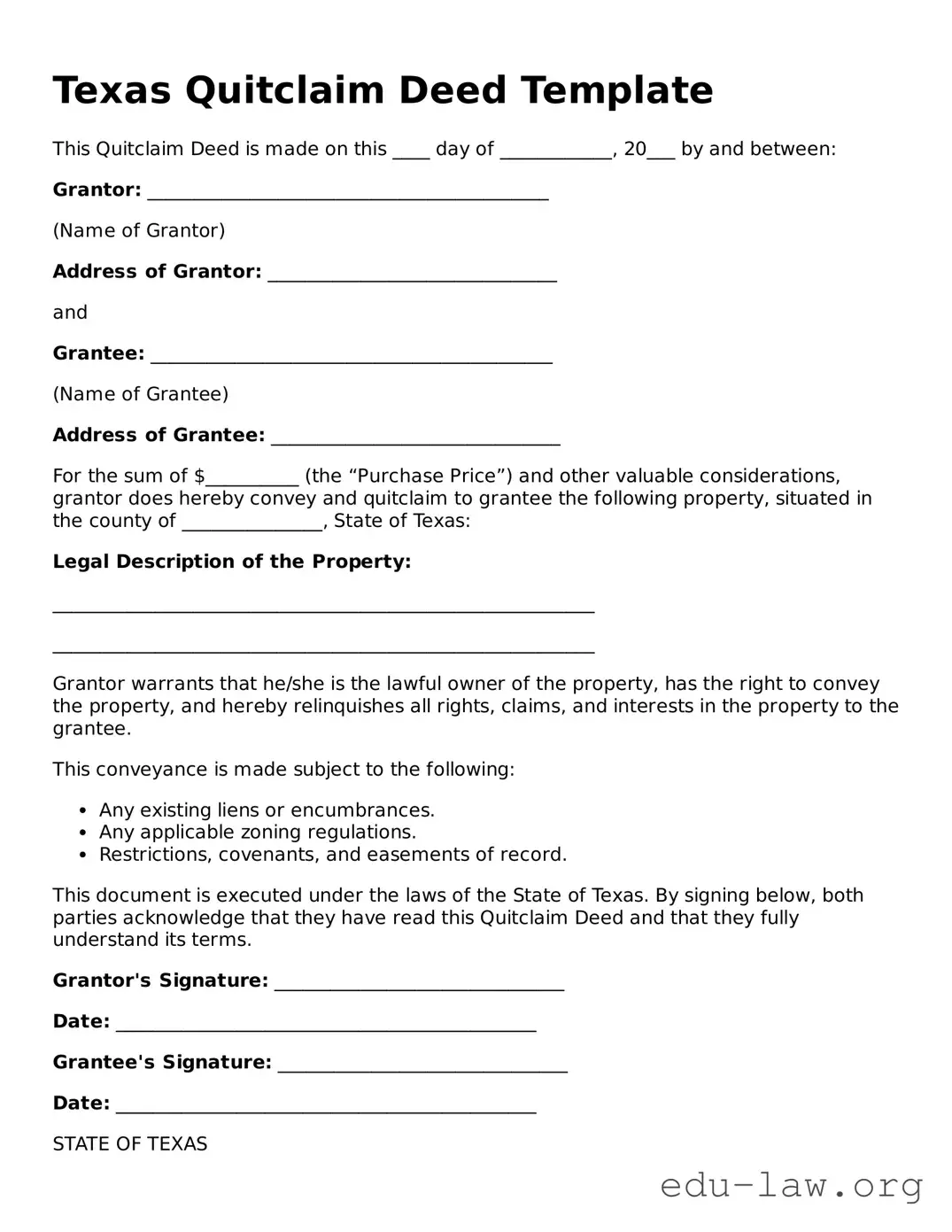

Texas Quitclaim Deed Template

This Quitclaim Deed is made on this ____ day of ____________, 20___ by and between:

Grantor: ___________________________________________

(Name of Grantor)

Address of Grantor: _______________________________

and

Grantee: ___________________________________________

(Name of Grantee)

Address of Grantee: _______________________________

For the sum of $__________ (the “Purchase Price”) and other valuable considerations, grantor does hereby convey and quitclaim to grantee the following property, situated in the county of _______________, State of Texas:

Legal Description of the Property:

__________________________________________________________

__________________________________________________________

Grantor warrants that he/she is the lawful owner of the property, has the right to convey the property, and hereby relinquishes all rights, claims, and interests in the property to the grantee.

This conveyance is made subject to the following:

- Any existing liens or encumbrances.

- Any applicable zoning regulations.

- Restrictions, covenants, and easements of record.

This document is executed under the laws of the State of Texas. By signing below, both parties acknowledge that they have read this Quitclaim Deed and that they fully understand its terms.

Grantor's Signature: _______________________________

Date: _____________________________________________

Grantee's Signature: _______________________________

Date: _____________________________________________

STATE OF TEXAS

COUNTY OF _______________

Before me, the undersigned authority, on this day personally appeared ______________________ (Grantor's Name) and ______________________ (Grantee's Name), known to me to be the persons whose names are subscribed to the foregoing instrument and acknowledged to me that they respectively executed the same for the purposes and consideration therein expressed.

Given under my hand and seal this ____ day of ____________, 20___.

Notary Public Signature: _____________________________

My Commission Expires: _____________________________