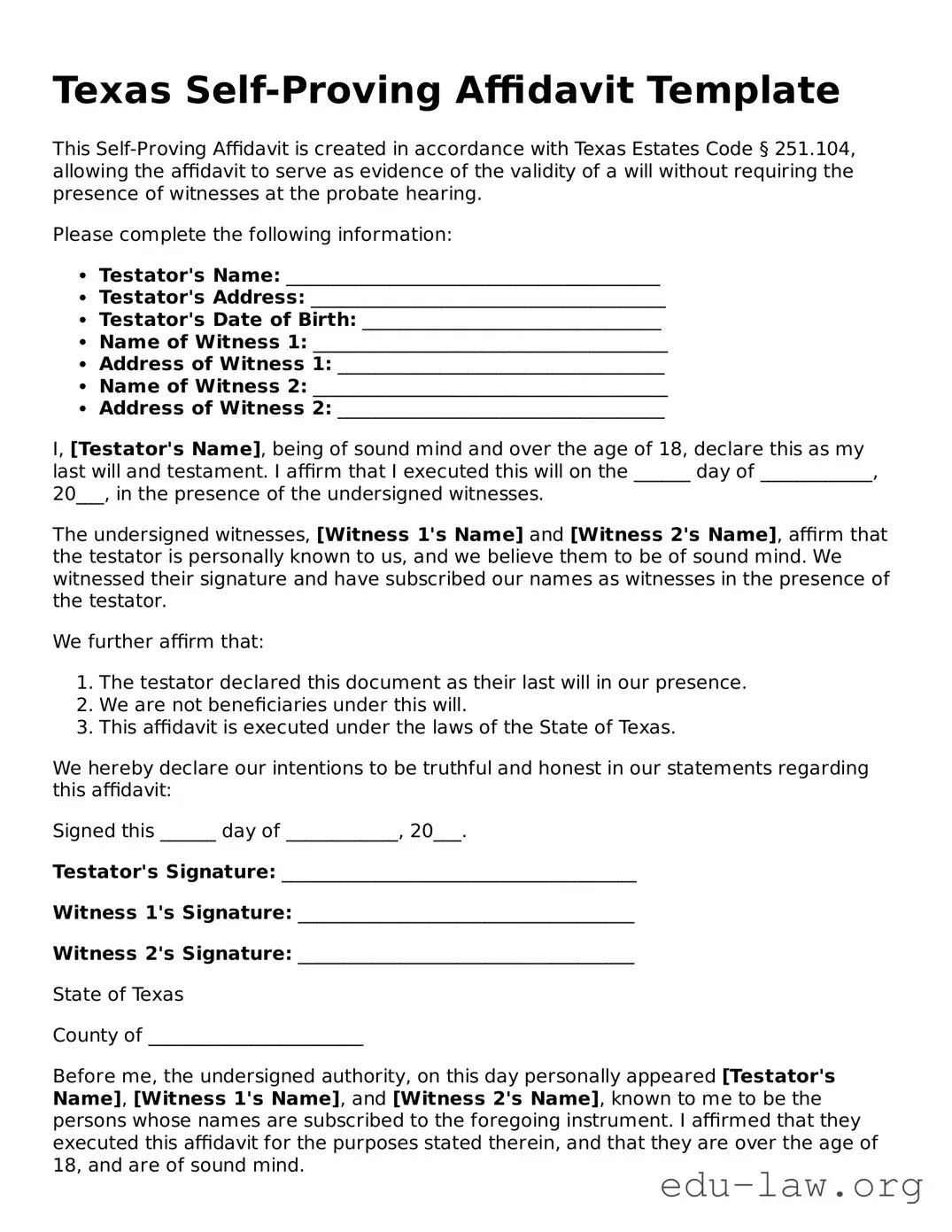

Texas Self-Proving Affidavit Template

This Self-Proving Affidavit is created in accordance with Texas Estates Code § 251.104, allowing the affidavit to serve as evidence of the validity of a will without requiring the presence of witnesses at the probate hearing.

Please complete the following information:

- Testator's Name: ________________________________________

- Testator's Address: ______________________________________

- Testator's Date of Birth: ________________________________

- Name of Witness 1: ______________________________________

- Address of Witness 1: ___________________________________

- Name of Witness 2: ______________________________________

- Address of Witness 2: ___________________________________

I, [Testator's Name], being of sound mind and over the age of 18, declare this as my last will and testament. I affirm that I executed this will on the ______ day of ____________, 20___, in the presence of the undersigned witnesses.

The undersigned witnesses, [Witness 1's Name] and [Witness 2's Name], affirm that the testator is personally known to us, and we believe them to be of sound mind. We witnessed their signature and have subscribed our names as witnesses in the presence of the testator.

We further affirm that:

- The testator declared this document as their last will in our presence.

- We are not beneficiaries under this will.

- This affidavit is executed under the laws of the State of Texas.

We hereby declare our intentions to be truthful and honest in our statements regarding this affidavit:

Signed this ______ day of ____________, 20___.

Testator's Signature: ______________________________________

Witness 1's Signature: ____________________________________

Witness 2's Signature: ____________________________________

State of Texas

County of _______________________

Before me, the undersigned authority, on this day personally appeared [Testator's Name], [Witness 1's Name], and [Witness 2's Name], known to me to be the persons whose names are subscribed to the foregoing instrument. I affirmed that they executed this affidavit for the purposes stated therein, and that they are over the age of 18, and are of sound mind.

Given under my hand and seal of office, this ______ day of ____________, 20___.

Notary Public's Signature: __________________________________

My Commission Expires: ____________________________________