What is a Texas Promissory Note?

A Texas Promissory Note is a written agreement in which one party (the borrower) promises to pay a specified sum of money to another party (the lender) under agreed-upon terms. The note outlines the amount borrowed, the interest rate if applicable, the repayment schedule, and any conditions surrounding the loan. It serves as a legal document to protect the interests of both parties.

Who can use a Texas Promissory Note?

Any individual or business in Texas can use this document to lend or borrow money. It is commonly utilized for personal loans, business loans, or even loans between friends and family. However, both parties must be legally capable of entering into a contract to ensure that the note is valid.

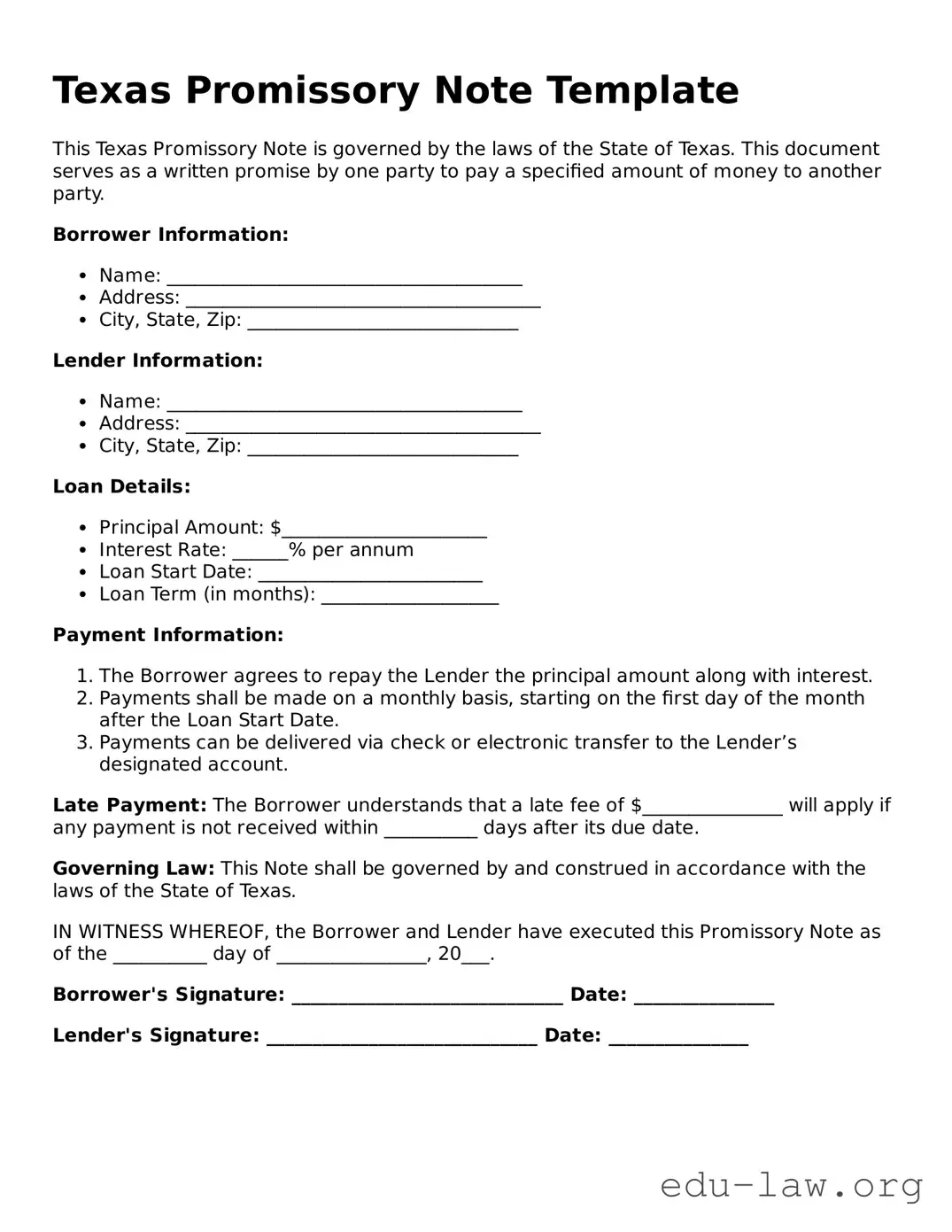

What information should be included in a Texas Promissory Note?

A well-prepared Texas Promissory Note should include the names and addresses of both the borrower and lender, the amount being borrowed, the interest rate, the repayment schedule (including due dates), any penalties for late payments, and signatures from both parties. Additionally, including any specific terms for repayment can be beneficial.

Is a Texas Promissory Note legally binding?

Yes, a Texas Promissory Note is legally binding. Once both parties sign the document, it creates an enforceable obligation for the borrower to repay the loan according to the terms outlined in the note. If the borrower defaults, the lender may take legal action to recover the owed amount.

Do I need a witness or notary for a Texas Promissory Note?

A witness or notary is not required for most informal promissory notes in Texas. However, having either or both can enhance the note's credibility and may make it easier to enforce in court. If a larger sum is involved or if either party has specific concerns, obtaining a notarized or witnessed document may be prudent.

Can I modify a Texas Promissory Note after it has been signed?

Yes, a Texas Promissory Note can be modified after it has been signed. However, both parties must agree to the changes and sign the revised note. It's essential to document any changes clearly to avoid misunderstandings or disputes in the future.

What happens if the borrower defaults on the Texas Promissory Note?

If the borrower defaults, the lender may take various actions to recover the funds. This can include contacting the borrower to negotiate a new repayment plan, seeking mediation, or taking legal action to secure a judgment against the borrower. The specific remedies available depend on the terms of the note and applicable Texas laws.

Where can I obtain a Texas Promissory Note form?

A Texas Promissory Note form can be obtained from various sources. You can find templates online, at legal stationery stores, or through legal service providers. It's important to choose a form that conforms to Texas laws and to customize it according to your specific agreement.