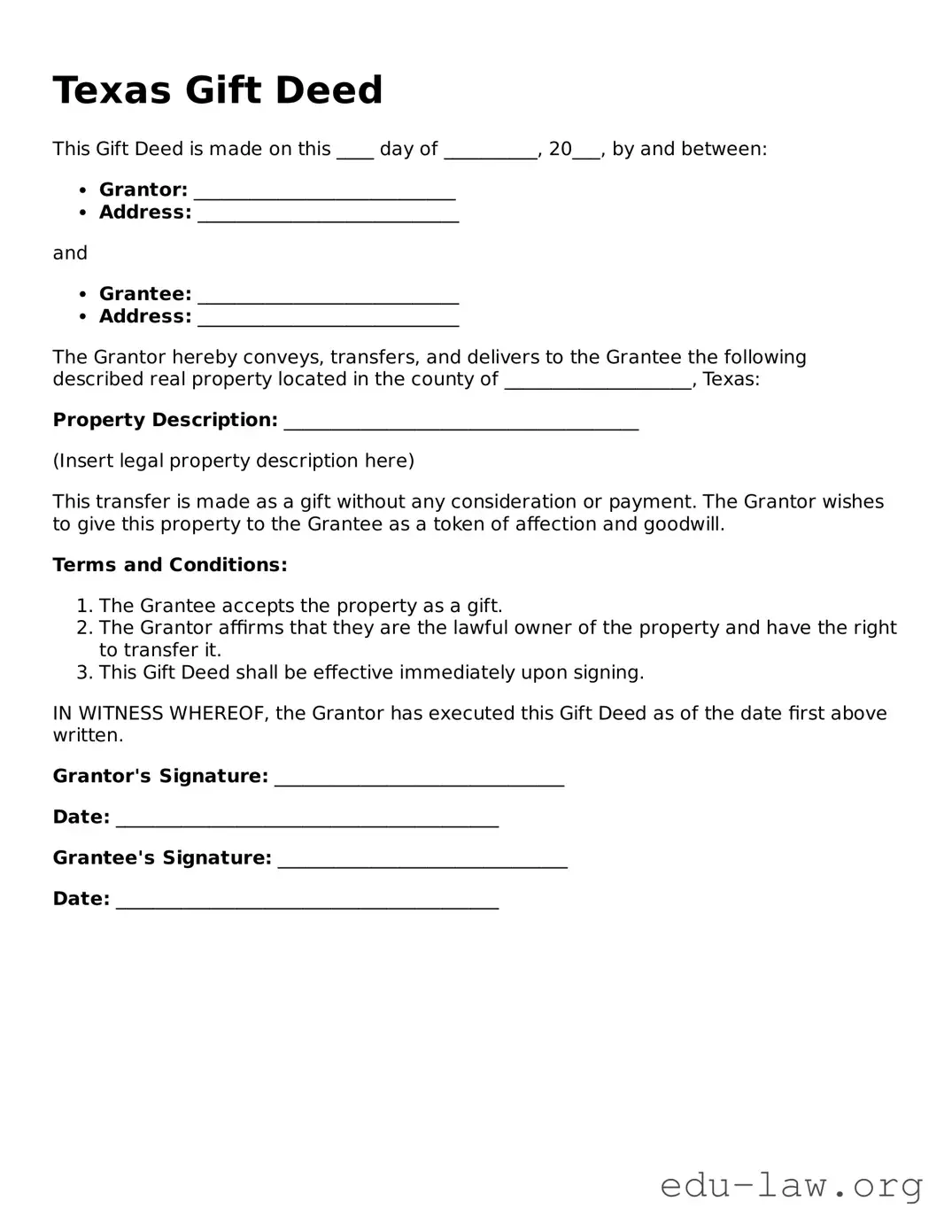

Texas Gift Deed

This Gift Deed is made on this ____ day of __________, 20___, by and between:

- Grantor: ____________________________

- Address: ____________________________

and

- Grantee: ____________________________

- Address: ____________________________

The Grantor hereby conveys, transfers, and delivers to the Grantee the following described real property located in the county of ____________________, Texas:

Property Description: ______________________________________

(Insert legal property description here)

This transfer is made as a gift without any consideration or payment. The Grantor wishes to give this property to the Grantee as a token of affection and goodwill.

Terms and Conditions:

- The Grantee accepts the property as a gift.

- The Grantor affirms that they are the lawful owner of the property and have the right to transfer it.

- This Gift Deed shall be effective immediately upon signing.

IN WITNESS WHEREOF, the Grantor has executed this Gift Deed as of the date first above written.

Grantor's Signature: _______________________________

Date: _________________________________________

Grantee's Signature: _______________________________

Date: _________________________________________