What is a Lady Bird Deed in Texas?

A Lady Bird Deed, also known as an Enhanced Life Estate Deed, allows an individual to transfer property to beneficiaries while retaining the right to live in and control the property during their lifetime. After the owner's death, the property automatically transfers to the beneficiaries without the need for probate. This mechanism can simplify the process and provide peace of mind for property owners.

Who can use a Lady Bird Deed?

Any property owner in Texas can use a Lady Bird Deed to transfer their property to beneficiaries while maintaining control over it during their life. This method is particularly beneficial for individuals who wish to ensure their assets are passed on to their loved ones while avoiding the complexities of the probate process.

What are the benefits of a Lady Bird Deed?

Several advantages come with a Lady Bird Deed. First, it allows the property owner to avoid probate, which can be time-consuming and costly. Second, the owner retains full control and use of the property while alive. Third, it can potentially help in reducing estate taxes. Finally, it ensures a smooth transition of property ownership to heirs without the usual legal entanglements.

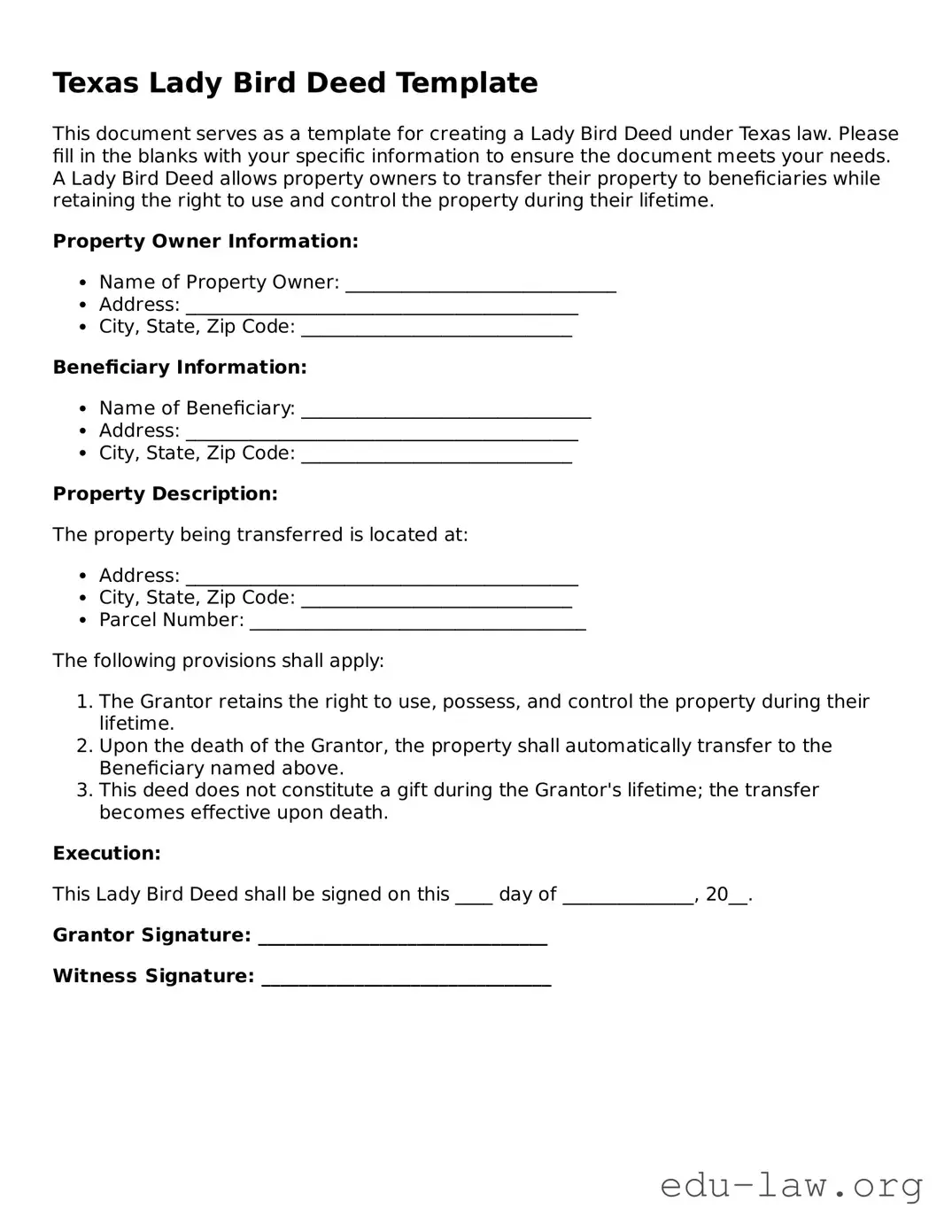

What is the process for creating a Lady Bird Deed?

To create a Lady Bird Deed, the property owner must draft the deed with specific language that indicates the intent to create an enhanced life estate. The deed must then be signed, dated, and notarized. After that, it should be filed with the county clerk's office in the county where the property is located. It is advisable to consult with a legal professional to ensure that the deed complies with all state requirements.

Can I change or revoke a Lady Bird Deed after it is created?

Yes, one of the primary benefits of a Lady Bird Deed is that it can be altered or revoked at any time during the property owner's lifetime. This provides flexibility should circumstances change, such as the need to add or remove beneficiaries, or if the owner decides to sell or transfer the property to someone else.

Are there any tax implications with a Lady Bird Deed?

Generally, property that is transferred via a Lady Bird Deed may receive a step-up in basis for tax purposes upon the owner's death. However, it’s crucial to consult with a tax professional or an attorney experienced in estate planning to understand potential tax liabilities and implications fully, as individual situations may vary.

Can a Lady Bird Deed be used for any type of property?

A Lady Bird Deed can typically be used for various types of real estate, including residential homes and vacant land. However, it may not be applicable for all asset types, such as personal property or real estate located outside of Texas. It is advisable to confirm suitability with a qualified legal consultant to ensure that the property in question can be effectively transferred using this deed.

What happens if the property owner becomes incapacitated?

If the property owner becomes incapacitated, a Lady Bird Deed still allows the owner to maintain their rights to the property. Since the owner retains control over the property during their lifetime, any decisions regarding its use and management can continue without interruption. Nonetheless, if a guardian or power of attorney is appointed, they may need to be involved in decisions regarding the property, which can be addressed in advance through proper legal planning.