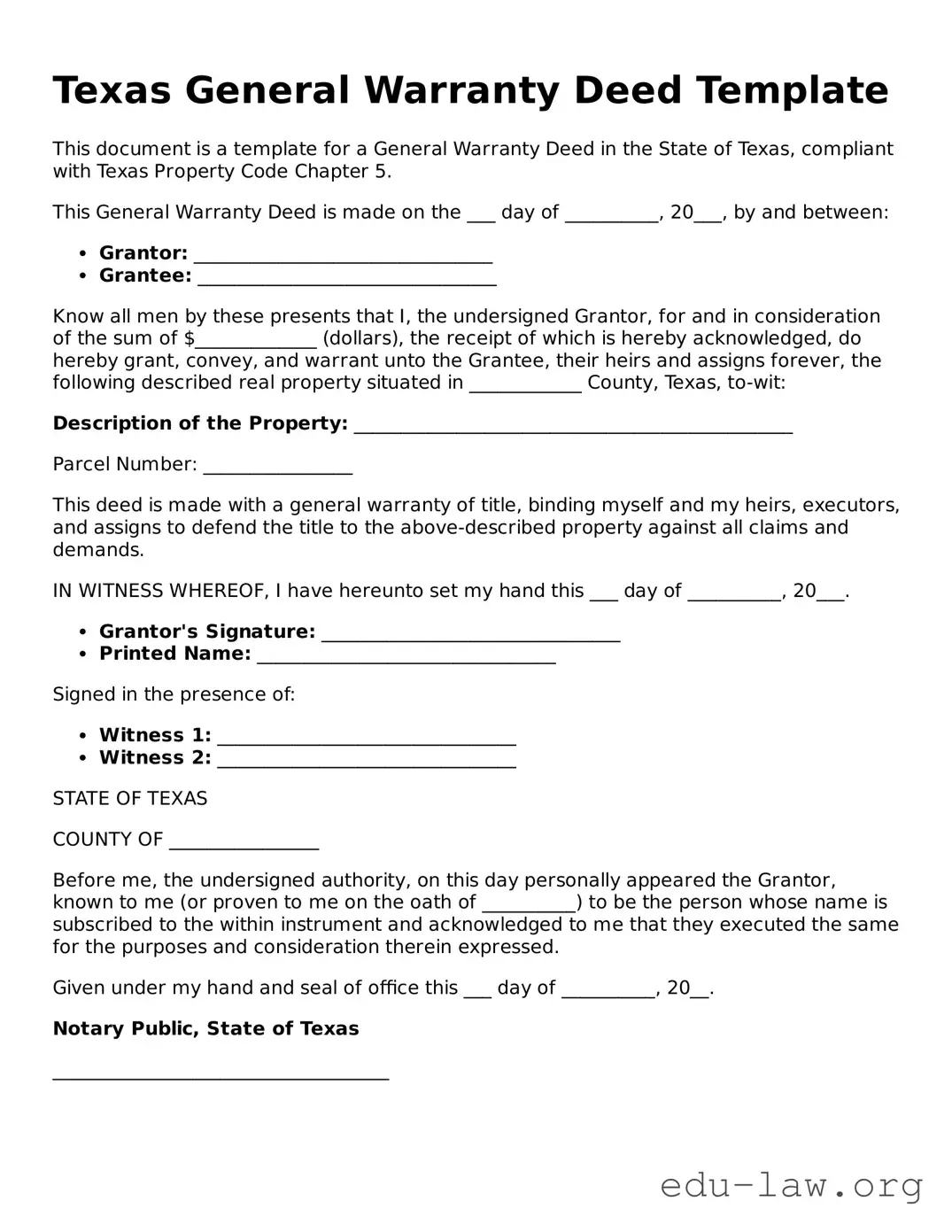

Texas General Warranty Deed Template

This document is a template for a General Warranty Deed in the State of Texas, compliant with Texas Property Code Chapter 5.

This General Warranty Deed is made on the ___ day of __________, 20___, by and between:

- Grantor: ________________________________

- Grantee: ________________________________

Know all men by these presents that I, the undersigned Grantor, for and in consideration of the sum of $_____________ (dollars), the receipt of which is hereby acknowledged, do hereby grant, convey, and warrant unto the Grantee, their heirs and assigns forever, the following described real property situated in ____________ County, Texas, to-wit:

Description of the Property: _______________________________________________

Parcel Number: ________________

This deed is made with a general warranty of title, binding myself and my heirs, executors, and assigns to defend the title to the above-described property against all claims and demands.

IN WITNESS WHEREOF, I have hereunto set my hand this ___ day of __________, 20___.

- Grantor's Signature: ________________________________

- Printed Name: ________________________________

Signed in the presence of:

- Witness 1: ________________________________

- Witness 2: ________________________________

STATE OF TEXAS

COUNTY OF ________________

Before me, the undersigned authority, on this day personally appeared the Grantor, known to me (or proven to me on the oath of __________) to be the person whose name is subscribed to the within instrument and acknowledged to me that they executed the same for the purposes and consideration therein expressed.

Given under my hand and seal of office this ___ day of __________, 20__.

Notary Public, State of Texas

____________________________________