What is a Michigan Transfer-on-Death Deed?

A Michigan Transfer-on-Death Deed (TODD) allows a property owner to transfer their real estate to a designated beneficiary upon their death. This deed ensures that the property does not go through probate, making the process quicker and simpler for the beneficiary.

How does a Transfer-on-Death Deed work?

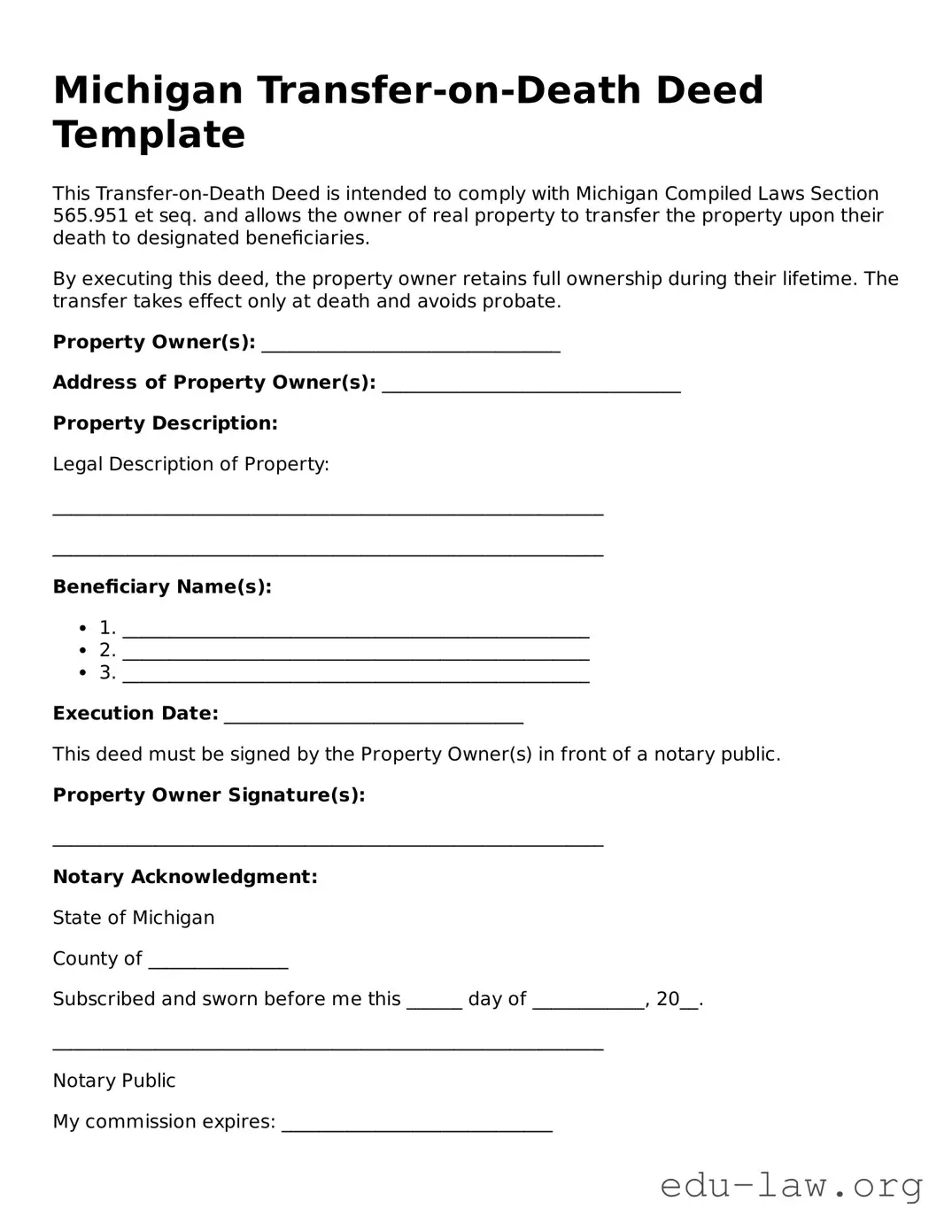

The owner completes the TODD form, naming the beneficiary who will receive the property after death. The deed must be signed, dated, and recorded with the county register of deeds before the owner’s death to be valid. Once the owner passes, ownership automatically transfers to the beneficiary without the need for probate.

Who can be a beneficiary on a Transfer-on-Death Deed?

Beneficiaries can be individuals, such as family members or friends, or entities like trusts or charities. The deed can name multiple beneficiaries, dividing the property interest among them according to the owner’s wishes.

Are there any restrictions on what property can be transferred using a TODD?

Yes, the TODD can only be used for residential property or vacant land. It cannot be used for properties that are subject to mortgages or liens unless those obligations will be addressed prior to the transfer.

Can I revoke a Transfer-on-Death Deed?

Yes, the owner can revoke a TODD at any time before their death. Revocation must be done in writing and filed with the county register of deeds. The owner can also create a new TODD that supersedes any previous deeds.

Does a Transfer-on-Death Deed affect property taxes?

No, transferring property through a TODD does not affect property taxes during the owner's lifetime. However, the property will be reassessed for tax purposes when it is transferred to the beneficiary after death.

Do beneficiaries have any rights to the property before the owner's death?

No, beneficiaries do not have any rights to the property until the owner's death. The owner retains full control and can sell, rent, or otherwise manage the property without the beneficiary's involvement.

Is a Transfer-on-Death Deed the same as a will?

No, they are different legal documents. A will distributes a person's entire estate, including assets, upon death and goes through the probate process. A TODD specifically transfers the property outside of probate and directly to the named beneficiary.

What happens if I change my mind about who should receive the property?

If an owner decides to change the beneficiary, they can complete a new TODD that names the new beneficiary. This new deed must also be signed, dated, and recorded with the county register of deeds to be effective.

How can I obtain a Michigan Transfer-on-Death Deed form?

The form is typically available from legal stationery stores, online legal services, or the Michigan Department of Licensing and Regulatory Affairs website. It is important to ensure that the form complies with Michigan law and all necessary guidelines are followed when filling it out.