What is a Texas Golf Cart Bill of Sale?

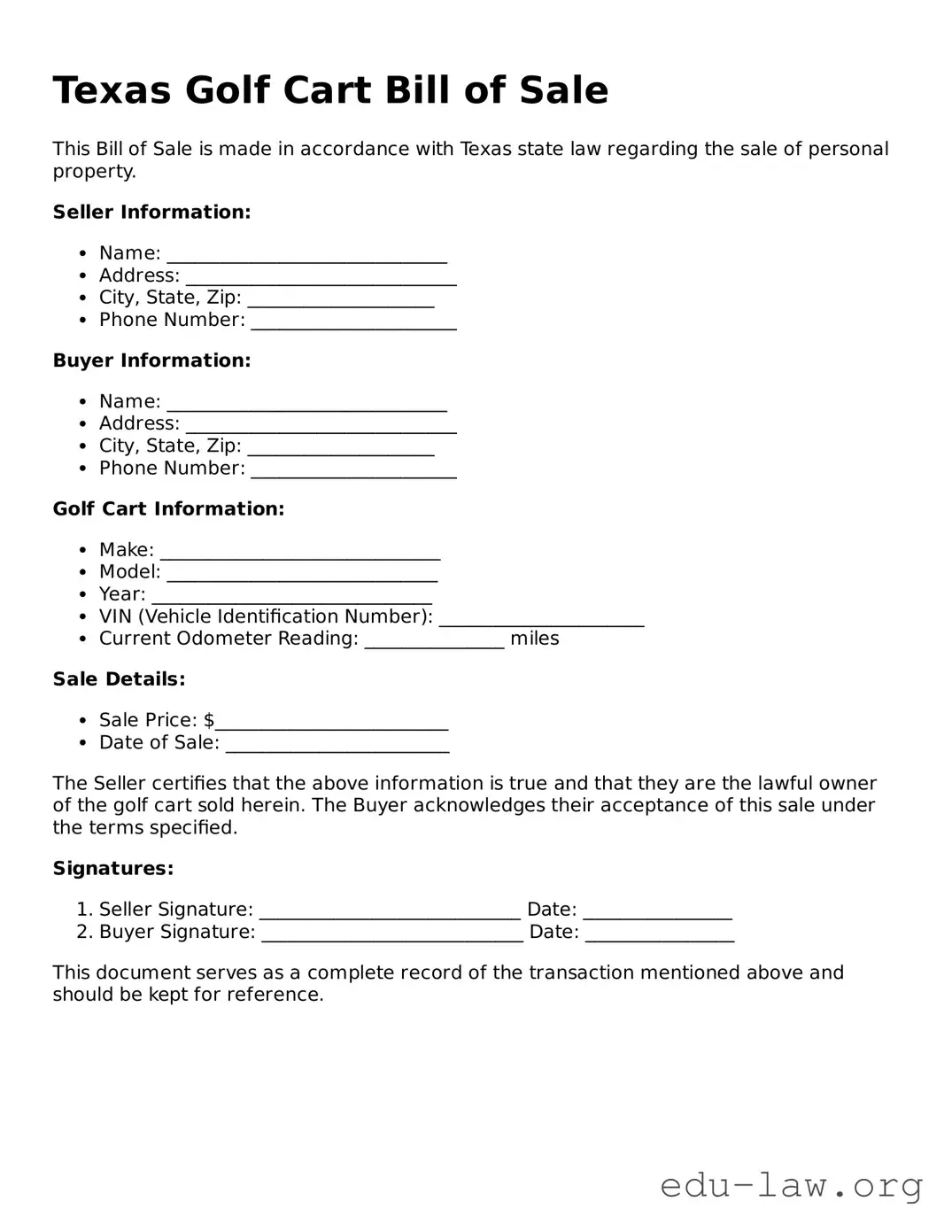

A Texas Golf Cart Bill of Sale is a legal document that outlines the sale of a golf cart. It serves as proof of the transaction between the seller and the buyer, detailing important information about the golf cart, the parties involved, and the terms of the sale.

Is a Golf Cart Bill of Sale required in Texas?

While it is not legally required to have a Bill of Sale for a golf cart in Texas, it is highly recommended. The document provides an official record of the transaction, which can be useful in case of disputes or for registration purposes.

What information is typically included in a Golf Cart Bill of Sale?

Typically, the Bill of Sale will include the names and addresses of the buyer and seller, a description of the golf cart (including make, model, year, and Vehicle Identification Number), the sale price, and the date of the transaction. It may also include any warranties or conditions associated with the sale.

Do I need to have the Bill of Sale notarized?

In Texas, notarization of a Bill of Sale for a golf cart is not required. However, having a notary public witness the signatures can add an extra layer of security and authenticity to the document.

What should I do with the Bill of Sale after the sale?

After completing the sale, both the buyer and seller should keep a signed copy of the Bill of Sale for their records. The buyer may also need it to register the golf cart with their local authorities if applicable.

Can I use a generic Bill of Sale template for my golf cart?

While you can use a generic Bill of Sale template, it is advisable to use one specifically tailored for golf carts. This ensures that all pertinent details related to the transaction are included, which can help prevent misunderstandings later on.

What if there's a dispute after the sale?

If a dispute arises after the sale, the Bill of Sale can serve as crucial evidence. It outlines the terms agreed upon by both parties and can help clarify responsibilities. If necessary, the parties may seek legal counsel to resolve the issue.

Are there any tax implications for buying or selling a golf cart?

Yes, in Texas, sales tax is typically imposed on the sale of a golf cart. The buyer is usually responsible for paying this tax at the time of registration. It's important to check the specific tax rates and regulations with the Texas Comptroller's office.

Can the seller include warranties in the Bill of Sale?

Yes, the seller can include warranties or conditions in the Bill of Sale. If the golf cart comes with any guarantees regarding its condition or performance, these should be clearly outlined in the document to protect both parties.

What should I do if the golf cart was a gift?

If the golf cart is being gifted rather than sold, a Bill of Sale is not strictly necessary. However, documenting the transfer with a simple gift letter can be helpful, especially for tax purposes. It should include the details of the golf cart and mention that it was given as a gift.