What is a Release of Promissory Note?

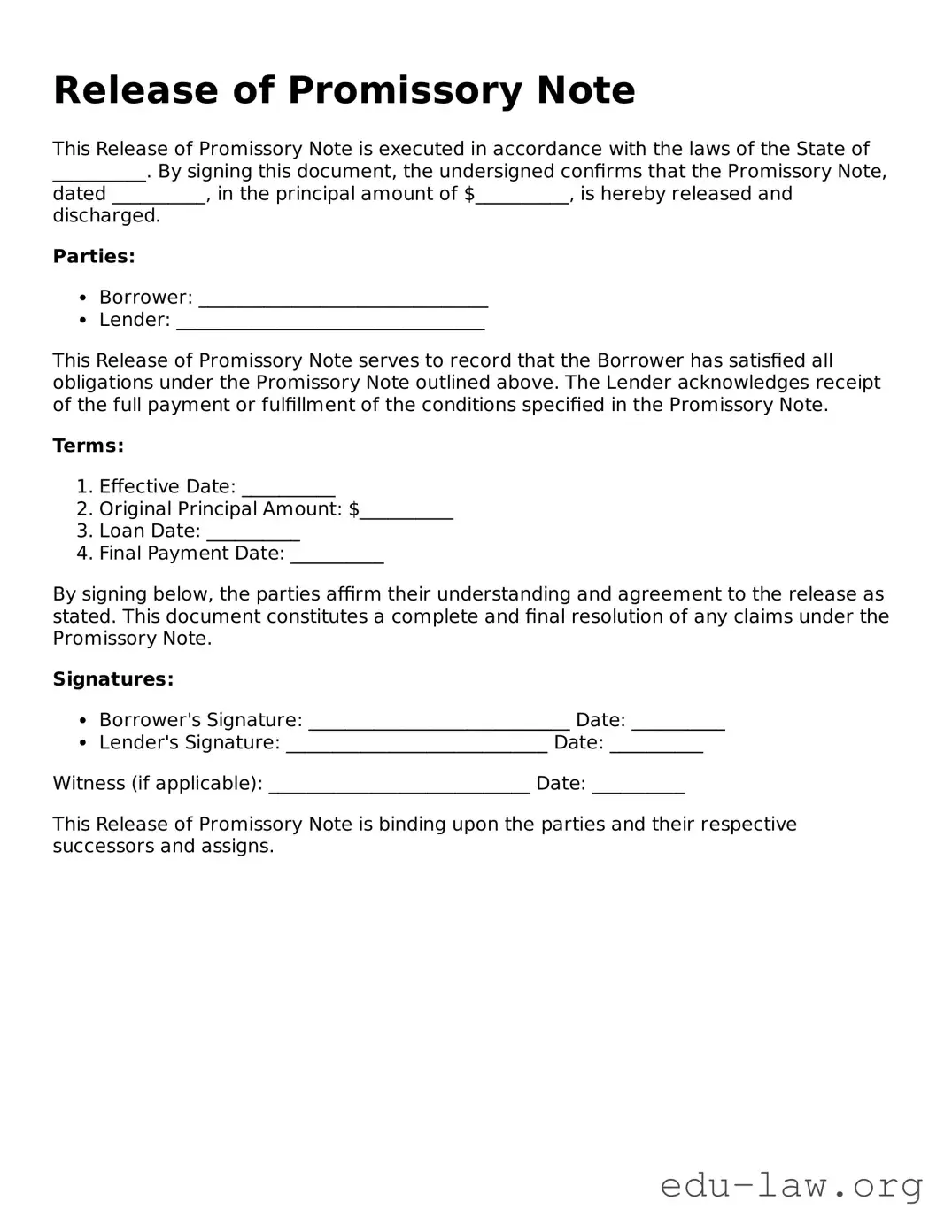

A Release of Promissory Note is a document that formally signifies the discharge of a debt obligation represented by a promissory note. When a borrower pays off their debt in full, the lender may issue this release to confirm that they no longer have any claim to the amount owed. This document serves to protect both parties by providing clarity and closure in the borrowing arrangement.

Why is it important to obtain a Release of Promissory Note?

Securing a Release of Promissory Note is important for several reasons. First, it offers evidence that the borrower has fulfilled their financial commitment, thereby preventing any future claims by the lender. Second, it can be vital for maintaining a clean credit history, as having such releases documented can be advantageous if the borrower applies for additional loans in the future. Moreover, it contributes to the overall transparency and mutual understanding between both parties involved in the transaction.

How do I get a Release of Promissory Note?

Receiving a Release of Promissory Note typically requires communication between the borrower and the lender after the debt has been fully paid. The borrower should request the release in writing, reminding the lender of the completed payment details. Once the lender processes the request, they will prepare and sign the release document. Borrowers should ensure they keep a copy for their records, as it may be needed for future reference.

Is there a fee associated with obtaining a Release of Promissory Note?

Generally, obtaining a Release of Promissory Note does not involve any fees; however, this can vary depending on the lender’s policies. Some lenders may charge administrative fees for processing such documents, so it's wise to inquire beforehand. Understanding any potential costs can help borrowers manage their finances more effectively.

What if the lender refuses to issue a Release of Promissory Note?

If a lender refuses to provide a Release of Promissory Note after full payment has been made, the borrower should first attempt to resolve the issue through communication. Keeping records of all payments and correspondence is important in this scenario. If the lender remains uncooperative, the borrower may need to seek legal advice to explore their options for enforcing their rights to the release.

Can a Release of Promissory Note be recorded in public records?

Yes, in some cases, a Release of Promissory Note can be recorded in public records, especially when it relates to a secured loan where a lien has been placed on property. Recording the release provides further public verification of the satisfaction of the debt. Borrowers should ensure that their lender files the necessary paperwork with the appropriate local authority if recording is required.