What are Articles of Incorporation in Texas?

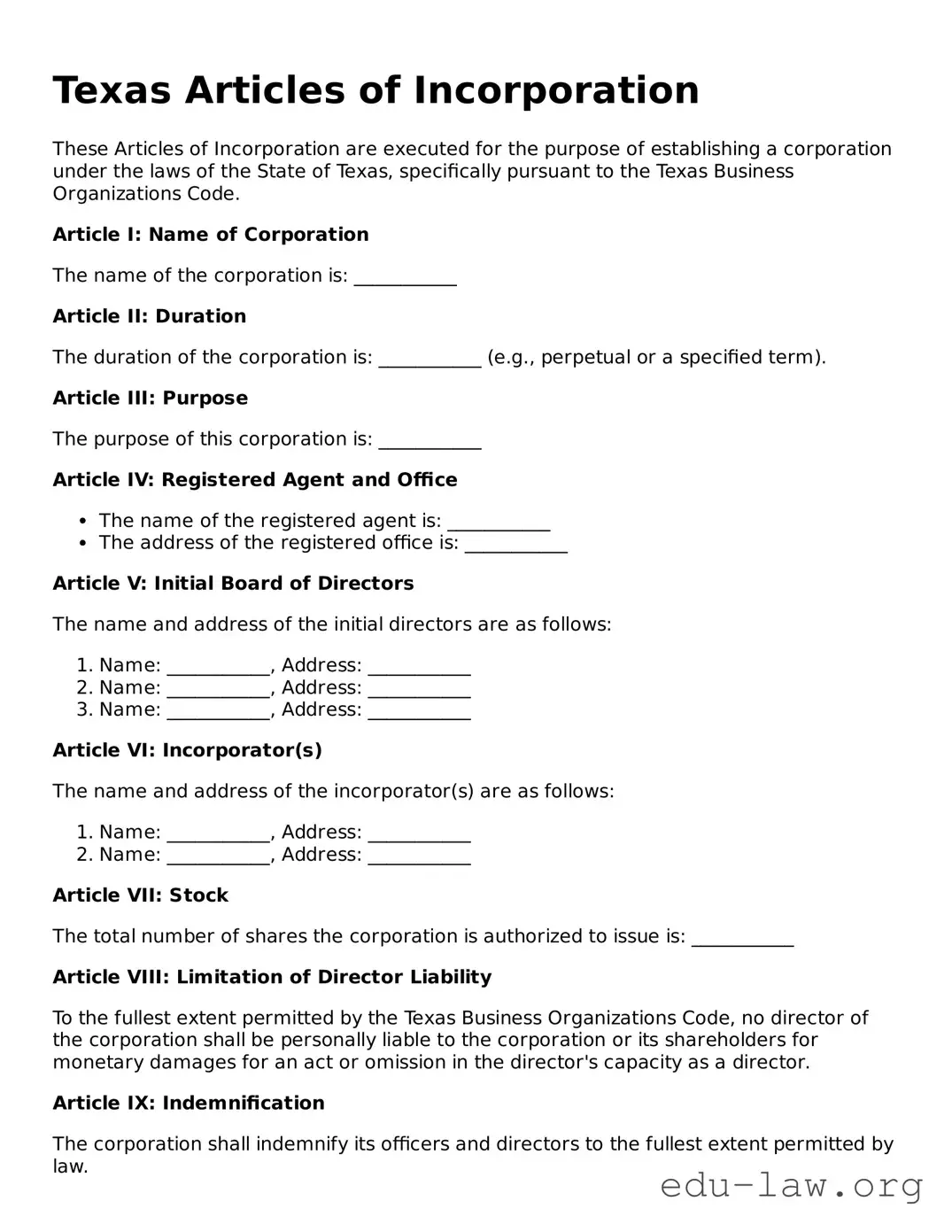

Articles of Incorporation are legal documents filed with the state to create a corporation. In Texas, this form establishes your business as a corporation and outlines essential details about your company, such as its name, purpose, and the structure of its stock. It’s a foundational step in the process of incorporating your business.

How do I file Articles of Incorporation in Texas?

You can file Articles of Incorporation in Texas either online or by mail. For online filing, visit the Texas Secretary of State’s website, where you can complete the form and pay the associated fee. If you prefer to file by mail, you will need to fill out the form and send it to the Secretary of State's office, along with payment.

What information do I need to include in the Articles of Incorporation?

You'll need to provide several key details. These include your corporation's name, the purpose of your business, the registered agent's name and address, the number of shares your corporation is authorized to issue, and any other provisions you wish to include. Be sure that the name you choose is unique and not already in use by another corporation in Texas.

Is there a fee to file Articles of Incorporation in Texas?

Yes, there is a filing fee that must be paid when you submit your Articles of Incorporation. The amount can vary based on several factors including the type of corporation you are forming. It’s advisable to check the Texas Secretary of State’s website for the most current fee schedule.

How long does it take to process Articles of Incorporation in Texas?

Typically, processing time can vary. Standard processing can take about 3 to 5 business days. If you choose expedited service, it may be processed more quickly, often within 1 business day. Keep in mind that this may change based on the volume of applications being received.

What happens after I file the Articles of Incorporation?

Once your Articles of Incorporation are filed and approved, you will receive a certificate of incorporation. This certificate serves as official proof that your business is recognized as a corporation in Texas. You will then need to follow up with any further compliance steps, such as obtaining an Employer Identification Number (EIN) and creating corporate bylaws.

Do I need a lawyer to file Articles of Incorporation in Texas?

While you are not required to have a lawyer, consulting one can be beneficial. A legal expert can help ensure that all your documents are filled out correctly and that you comply with state laws. This can save you time and potential complications later on.

What is the difference between a corporation and an LLC?

A corporation and a Limited Liability Company (LLC) are both business structures, but they differ in terms of formation, management, and taxes. Corporations typically offer stock, have a formal structure, and may be subject to double taxation, while LLCs provide more flexibility, fewer formalities, and pass-through taxation. Your choice will depend on your business objectives and needs.

Can I amend my Articles of Incorporation once they are filed?

Yes, you can amend your Articles of Incorporation if you need to make changes. This may include altering the corporation's name, purpose, or other details. To do this, you would need to file an amendment form with the Texas Secretary of State and pay the required fee.

What should I do if my Articles of Incorporation are rejected?

If your Articles are rejected, you should receive a notice explaining the reasons for the rejection. Typically, you can correct the issues and resubmit the documents. It’s important to address any errors or omissions to avoid further delays.