What is a Real Estate Power of Attorney?

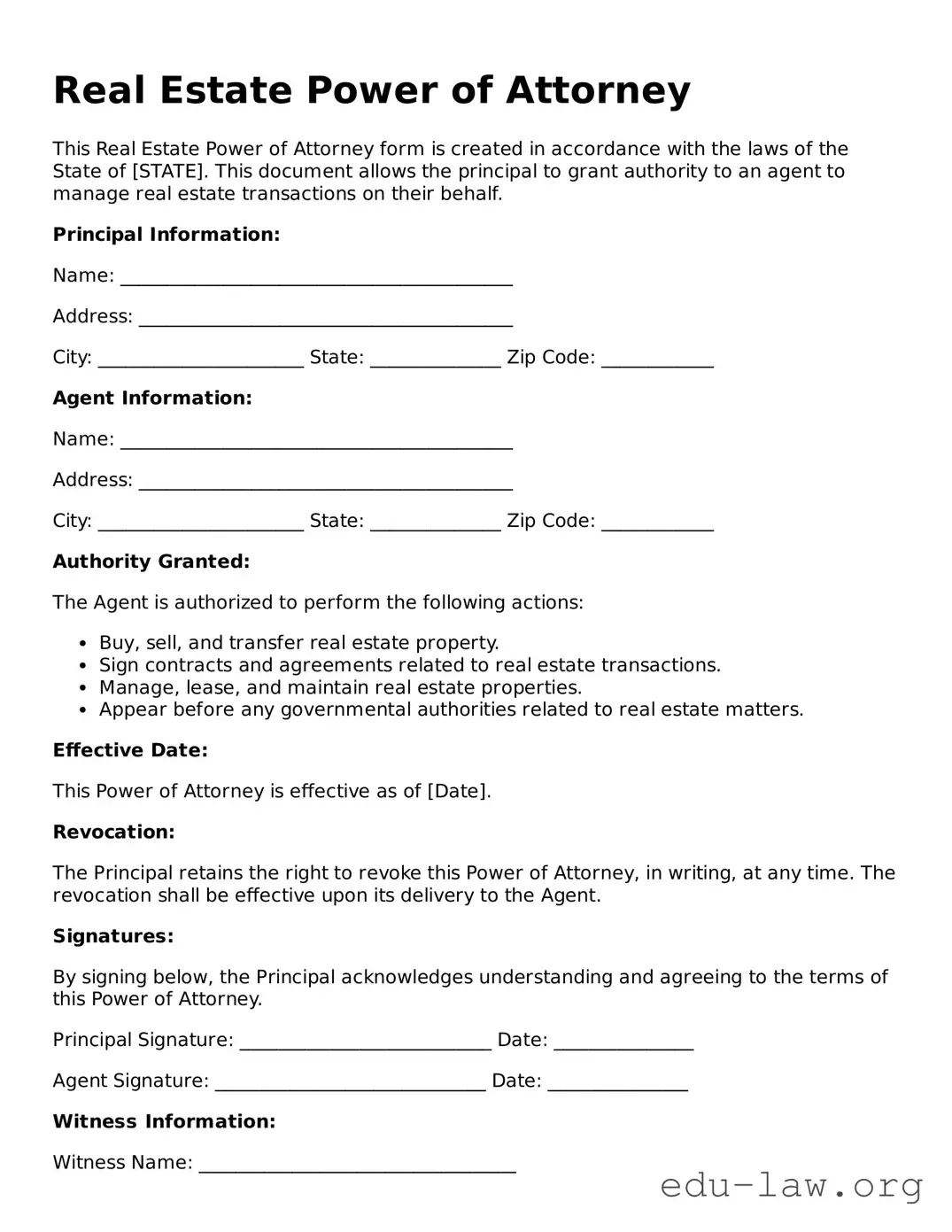

A Real Estate Power of Attorney (POA) is a legal document that grants someone the authority to act on your behalf in matters related to real estate transactions. This can include buying, selling, leasing, or managing property. The person you designate is known as your agent or attorney-in-fact and must act in your best interests.

Why would I need a Real Estate Power of Attorney?

There are several reasons to consider a Real Estate POA. You might be unable to attend a closing due to an emergency or travel restrictions. It can also be useful if you’re managing properties and need to delegate authority for decision-making. It ensures your interests are safeguarded, even when you're not able to be present.

How do I create a Real Estate Power of Attorney?

Creating a Real Estate POA typically involves drafting the document, specifying the powers you want to grant, and signing it in front of a notary public. Many templates are available online, but it's advisable to consult with an expert to ensure everything is done correctly and in accordance with state laws.

Can I limit the powers granted in a Real Estate Power of Attorney?

Absolutely! You can customize your Real Estate POA to specify which authorities your agent has. For example, you might limit them to only selling a specific property or making decisions related to a particular lease. Limiting powers can help retain control over your assets while still allowing someone else to act on your behalf.

Do I need to notify my agent before granting them Power of Attorney?

It’s best practice to discuss your intentions with the person you wish to designate as your agent before you create the document. They should understand their duties and responsibilities. Open communication helps to ensure they are willing and prepared to take on the role.

Can I revoke a Real Estate Power of Attorney?

Yes, you can revoke a Real Estate POA at any time, as long as you are mentally competent. You would need to create a revocation document and notify your agent, as well as any relevant third parties, such as banks or title companies, to ensure they are aware of the changes.

Is a Real Estate Power of Attorney valid in all states?

While a Real Estate POA is commonly used across the United States, requirements can vary by state. Certain states may have specific rules regarding notarization or witnessing. It’s essential to check your local laws or consult a legal professional to ensure your document is valid.

What if my agent makes a decision I disagree with?

There’s always the possibility that your agent might make decisions you disagree with. This is why choosing someone trustworthy is critical. If they act outside the authority granted in the POA, you may have recourse. Keeping open lines of communication and discussing your preferences beforehand can help avoid conflicts later.

Do I need to file my Real Estate Power of Attorney with the government?

In most cases, you do not need to file your Real Estate POA with any government office. However, it’s common practice to provide a copy to any third parties who may be involved in real estate transactions, such as realtors or title companies, to ensure they will recognize your agent’s authority.