What is a P45 form?

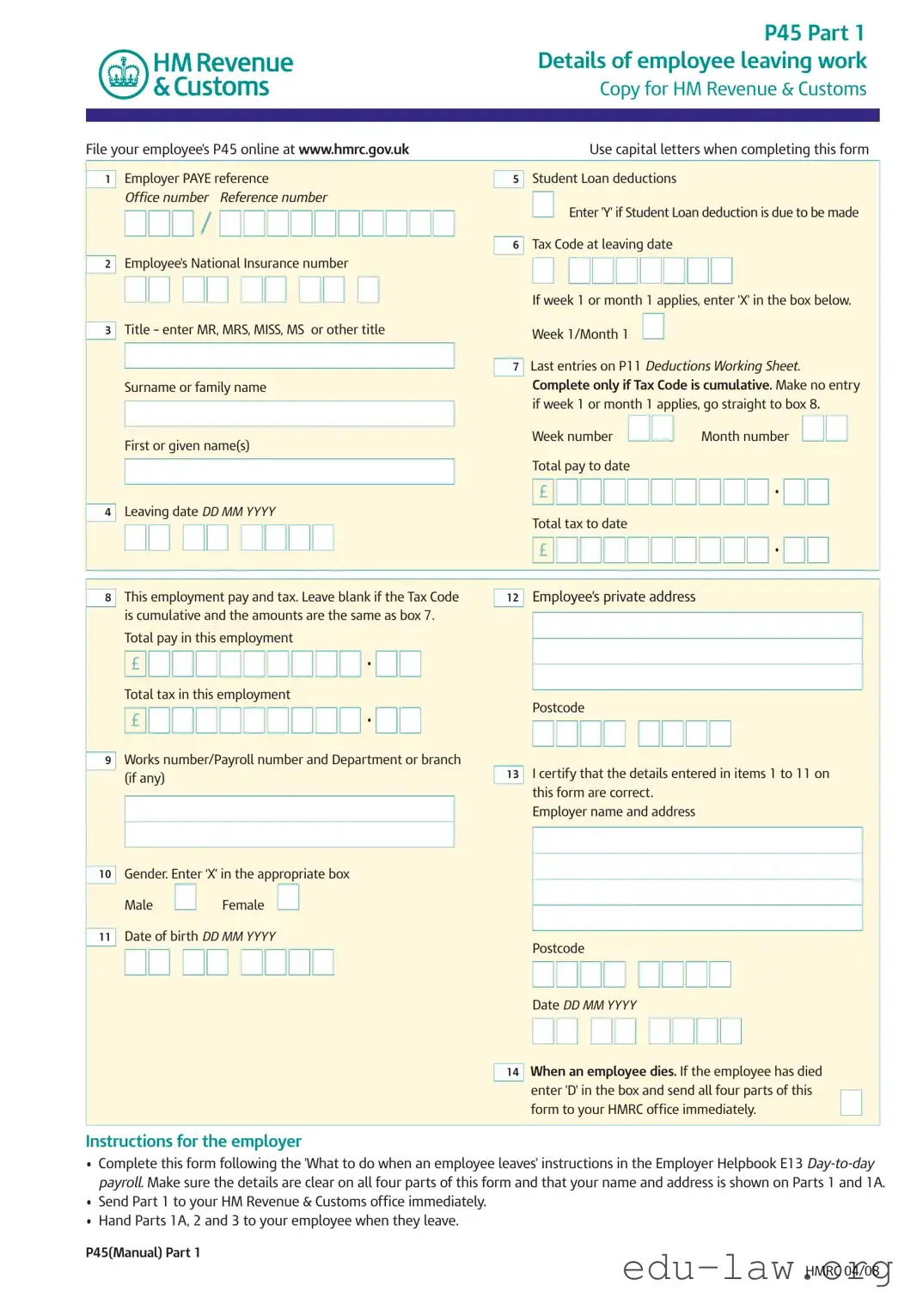

The P45 form is a document issued by an employer when an employee leaves their job. It provides information about the employee's tax code, National Insurance number, and earnings. The form is divided into three parts, with one for HM Revenue & Customs (HMRC), one for the employee, and one for the new employer. This document is essential for ensuring that the correct amount of tax is deducted in future employment or when claiming state benefits.

How do I receive my P45 after leaving a job?

Your employer is responsible for issuing you a P45 on your last day of work or shortly thereafter. They should provide you with Parts 1A, 2, and 3 of the P45. It is crucial to request this document if you do not receive it, as you’ll need it for any subsequent tax filings or employment.

What should I do with my P45?

Once you receive your P45, keep it in a safe place. You will need Part 1A for your records, particularly if you are required to fill out a Tax Return. Parts 2 and 3 should be given to your new employer to ensure your tax deductions are applied correctly. This also prevents any emergency tax codes from coming into effect.

What information is included in the P45 form?

The P45 includes your personal details, such as your name and National Insurance number, along with your earnings and tax details for the tax year up until your leaving date. This could include your total pay to date, total tax deducted, and your tax code. Also, it contains important information relevant to Student Loan deductions, if applicable.

What if I don’t receive a P45?

If you do not receive a P45 from your employer, contact them directly to request it. If problems persist, you may need to contact HMRC for assistance. Remember, without a P45, you could end up paying too much tax with your new employer due to emergency tax codes being applied.

Can I use my P45 if I am self-employed?

A P45 is mainly for employees transitioning to new employment or claiming state benefits. If you become self-employed, you won't use your P45 directly. However, you should keep it for your records, as it shows your tax history, which may be useful when filing your tax return.

What do I do if I change jobs frequently?

Every time you leave a job, you should receive a new P45. Make sure to keep each one and provide your new employer with your latest P45. This will ensure your tax deductions are accurate and prevent overtaxing. If you have not received a P45 and you are starting a new job, inform your new employer to avoid emergency tax codes.

What information should I check for correctness on my P45?

Carefully review your P45 for accuracy. Check your personal details like name, National Insurance number, and earnings. Ensure that the tax code and tax deducted amounts are correct, as errors may impact how much you are taxed in future jobs. If you find inaccuracies, contact your previous employer to correct them.

/

/

•

•

•

•

/

/

•

•