The Operating Agreement is often compared to the Partnership Agreement, which outlines the terms and conditions established between partners in a business partnership. Like an Operating Agreement, a Partnership Agreement clarifies the roles and responsibilities of each partner, profit-sharing arrangements, and dispute resolution mechanisms. Both documents serve as foundational guides that govern the operation of the business, ensuring that each party has a clear understanding of their rights and obligations.

Similarly, the Shareholders’ Agreement serves as a vital document for corporations with multiple shareholders. This agreement specifies how shares can be bought and sold, outlines the rights of shareholders regarding voting and dividends, and addresses conflict resolution. Comparable to an Operating Agreement, the Shareholders’ Agreement aims to provide stability and clear expectations within the corporate structure.

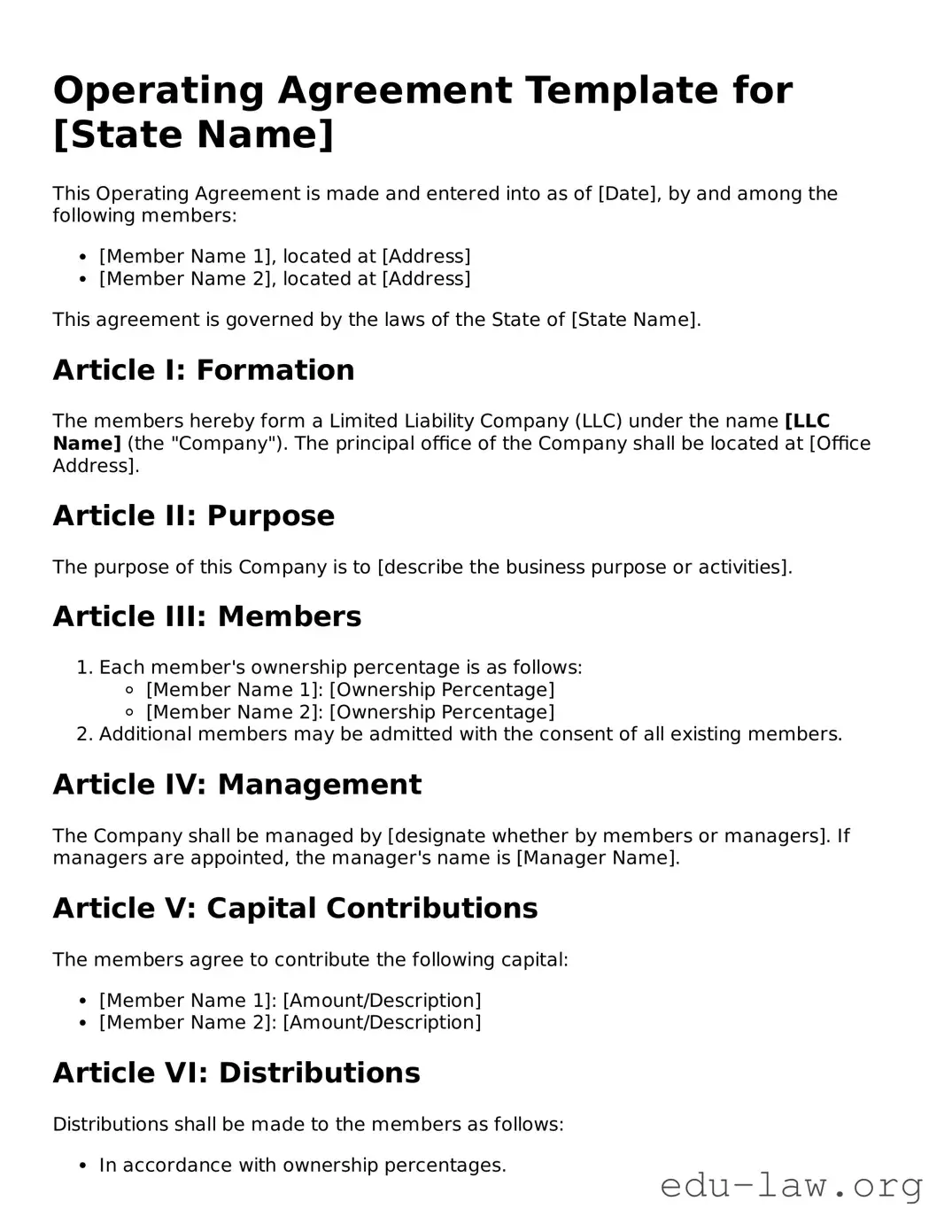

A Limited Liability Company (LLC) Formation Document, often filed with the state, is another closely related document. This document formally establishes the LLC as a legal entity and typically outlines the basic structure of the company, including management and ownership information. While the Operating Agreement provides more detailed operational provisions, the Formation Document lays the groundwork for an LLC’s existence.

The Bylaws of a corporation similarly outline the internal rules governing the management of the company. They include procedures for holding meetings, appointing directors, and making corporate decisions. Both the Bylaws and the Operating Agreement aim to maintain order within the organization and clarify the decision-making processes that guide daily operations.

The Business Plan, while more focused on the strategic direction of a business, shares similarities with an Operating Agreement in that it outlines goals, management structure, and operational strategies. The Operating Agreement addresses the internal functioning of the business, while the Business Plan focuses more on long-term objectives and market position, yet both provide essential frameworks for the company’s approach to achieving its mission.

The Employment Agreement offers another point of comparison as it defines the relationship between an employer and employee. This document typically outlines duties, compensation, and termination clauses. Much like an Operating Agreement defines roles and responsibilities within the whole company, an Employment Agreement specifies expectations and obligations for individual employees, thereby contributing to organizational clarity.

A Non-Disclosure Agreement, or NDA, serves a different purpose but shares a focus on confidentiality and trust within business relationships. While an Operating Agreement sets the stage for managing internal operations, an NDA protects sensitive information from being disclosed externally. Both are essential in safeguarding the interests of the entity and ensuring that all parties are aware of their obligations regarding confidentiality.

Operating as an internal governance document, a Resolution Book keeps a record of decisions made by the company’s members or directors. Like an Operating Agreement, which governs the operations of an LLC, the Resolution Book formalizes decisions made during meetings, ensuring that records are kept of key choices and actions taken by the organization.

The Independent Contractor Agreement also bears similarities to an Operating Agreement, as it delineates the nature of the relationship between a business and independent contractors. This document includes aspects such as payment terms, project scope, and expectations. While the Operating Agreement addresses the internal workings of a business, the Independent Contractor Agreement focuses on specific project-based relationships, highlighting the diverse ways businesses manage their human resources.

Lastly, an LLC Member Agreement serves a similar function to an Operating Agreement but is tailored specifically for multi-member LLCs. This document outlines the rights and obligations of members and, like the Operating Agreement, provides detailed instructions on capital contributions, distribution of profits, and the process for resolving disputes. Thus, both agreements function to protect the interests of the members and ensure that the business operates smoothly and collaboratively.