What is a Promissory Note?

A Promissory Note is a financial document in which one party promises to pay a specified amount of money to another party at a predetermined time or on demand. It contains important details such as the amount owed, the interest rate (if applicable), payment schedule, and the consequences of non-payment. This document serves as a legal proof of the debt, making it a key element in personal and business financing arrangements.

Who typically uses a Promissory Note?

Promissory Notes are commonly used by individuals and businesses engaged in lending or borrowing money. They are often employed in personal loans between family and friends, as well as in formal business transactions. Lenders may use these notes to document loans to consumers or businesses, ensuring clarity regarding repayment terms and conditions.

What information should be included in a Promissory Note?

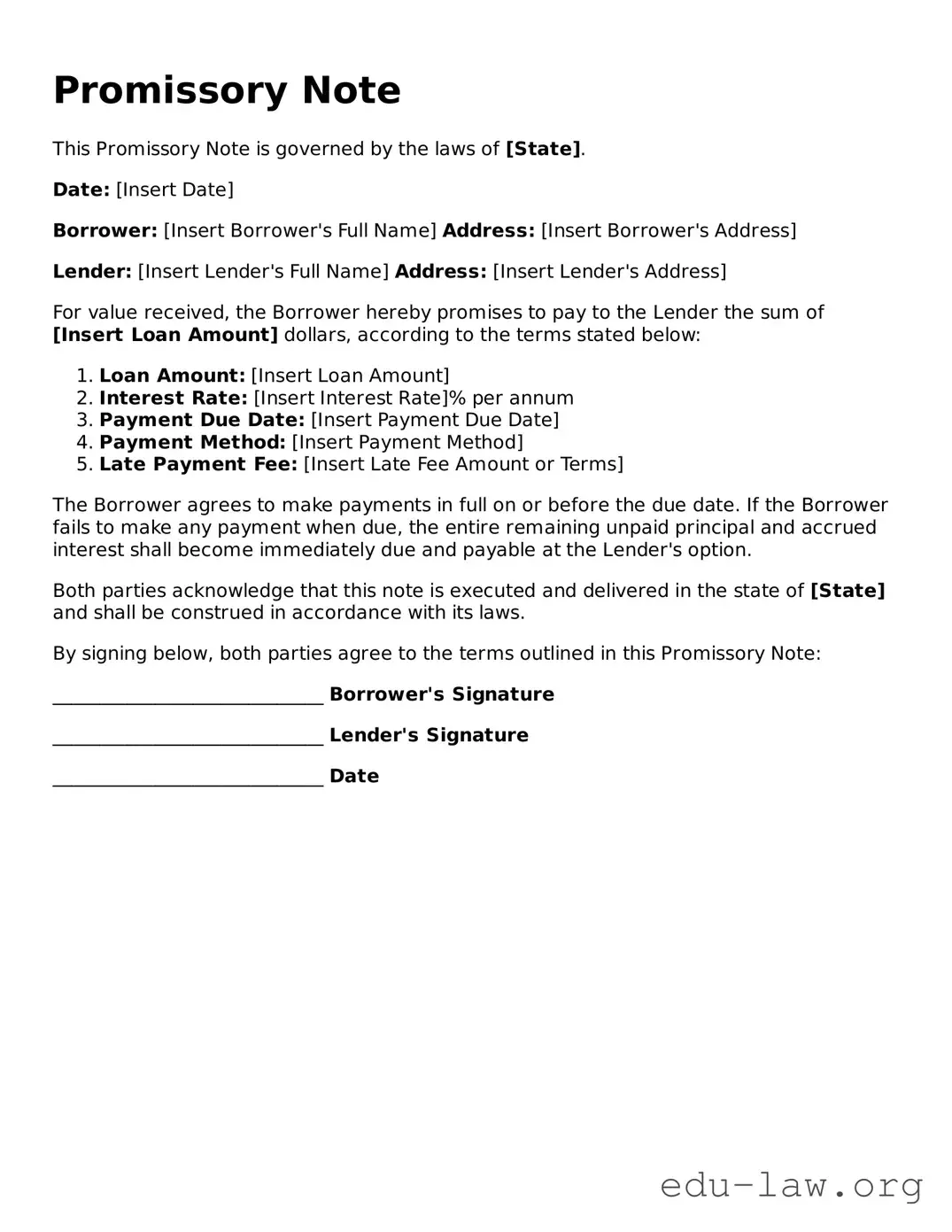

A comprehensive Promissory Note should include several key elements. First, the names and contact information of both the borrower and lender are essential. Next, it should state the principal amount being borrowed. The interest rate, whether it is fixed or variable, must be clearly described along with the payment schedule, including the due dates and methods of payment. Additionally, terms related to late payments or default should be outlined to protect both parties.

Is a Promissory Note legally binding?

Yes, a Promissory Note is a legally binding contract. This means that if the borrower fails to repay the loan according to the terms outlined in the note, the lender has the right to take legal action to recover the money owed. However, for the note to be enforceable, it must be clear, specific, and created with mutual consent from both parties. Notarization is not required but can provide additional validation.

How do I enforce a Promissory Note if the borrower defaults?

If a borrower defaults on repayment, the lender can take several steps to enforce the Promissory Note. Initially, communication with the borrower to discuss the missed payments is advisable, as there may be a simple resolution. If that fails, the lender has the option to seek legal counsel. They may choose to file a lawsuit to recover the owed amount, and having a well-drafted Promissory Note can significantly aid in this process. Engaging a lawyer who specializes in contract law can ensure the enforcement process is handled correctly.