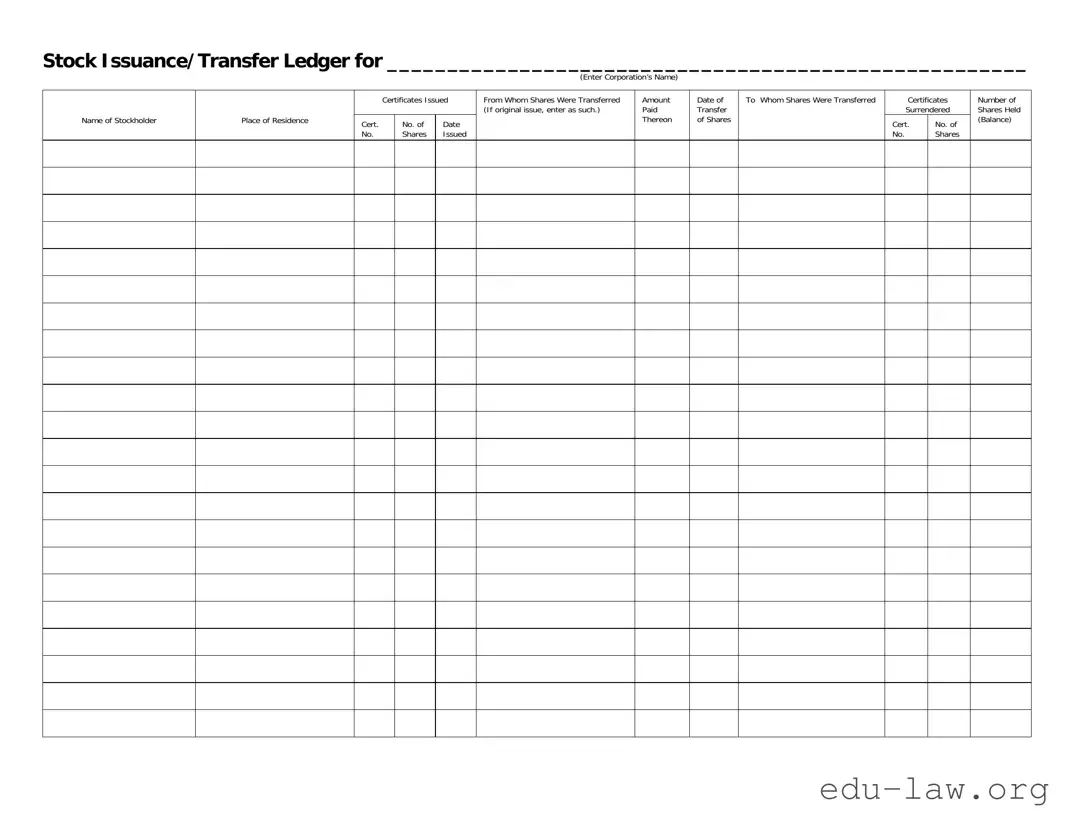

What is the Stock Transfer Ledger form?

The Stock Transfer Ledger form is a record used by corporations to track the issuance and transfer of stock. It helps maintain accurate records of who owns shares and when transfers occur. This is essential for ensuring compliance with corporate regulations and providing transparency within the company.

What information do I need to fill out the form?

You will need to provide details such as the corporation’s name, the names of stockholders, their places of residence, certificate numbers, dates of issuance, the number of shares issued, and information about any transfers, including dates and amounts paid.

Who can fill out this form?

This form can be filled out by corporate officers, including the secretary or treasurer. However, shareholders involved in the transfer can also provide the required information, especially regarding their own transactions.

Why is it important to maintain the Stock Transfer Ledger?

The Stock Transfer Ledger is crucial for corporate governance. It protects shareholders’ rights and ensures that all transactions are recorded accurately, which can be important in legal situations or when the company is seeking investments.

Can changes be made after the form is filled out?

Yes, but it’s important to make changes carefully. Any corrections should be documented properly, with the date of the change and the name of the person who made the correction. This ensures transparency and keeps the record accurate.

How do I handle a stock transfer?

To handle a stock transfer, complete the relevant sections of the form. This includes noting the dates, the number of shares being transferred, and the parties involved. After filling this out, both the seller and buyer should sign any required documents to finalize the transfer.

What happens if the original stock certificate is lost?

If a stock certificate is lost, the stockholder should inform the corporation immediately. They may need to provide documentation of the loss and may need to request a reissue of the stock certificate, following the corporation’s specific process for lost certificates.

Is there a fee for transferring shares?

Fees may vary by corporation. Some companies charge a nominal fee for processing stock transfers, while others may not have any charges. It’s best to check with the corporation’s stockholder services for their specific policies regarding fees.

Is there a specific format for submitting the Stock Transfer Ledger?

The format of the Stock Transfer Ledger form is typically provided by the corporation. Ensure that you follow the specified layout and fill out all required fields accurately to avoid any issues with record-keeping.

How often should the Stock Transfer Ledger be updated?

The Stock Transfer Ledger should be updated immediately after any stock issuance or transfer occurs. Keeping the ledger current is essential for maintaining accurate records and for the company’s financial reporting needs.