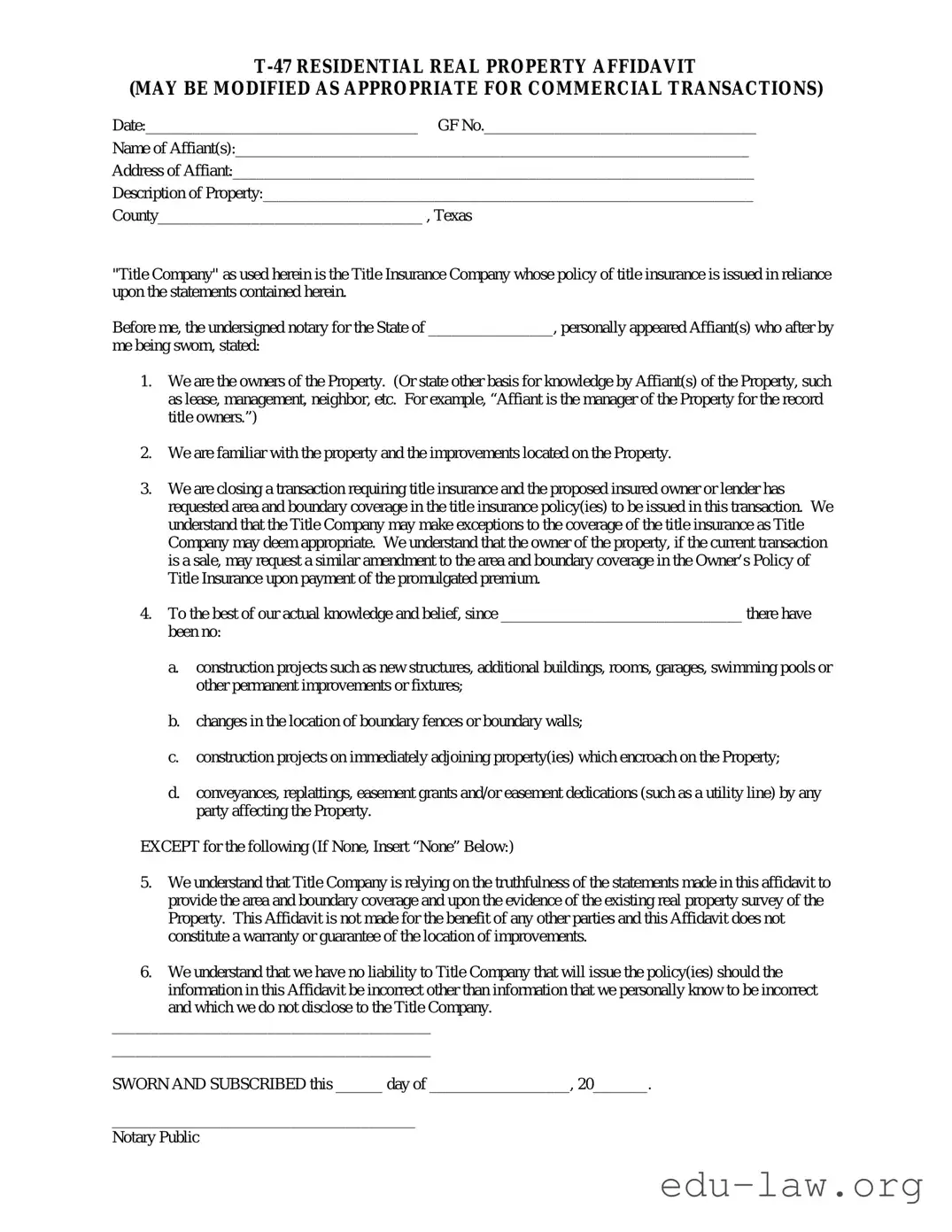

T-47 RESIDENTIAL REAL PROPERTY AFFIDAVIT

(MAY BE MODIFIED AS APPROPRIATE FOR COMMERCIAL TRANSACTIONS)

Date:___________________________________ GF No.___________________________________

Name of Affiant(s):__________________________________________________________________

Address of Affiant:___________________________________________________________________

Description of Property:_______________________________________________________________

County__________________________________ , Texas

"Title Company" as used herein is the Title Insurance Company whose policy of title insurance is issued in reliance upon the statements contained herein.

Before me, the undersigned notary for the State of ________________, personally appeared Affiant(s) who after by

me being sworn, stated:

1.We are the owners of the Property. (Or state other basis for knowledge by Affiant(s) of the Property, such as lease, management, neighbor, etc. For example, “Affiant is the manager of the Property for the record title owners.”)

2.We are familiar with the property and the improvements located on the Property.

3.We are closing a transaction requiring title insurance and the proposed insured owner or lender has requested area and boundary coverage in the title insurance policy(ies) to be issued in this transaction. We understand that the Title Company may make exceptions to the coverage of the title insurance as Title Company may deem appropriate. We understand that the owner of the property, if the current transaction is a sale, may request a similar amendment to the area and boundary coverage in the Owner’s Policy of Title Insurance upon payment of the promulgated premium.

4.To the best of our actual knowledge and belief, since _______________________________ there have been no:

a.construction projects such as new structures, additional buildings, rooms, garages, swimming pools or other permanent improvements or fixtures;

b.changes in the location of boundary fences or boundary walls;

c.construction projects on immediately adjoining property(ies) which encroach on the Property;

d.conveyances, replattings, easement grants and/or easement dedications (such as a utility line) by any party affecting the Property.

EXCEPT for the following (If None, Insert “None” Below:)

5.We understand that Title Company is relying on the truthfulness of the statements made in this affidavit to provide the area and boundary coverage and upon the evidence of the existing real property survey of the Property. This Affidavit is not made for the benefit of any other parties and this Affidavit does not constitute a warranty or guarantee of the location of improvements.

6.We understand that we have no liability to Title Company that will issue the policy(ies) should the

information in this Affidavit be incorrect other than information that we personally know to be incorrect and which we do not disclose to the Title Company.

_________________________________________

_________________________________________

SWORN AND SUBSCRIBED this ______ day of __________________, 20_______.

_______________________________________

Notary Public