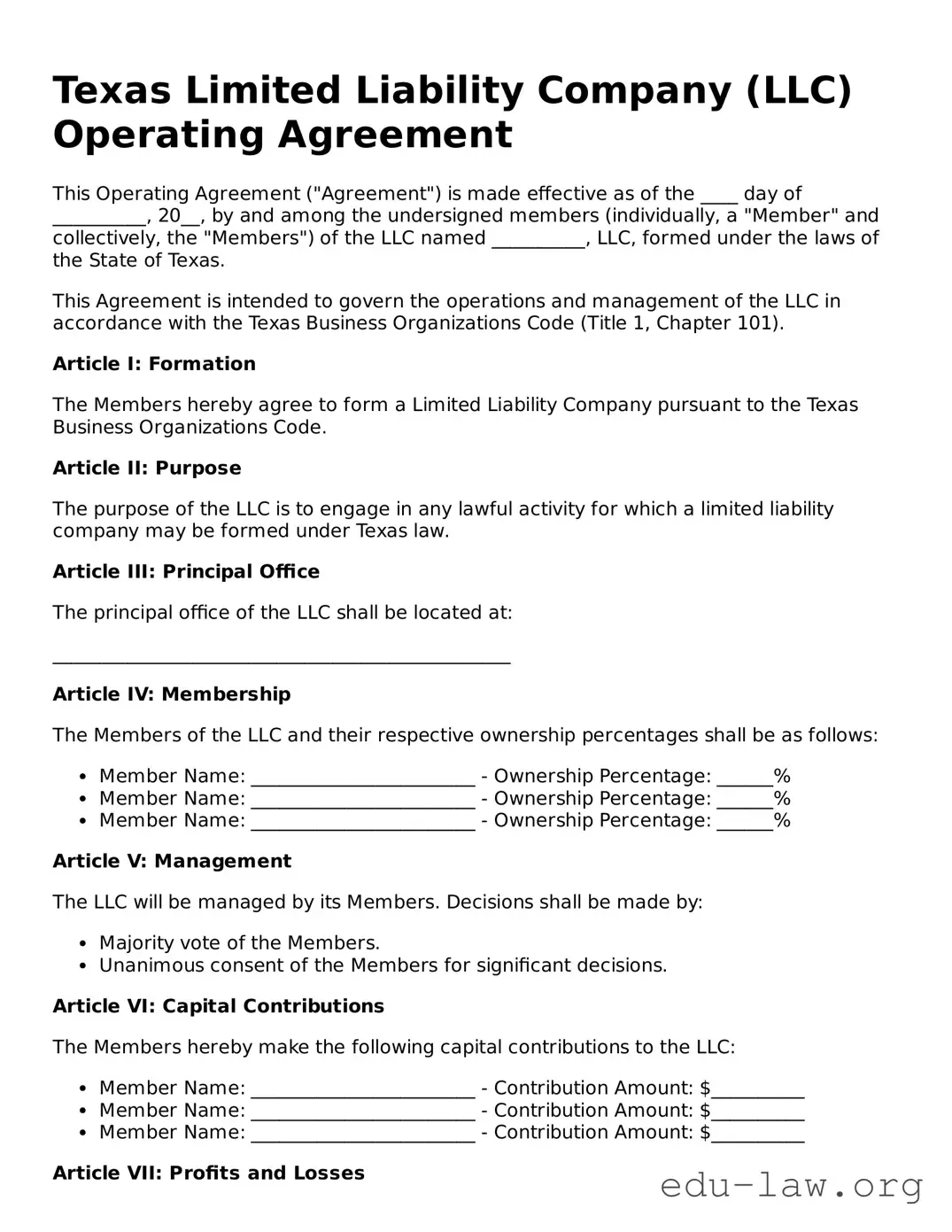

Texas Limited Liability Company (LLC) Operating Agreement

This Operating Agreement ("Agreement") is made effective as of the ____ day of __________, 20__, by and among the undersigned members (individually, a "Member" and collectively, the "Members") of the LLC named __________, LLC, formed under the laws of the State of Texas.

This Agreement is intended to govern the operations and management of the LLC in accordance with the Texas Business Organizations Code (Title 1, Chapter 101).

Article I: Formation

The Members hereby agree to form a Limited Liability Company pursuant to the Texas Business Organizations Code.

Article II: Purpose

The purpose of the LLC is to engage in any lawful activity for which a limited liability company may be formed under Texas law.

Article III: Principal Office

The principal office of the LLC shall be located at:

_________________________________________________

Article IV: Membership

The Members of the LLC and their respective ownership percentages shall be as follows:

- Member Name: ________________________ - Ownership Percentage: ______%

- Member Name: ________________________ - Ownership Percentage: ______%

- Member Name: ________________________ - Ownership Percentage: ______%

Article V: Management

The LLC will be managed by its Members. Decisions shall be made by:

- Majority vote of the Members.

- Unanimous consent of the Members for significant decisions.

Article VI: Capital Contributions

The Members hereby make the following capital contributions to the LLC:

- Member Name: ________________________ - Contribution Amount: $__________

- Member Name: ________________________ - Contribution Amount: $__________

- Member Name: ________________________ - Contribution Amount: $__________

Article VII: Profits and Losses

Profits and losses of the LLC shall be allocated to the Members in proportion to their respective ownership percentages.

Article VIII: Distributions

Distributions of cash or property shall be made to the Members in accordance with their ownership percentages.

Article IX: Amendments

This Agreement may be amended only by a written agreement signed by all Members.

Article X: Governing Law

This Agreement shall be governed by the laws of the State of Texas.

Article XI: Signatures

The undersigned Members hereby execute this Operating Agreement as of the effective date above:

____________________________________ Date: ____________

Member Name: _______________________

____________________________________ Date: ____________

Member Name: _______________________

____________________________________ Date: ____________

Member Name: _______________________