What is a Texas Bill of Sale form?

A Texas Bill of Sale form is a legal document that serves as a record of the transfer of ownership for personal property from one individual to another. This form typically outlines details such as the item being sold, the purchase price, and information about both the seller and the buyer. While it is not required by law for every transaction, it is highly recommended for added clarity and protection for both parties involved.

When do I need a Bill of Sale in Texas?

A Bill of Sale is particularly important in transactions involving high-value items, such as vehicles, boats, or heavy machinery. It serves as proof of ownership transfer and can be crucial for registration or titling purposes. Additionally, if disputes arise regarding the sale, having this document can help resolve issues by providing legal evidence of the agreement.

Are there different types of Bill of Sale forms in Texas?

Yes, there are various types of Bill of Sale forms used for different purposes. Common types include the General Bill of Sale, Vehicle Bill of Sale, and Boat Bill of Sale. Each form is tailored to meet specific needs, addressing details pertinent to the type of property being sold. Ensure you choose the appropriate form to fit your transaction.

How do I fill out a Texas Bill of Sale form?

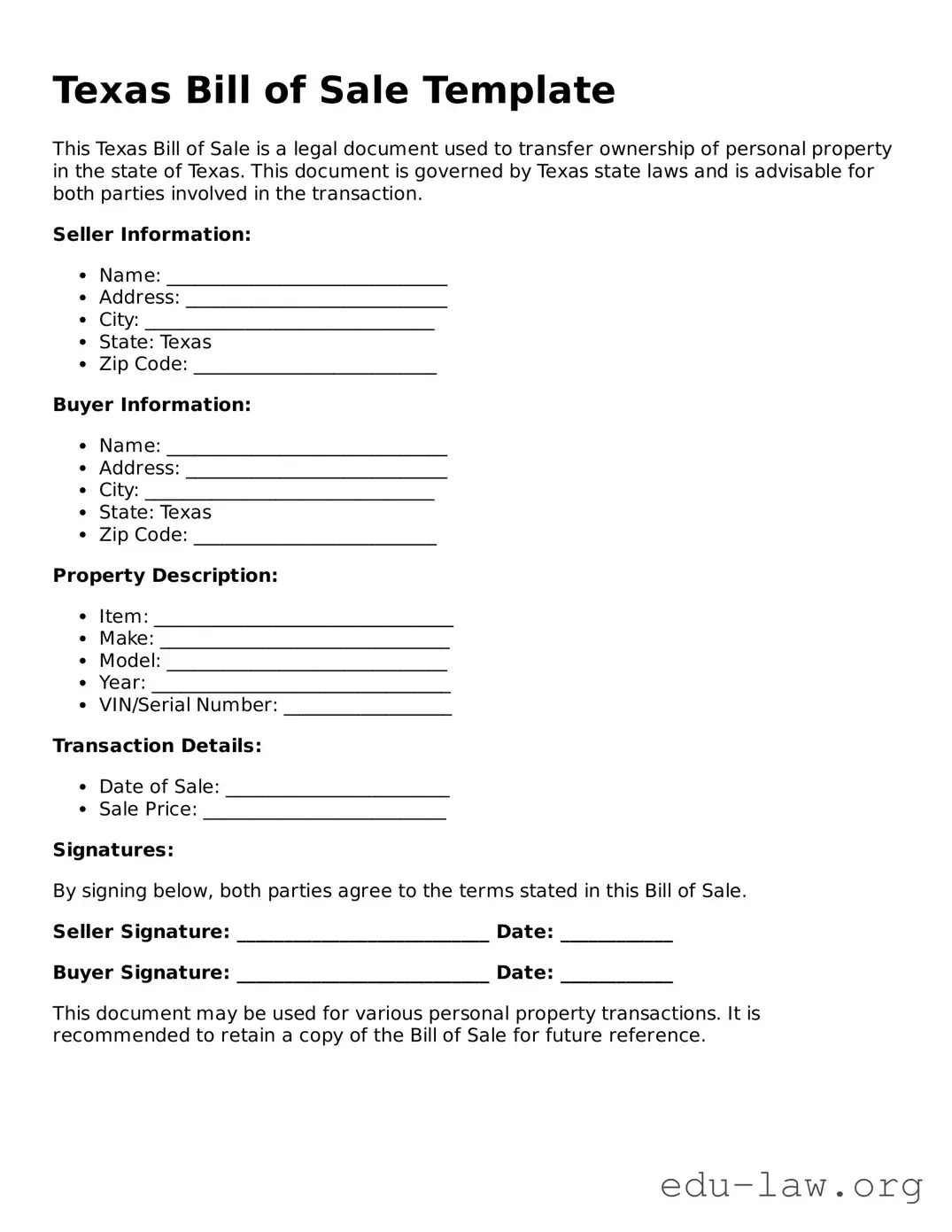

To complete a Texas Bill of Sale, begin by providing the date of the sale. Next, include the names and addresses of both the seller and the buyer. Clearly describe the item being sold, including any identification numbers, make, model, and condition. Lastly, specify the purchase price and any terms of sale, if applicable. Both parties should sign the document to validate the agreement.

Do I need to have the Bill of Sale notarized?

In Texas, notarization of the Bill of Sale is not a requirement for it to be considered valid. However, notarizing the document may provide an additional layer of security and verification for both parties, especially in larger transactions. It can enhance trust and act as a safeguard should any disputes arise in the future.

Can I use a Bill of Sale to register a vehicle in Texas?

Yes, a Bill of Sale is a necessary document for registering a vehicle in Texas. When purchasing a vehicle, the Bill of Sale acts as evidence of the transaction and must be provided along with other documents, such as the original title, when applying for registration. Ensure that all details on the Bill of Sale are accurate to facilitate a smooth registration process.

What should I do if I lose my Bill of Sale?

If you lose your Bill of Sale, it can lead to complications, especially for high-value items like vehicles. If you are the seller, try to reconstruct the original document with the buyer’s help, including all relevant transaction details. The buyer can also contact the seller for a copy. In case of a vehicle sale, reaching out to the Texas Department of Motor Vehicles might provide assistance with title issues that arise from a lost Bill of Sale.