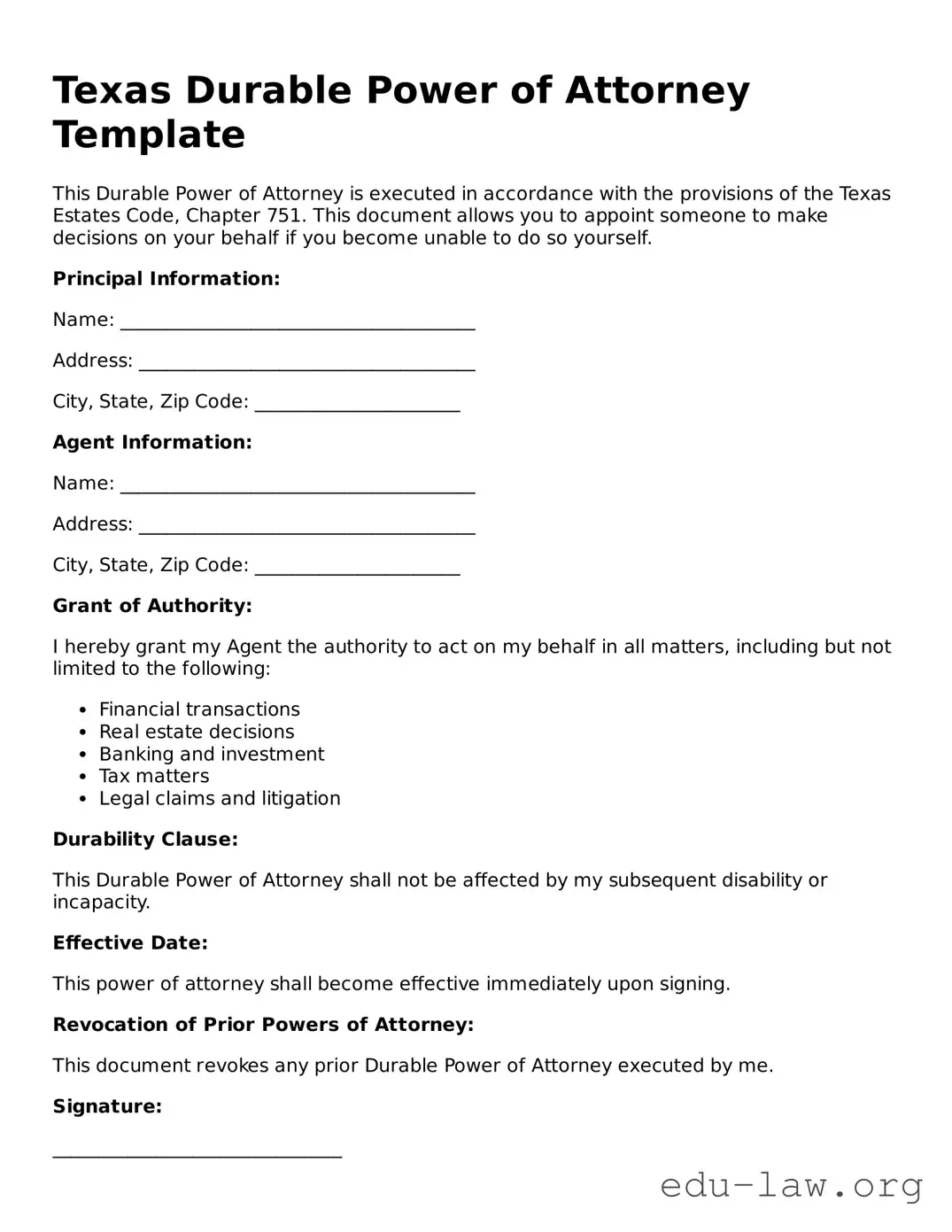

Texas Durable Power of Attorney Template

This Durable Power of Attorney is executed in accordance with the provisions of the Texas Estates Code, Chapter 751. This document allows you to appoint someone to make decisions on your behalf if you become unable to do so yourself.

Principal Information:

Name: ______________________________________

Address: ____________________________________

City, State, Zip Code: ______________________

Agent Information:

Name: ______________________________________

Address: ____________________________________

City, State, Zip Code: ______________________

Grant of Authority:

I hereby grant my Agent the authority to act on my behalf in all matters, including but not limited to the following:

- Financial transactions

- Real estate decisions

- Banking and investment

- Tax matters

- Legal claims and litigation

Durability Clause:

This Durable Power of Attorney shall not be affected by my subsequent disability or incapacity.

Effective Date:

This power of attorney shall become effective immediately upon signing.

Revocation of Prior Powers of Attorney:

This document revokes any prior Durable Power of Attorney executed by me.

Signature:

_______________________________

Signature of Principal

Date: ___________________________

Witness Signatures:

Witness 1: ____________________________

Date: ________________________________

Witness 2: ____________________________

Date: ________________________________

Notary Public:

State of Texas

County of ________________

On this ____ day of ___________, 20__, before me appeared _____________________, known to be the person who executed the foregoing instrument, and acknowledged that he/she executed the same for the purpose therein expressed.

_______________________________

Notary Public Signature

My Commission Expires: ______________