What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer ownership of real property from one person to another. Unlike a warranty deed, the Quitclaim Deed does not guarantee that the person transferring the property, known as the grantor, has a clear title to the property. Instead, it simply conveys whatever interest the grantor may have in the property, which could be none at all. This type of deed is commonly used among family members or in situations where the parties know each other and trust each other to handle the transaction fairly.

When should I use a Quitclaim Deed?

A Quitclaim Deed is often used in various situations, such as when transferring property between family members, during divorce settlements, or when adding or removing someone from a property title. For example, if parents wish to transfer ownership of the family home to their children, a Quitclaim Deed would be a suitable option. However, it is essential to consider whether the beneficiary is fully aware of any potential issues with the title before proceeding.

What are the advantages of using a Quitclaim Deed?

One significant advantage of a Quitclaim Deed is its simplicity. The process is straightforward, often requiring less paperwork and fewer formalities than other types of deeds. Additionally, it can be quicker and more cost-effective, making it ideal for informal transfers. Because it doesn’t guarantee the title, it’s essential to remember that the grantee assumes some risks, but this lack of liability can also streamline the transaction in trusted situations.

Are there any disadvantages to using a Quitclaim Deed?

Yes, there are disadvantages. The primary concern is the absence of any warranty regarding the title. If there are undisclosed liens, claims, or other issues with the property, the grantee may find themselves responsible for resolving these problems. This lack of security makes it crucial that all parties fully understand the implications of using a Quitclaim Deed and are confident in their relationship and trust in each other.

Do I need an attorney to create a Quitclaim Deed?

While it is not legally required to have an attorney draft a Quitclaim Deed, seeking legal advice is often advisable. An attorney can ensure that all necessary details are included and that the deed complies with state laws. They can also explain the potential risks and protections to the parties involved, providing valuable insight and peace of mind during the transfer process.

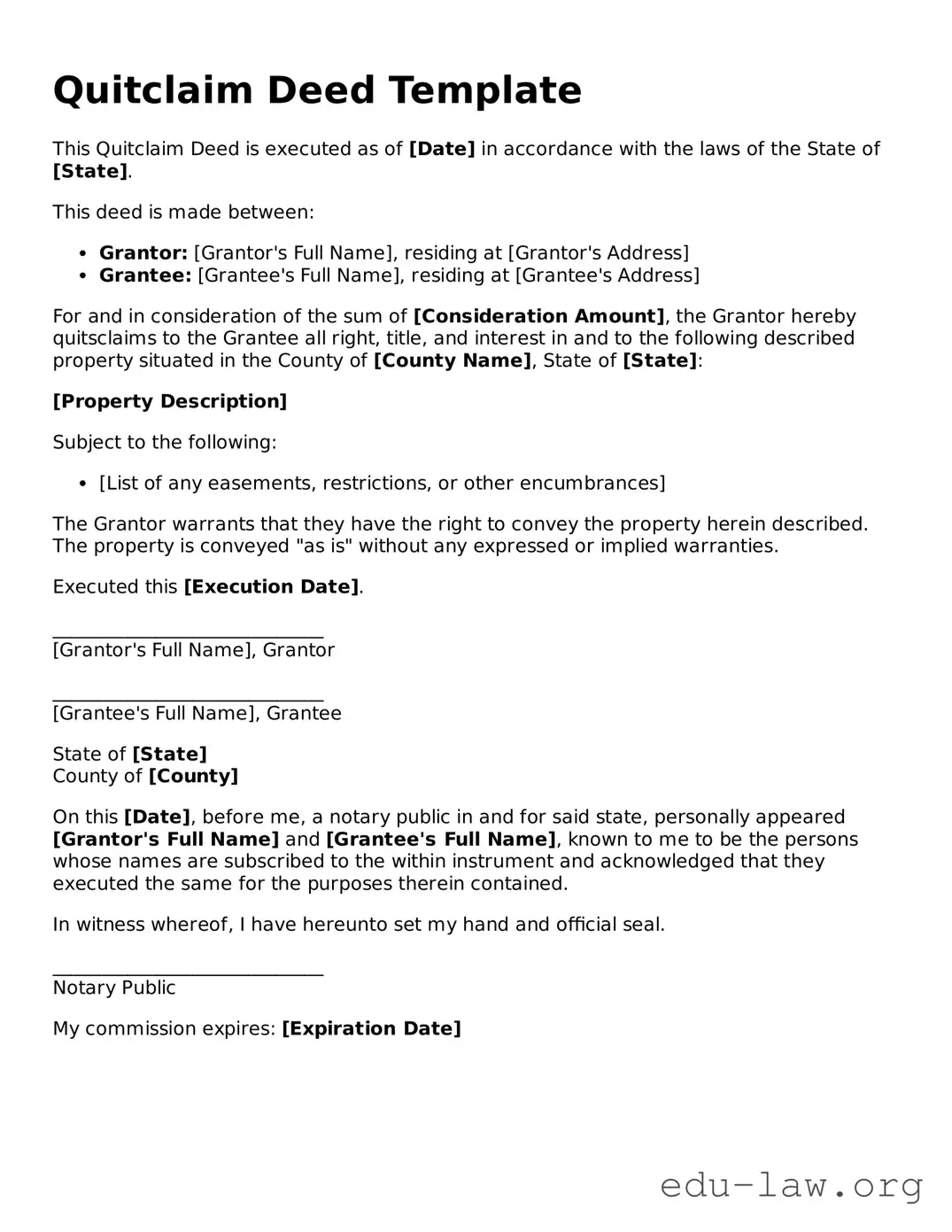

How do I properly execute a Quitclaim Deed?

To properly execute a Quitclaim Deed, both the grantor and grantee must sign the document. The deed typically needs to be notarized to verify the identities of the parties involved. Once completed, it should be filed with the county recorder’s office or the pertinent local government office where the property is located. This filing process effectively makes the transfer of ownership a matter of public record, helping to protect the interests of all parties involved.

Can a Quitclaim Deed be revoked?

A Quitclaim Deed, once executed and recorded, usually cannot be revoked unilaterally. The grantor can’t simply decide to take back the transfer without the grantee's consent. However, the grantor and grantee could agree to create a new deed to reverse the transaction if both parties are willing. It’s wise to document all agreements and changes, ensuring clarity and protection for everyone involved.

Is a Quitclaim Deed effective in all states?

Yes, Quitclaim Deeds are recognized in all states, but the specific requirements for execution, notarization, and recording may vary. It is essential to check local regulations and statutes to ensure compliance with applicable laws. Being aware of these differences can help facilitate a smoother process and prevent potential legal issues in the future.