What is a Texas Horse Bill of Sale?

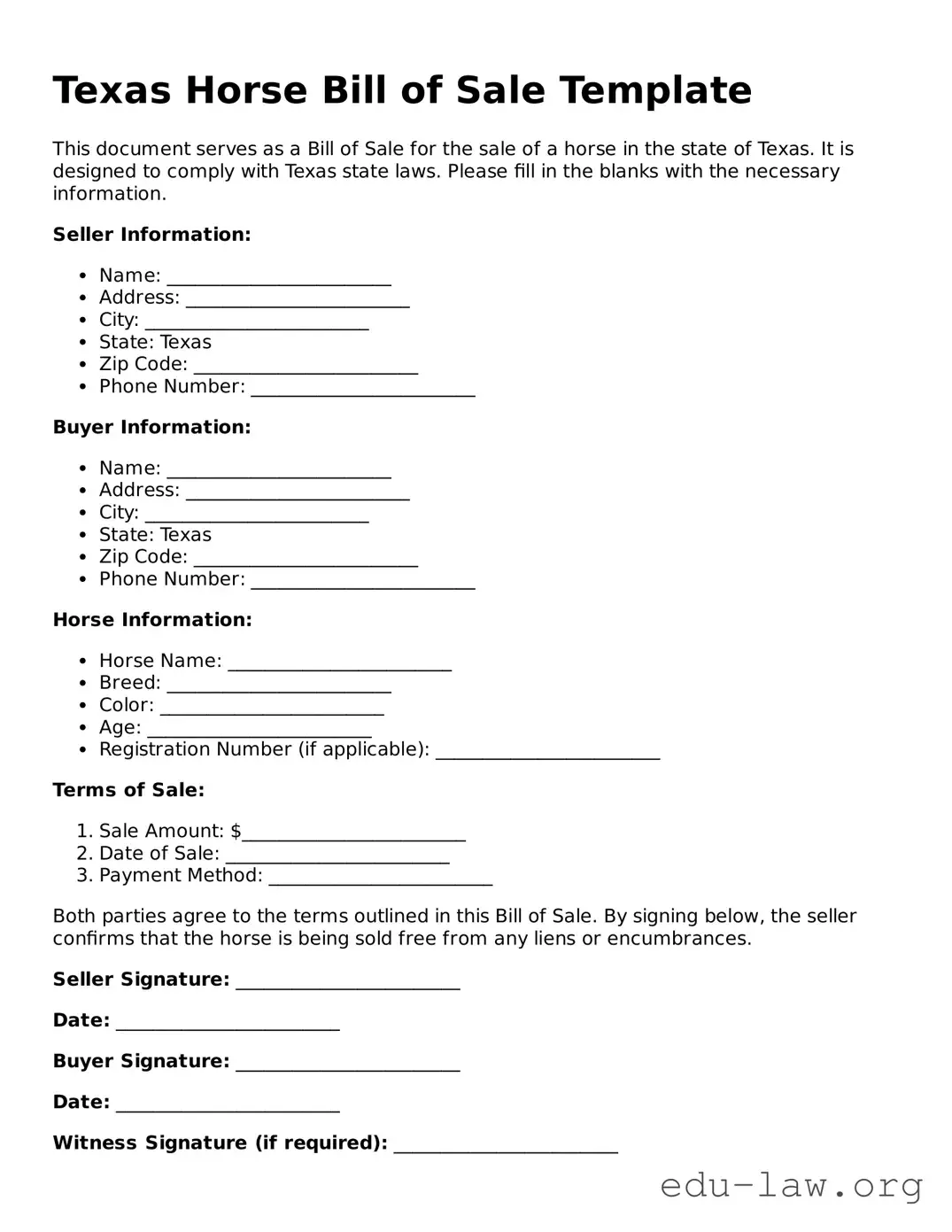

A Texas Horse Bill of Sale is a legal document used when buying or selling a horse in Texas. This form captures important details about the horse, the buyer, and the seller. It serves as proof of the transaction and includes information like the horse's breed, age, and registration details, if applicable. Having this document is crucial for both parties as it clarifies the terms of the sale and helps protect their interests.

Why is it important to have a Bill of Sale when buying a horse?

Having a Bill of Sale is important for several reasons. First, it provides proof of ownership. In the case of a dispute, this document clearly states who owns the horse. Second, it outlines the terms of the sale, including price and any specific conditions. This clarity can prevent misunderstandings later on. Finally, a Bill of Sale may be necessary for registering the horse with breed associations or for transportation across state lines.

What information should be included in the Texas Horse Bill of Sale?

The Texas Horse Bill of Sale should include several key elements. This includes the names and contact information of both the buyer and seller. You will need to list the horse's description—breed, color, age, and any registration numbers. The document should also specify the sale price. Finally, it may include details such as any warranties or guarantees related to the horse’s health or behavior at the time of sale.

Do I need to have the Bill of Sale notarized?

While it is generally not required to have a Bill of Sale notarized in Texas, doing so can add an extra layer of security. Notarization helps verify the identities of the parties involved and provides an official record of the transaction. This can be particularly useful if any disputes arise later. To ensure you meet all your needs, consider consulting with a legal professional if you're unsure.

What should I do after completing the Bill of Sale?

After completing the Texas Horse Bill of Sale, both the buyer and seller should keep copies for their records. The buyer should take steps to register the horse with any relevant breed associations, if applicable. This is also a good time to make sure that the horse’s health records are updated and transferred. Additionally, if the horse is being transported or held in a different location, ensure that all necessary arrangements are in place for a smooth transition.