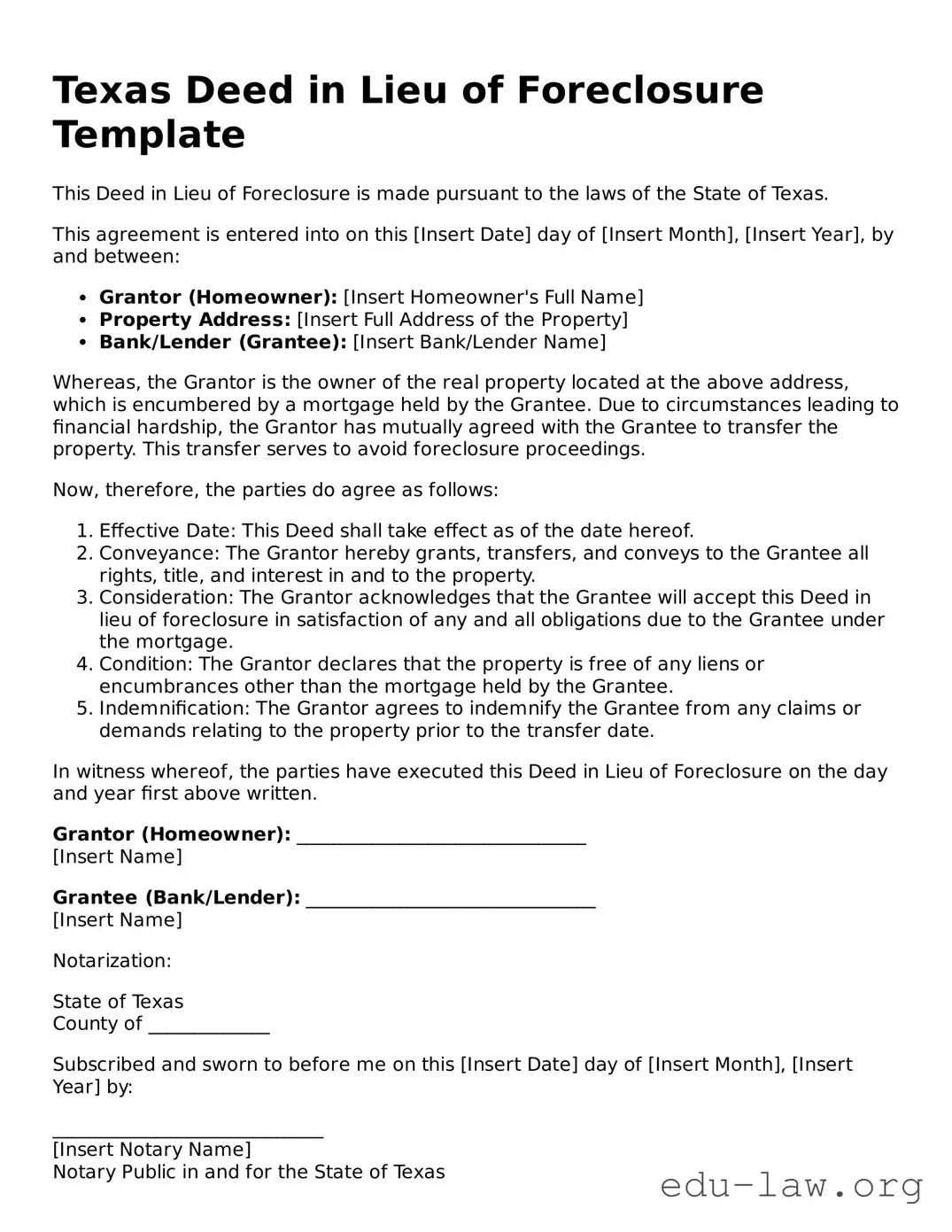

Texas Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made pursuant to the laws of the State of Texas.

This agreement is entered into on this [Insert Date] day of [Insert Month], [Insert Year], by and between:

- Grantor (Homeowner): [Insert Homeowner's Full Name]

- Property Address: [Insert Full Address of the Property]

- Bank/Lender (Grantee): [Insert Bank/Lender Name]

Whereas, the Grantor is the owner of the real property located at the above address, which is encumbered by a mortgage held by the Grantee. Due to circumstances leading to financial hardship, the Grantor has mutually agreed with the Grantee to transfer the property. This transfer serves to avoid foreclosure proceedings.

Now, therefore, the parties do agree as follows:

- Effective Date: This Deed shall take effect as of the date hereof.

- Conveyance: The Grantor hereby grants, transfers, and conveys to the Grantee all rights, title, and interest in and to the property.

- Consideration: The Grantor acknowledges that the Grantee will accept this Deed in lieu of foreclosure in satisfaction of any and all obligations due to the Grantee under the mortgage.

- Condition: The Grantor declares that the property is free of any liens or encumbrances other than the mortgage held by the Grantee.

- Indemnification: The Grantor agrees to indemnify the Grantee from any claims or demands relating to the property prior to the transfer date.

In witness whereof, the parties have executed this Deed in Lieu of Foreclosure on the day and year first above written.

Grantor (Homeowner): _______________________________

[Insert Name]

Grantee (Bank/Lender): _______________________________

[Insert Name]

Notarization:

State of Texas

County of _____________

Subscribed and sworn to before me on this [Insert Date] day of [Insert Month], [Insert Year] by:

_____________________________

[Insert Notary Name]

Notary Public in and for the State of Texas