What is a Power of Attorney in Texas?

A Power of Attorney (POA) in Texas is a legal document that grants one person the authority to act on behalf of another in various matters. This can include financial, medical, or legal decisions. The person granting this authority is referred to as the “principal,” while the person receiving it is the “agent” or “attorney-in-fact.”

Why would someone need a Power of Attorney?

Individuals often create a Power of Attorney to ensure their affairs are managed according to their wishes in situations where they may be unable to make decisions for themselves. This could involve incapacitation due to illness, travel, or other reasons. A POA can help avoid complications in managing finances, healthcare, and other personal matters.

What types of Power of Attorney are available in Texas?

Texas recognizes several types of Power of Attorney forms. A durable Power of Attorney remains effective even if the principal becomes incapacitated. A medical Power of Attorney allows the agent to make healthcare decisions. There is also a limited Power of Attorney, which grants the agent authority to act only in specific situations.

How do I create a Power of Attorney in Texas?

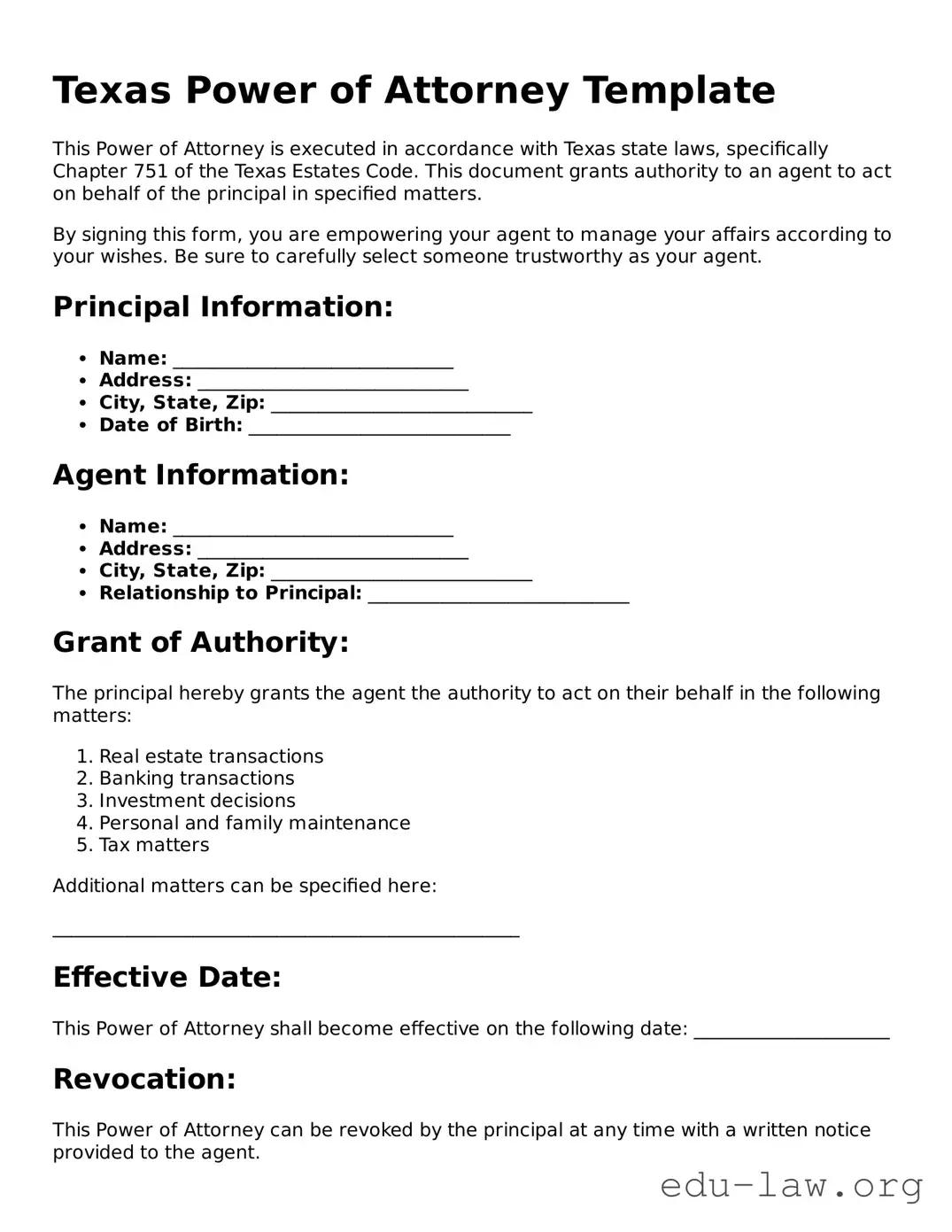

To create a Power of Attorney in Texas, one must complete the appropriate form, which can be found through state resources or legal assistance websites. It must be signed by the principal and, in many cases, witnessed by at least one person or notarized to ensure its validity. Proper execution is crucial to avoid challenges later on.

Can I change or revoke a Power of Attorney?

Yes, a principal can change or revoke a Power of Attorney at any time, as long as they are mentally competent. To do this, a written notice must be provided to the agent and any relevant institutions that may have been relying on the previous POA. Creating a new POA will also automatically revoke any prior versions.

Are there any limitations to the Power of Attorney in Texas?

While a Power of Attorney grants significant authority to an agent, there are limitations. For instance, an agent cannot make decisions that are illegal or that would violate the principal’s wishes as outlined in the document. Additionally, a medical Power of Attorney only applies to healthcare-related decisions.

What happens if a Power of Attorney is not in place?

If a Power of Attorney is not established and an individual becomes incapacitated, family members may need to seek a court-appointed guardianship to manage the person's affairs. This process can be lengthy, costly, and may not align with the individual’s wishes.

Can I use a Power of Attorney for financial matters?

Yes, a Power of Attorney can be specifically designated for financial matters. This allows the agent to handle banking, pay bills, and manage investments on behalf of the principal. It is important to ensure that the form explicitly states the powers granted to the agent for financial activities.

Do I need a lawyer to create a Power of Attorney?

While it is not legally required to have a lawyer to create a Power of Attorney in Texas, it can be beneficial. Legal assistance ensures that the document is properly drafted and complies with all legal requirements, thereby minimizing the potential for future disputes or challenges.

How can I ensure my Power of Attorney is respected by others?

To ensure that your Power of Attorney is respected, keep multiple copies of the signed document and distribute them to relevant institutions, such as banks, hospitals, and legal representatives. Inform them of the existence of the POA and review their policies to confirm they accept it. Maintain communication with your agent to prevent misunderstandings.