What is an Owner Financing Contract?

An Owner Financing Contract is an agreement between a seller and a buyer where the seller finances the purchase of the property. Instead of obtaining a mortgage from a bank or financial institution, the buyer makes payments directly to the seller over time. This arrangement can benefit both parties, making home ownership more accessible for buyers and providing a steady income stream for sellers.

Who can use an Owner Financing Contract?

This type of contract can be utilized by any real estate seller who is willing to finance the sale of their property. It is often attractive to those looking to sell quickly or to buyers who may have difficulty securing traditional financing. Buyers should carefully assess their financial situation and intentions before entering into such an agreement.

What are the benefits of an Owner Financing Contract?

Owner financing offers several advantages. For buyers, it can provide easier access to property without the stringent requirements of traditional lenders. They may benefit from more flexible payment terms and possibly lower closing costs. Sellers can also gain benefits, such as selling their property quicker and potentially earning interest on the financed amount, which could lead to higher overall returns.

Are there risks involved with Owner Financing?

Yes, both parties face certain risks. Buyers may end up paying a higher interest rate than they would with a bank, depending on the market conditions. Sellers also take on the risk of the buyer defaulting on payments, which might necessitate costly legal action to reclaim the property. It is crucial for both parties to conduct thorough due diligence before entering into such a contract.

What terms should be included in the contract?

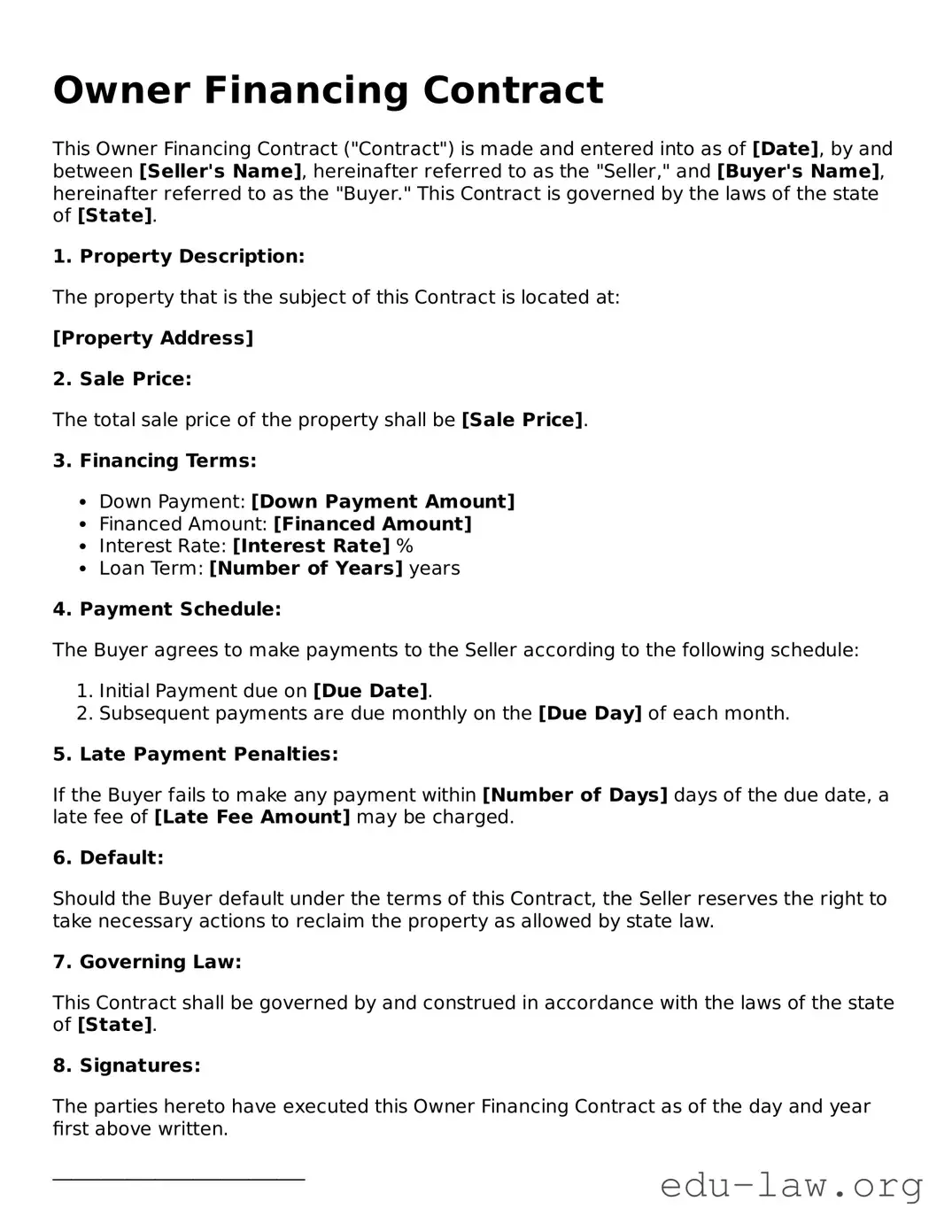

The contract should include key details such as the purchase price, down payment amount, interest rate, repayment schedule, and how long the financing will last. Additionally, it’s essential to outline any late fees, the process for default, and how property taxes and insurance will be handled. Clear terms can help prevent misunderstandings later on.

Is an Owner Financing Contract legally binding?

Yes, an Owner Financing Contract is a legally binding agreement once signed by both parties. It is crucial that both the seller and the buyer understand the terms before agreeing. Notarizing the documents can provide an added layer of protection and help affirm the agreement, should legal disputes arise in the future.

What should I do if there are issues with the contract?

If issues arise with the Owner Financing Contract, both parties should first attempt to address the problems through discussion. If that approach does not resolve the issue, seeking legal advice may be necessary. Consulting with a legal professional specializing in real estate can provide guidance tailored to the specific situation.