What is a Texas Motor Vehicle Bill of Sale?

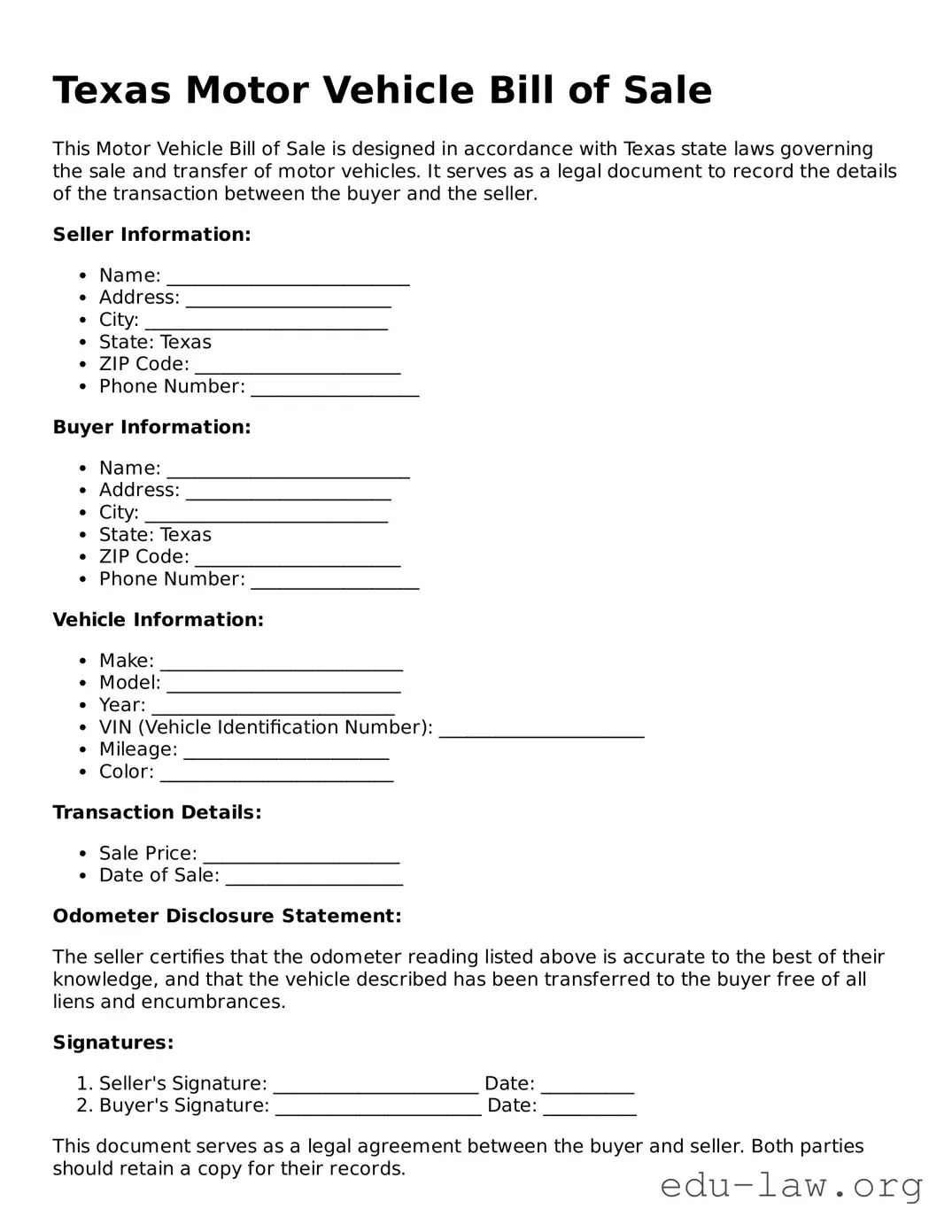

The Texas Motor Vehicle Bill of Sale is a legal document that serves as proof of a vehicle's sale and transfer of ownership from one person to another. This form records important details such as the vehicle's identification number (VIN), make, model, year, and the names and addresses of both the buyer and seller. It helps protect both parties by providing a record of the transaction.

Is a Bill of Sale required for vehicle sales in Texas?

While it's not legally required in Texas, having a Bill of Sale is highly recommended. It offers protection in case of disputes or misunderstandings after the sale. This document provides evidence that the ownership of the car has officially changed, which can be beneficial for both the buyer's and seller's records.

What information must be included in the Texas Motor Vehicle Bill of Sale?

A thorough Bill of Sale should include the following details: the names and addresses of the buyer and seller, the date of the sale, the vehicle's make, model, year, color, and VIN, the purchase price, and any warranties provided by the seller. Including all this information helps to ensure a smooth transaction.

Does the Bill of Sale need to be notarized?

No, the Texas Motor Vehicle Bill of Sale does not require notarization. However, having it notarized can add an extra layer of verification to the document, which might be helpful in case of any future disputes.

Can the Bill of Sale be completed electronically?

Yes, you can complete the Texas Motor Vehicle Bill of Sale electronically. Many online templates and platforms allow for filling out this form digitally. Just make sure that all required information is accurately captured, as this document must still be printed and signed by both parties.

What should I do with the completed Bill of Sale?

Once completed and signed by both parties, the Bill of Sale should be kept by the buyer for their records. It's wise to make copies of the document for both the buyer and seller to have a reference for the transaction. The seller should also provide the buyer with any necessary documents required for vehicle registration.

Will I need additional forms along with the Bill of Sale?

Yes, besides the Bill of Sale, you may also need to complete the Application for Texas Title (Form 130-U) to officially transfer the title of the vehicle. This form is necessary for the buyer to register the vehicle in their name. Ensure all forms are filled out correctly to avoid issues at the DMV.

How long should I keep a copy of the Bill of Sale?

It is advisable to keep a copy of the Bill of Sale for at least four to five years after the purchase. This time frame can help resolve any issues related to ownership, taxes, or liabilities that may arise regarding the vehicle.

What if the seller owes money on the vehicle?

If the seller has an outstanding loan on the vehicle, they may not have the legal right to sell it without paying off the loan first. Buyers should ask the seller for the loan payoff amount and contact the lending institution to ensure that any liens will be cleared once the sale is completed.

Can the Bill of Sale be used for anything other than a car sale?

Yes, while this document is specifically designed for vehicle sales, similar forms can be used for sales of other personal property. Always ensure that the relevant details pertaining to the specific item are captured accurately, regardless of the type of property being sold.