, including the make, model, year, VIN (Vehicle Identification Number), and any important features. Finally, specify the sale price, and both parties should sign the document. This ensures that everyone is in agreement about the sale's terms.

Do I need to have the Bill of Sale notarized?

In Texas, notarization is not mandatory for a Bill of Sale to be valid. However, having the document notarized can add an extra layer of security and authenticity. This may help prevent future disputes or claims regarding the sale. It’s generally a good practice to have important documents, such as a Bill of Sale, notarized to ensure that all parties are protected.