What is a Real Estate Purchase Agreement?

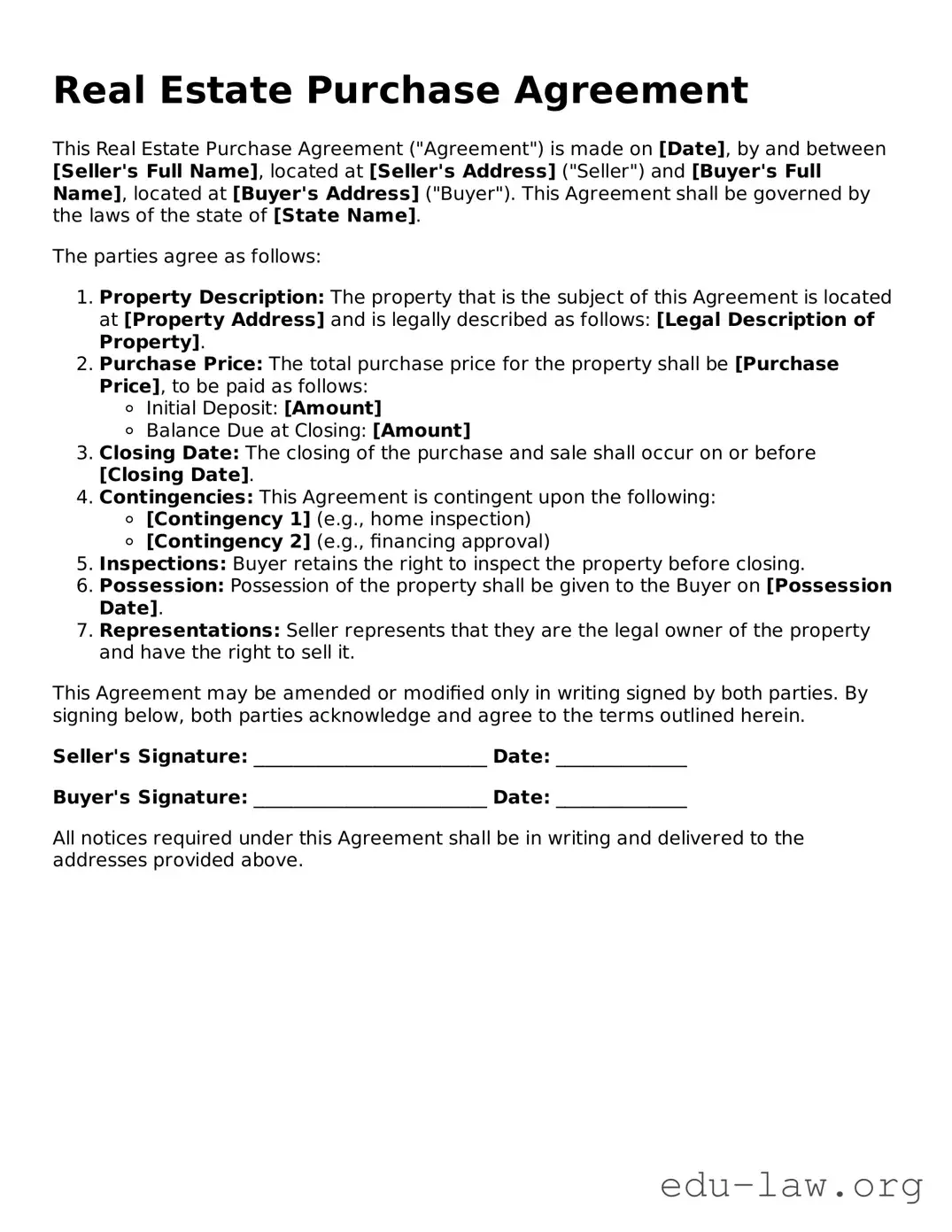

A Real Estate Purchase Agreement is a legally binding document between a buyer and a seller. It outlines the terms and conditions related to the sale of real estate. This includes details such as the purchase price, the closing date, and any contingencies needed to finalize the sale. It's essential for protecting both parties' interests during the transaction.

What are the key components of a Real Estate Purchase Agreement?

The key components typically include the names and contact information of both parties, a detailed description of the property, the agreed-upon purchase price, payment details, and closing date. Additionally, it may outline contingencies such as financing, inspections, and appraisal conditions. Each of these elements plays a vital role in ensuring clarity throughout the process.

Why is it important to have a Real Estate Purchase Agreement?

This agreement serves as a formal record of the terms agreed upon by both parties. It helps to prevent disputes by clearly outlining each party's responsibilities and expectations. Without this document, misunderstandings can arise, and one party may not fulfill their obligations, leading to potential legal issues down the line.

Can a Real Estate Purchase Agreement be modified?

Yes, a Real Estate Purchase Agreement can be modified, but any changes must be documented in writing and signed by both parties. Common reasons for modifications might include changes to the closing date or adjustments to the purchase price. These changes help ensure that both parties remain satisfied with the agreement as circumstances evolve.

What happens if one party breaches the Real Estate Purchase Agreement?

If one party fails to fulfill their obligations under the agreement, it is considered a breach. The non-breaching party typically has the right to seek legal remedies. These can include specific performance, where the court orders the breaching party to complete the transaction, or monetary damages for any losses suffered because of the breach.

Is a Real Estate Purchase Agreement the same as a lease agreement?

No, a Real Estate Purchase Agreement and a lease agreement are not the same. A purchase agreement is designed for the sale of property, while a lease agreement pertains to renting or leasing property for a specific period. The key difference lies in ownership transfer; a purchase agreement aims to convey ownership, whereas a lease retains ownership with the landlord.

Do I need a lawyer to draft a Real Estate Purchase Agreement?

While it is possible to find templates online or complete the agreement without legal assistance, consulting a lawyer is advisable. A lawyer can help ensure that the agreement accurately reflects your intentions and complies with local laws. They can also assist in negotiating terms, which may provide additional protection for both parties.

What should I do after signing a Real Estate Purchase Agreement?

Once you have signed the agreement, it becomes legally binding. Both parties should keep copies for their records. It is important to follow through with the outlined contingencies, such as obtaining financing or completing inspecitons. Additionally, actively communicating with the other party can help ensure a smooth closing process.