What is a Payroll Check form?

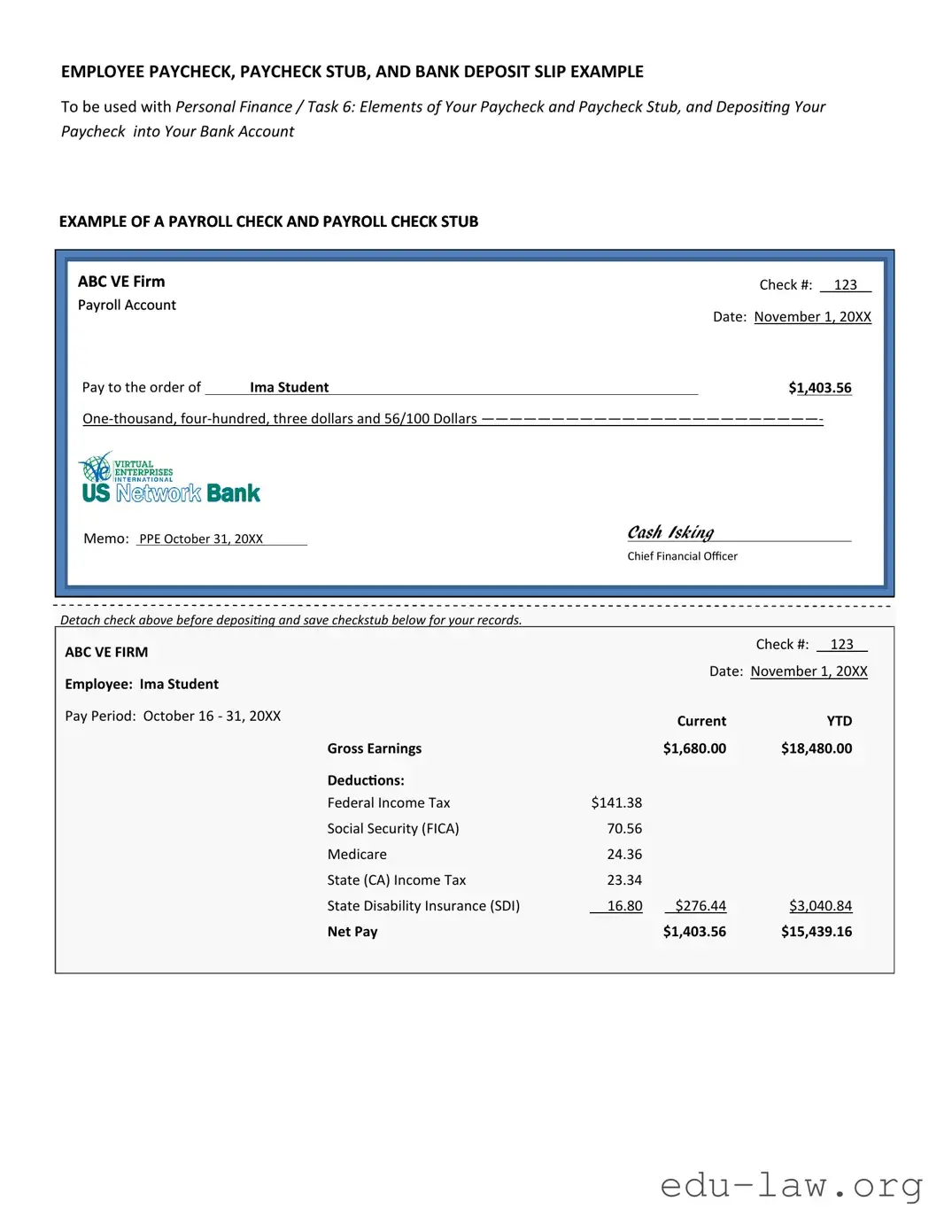

A Payroll Check form is a document used by employers to outline the details of employee payments. It typically includes information such as the employee's name, hours worked, pay rate, deductions, and the total amount to be paid. This form ensures accurate record-keeping and facilitates timely payment to employees.

How do I fill out the Payroll Check form?

To fill out the Payroll Check form, start by entering the employee's full name and identification number. Next, list the total hours worked during the pay period. Be sure to specify the pay rate and calculate the gross pay. After calculating deductions, such as taxes or benefits, provide the net pay amount. Double-check all entries for accuracy.

Who needs to sign the Payroll Check form?

The Payroll Check form usually requires the signature of the employer or payroll manager. This signature verifies that the information is accurate and that the payment has been authorized. Some companies may also require the employee's signature to acknowledge receipt of the payment.

When should I submit the Payroll Check form?

Submit the Payroll Check form during the designated payroll processing period. This could be weekly, bi-weekly, or monthly, depending on your company's payroll schedule. Timely submission ensures that employees receive their payments on schedule.

What happens if there is an error on the Payroll Check form?

If an error is found on the Payroll Check form after submission, it's crucial to notify the payroll department immediately. They will guide you on how to correct the mistake. This could involve completing a new form or adjusting the payroll records. Prompt action helps avoid delayed payments to the affected employee.

Can I include additional payments, like bonuses or overtime, on the Payroll Check form?

Yes, additional payments such as bonuses or overtime can be included on the Payroll Check form. When documenting these payments, clearly label them as separate line items. This transparency makes it easier for both the employer and the employee to understand how the total pay was calculated.

Is the Payroll Check form confidential?

Yes, the Payroll Check form contains sensitive personal information about employees, including their payment details. Employers should treat this information with confidentiality, restricting access to authorized personnel only. This precaution helps protect employee privacy.

What is the importance of keeping a copy of the Payroll Check form?

Keeping a copy of the Payroll Check form is essential for record-keeping and auditing purposes. It provides proof of payment and can be referenced in case of disputes or questions regarding employee compensation. Furthermore, maintaining accurate records helps ensure compliance with tax and employment regulations.

Where can I obtain a Payroll Check form?

A Payroll Check form can typically be obtained from your employer's payroll department or the company’s HR department. Some companies provide a standardized form, while others may allow you to use templates or online resources. Ensure that you are using the correct version as per company policy.