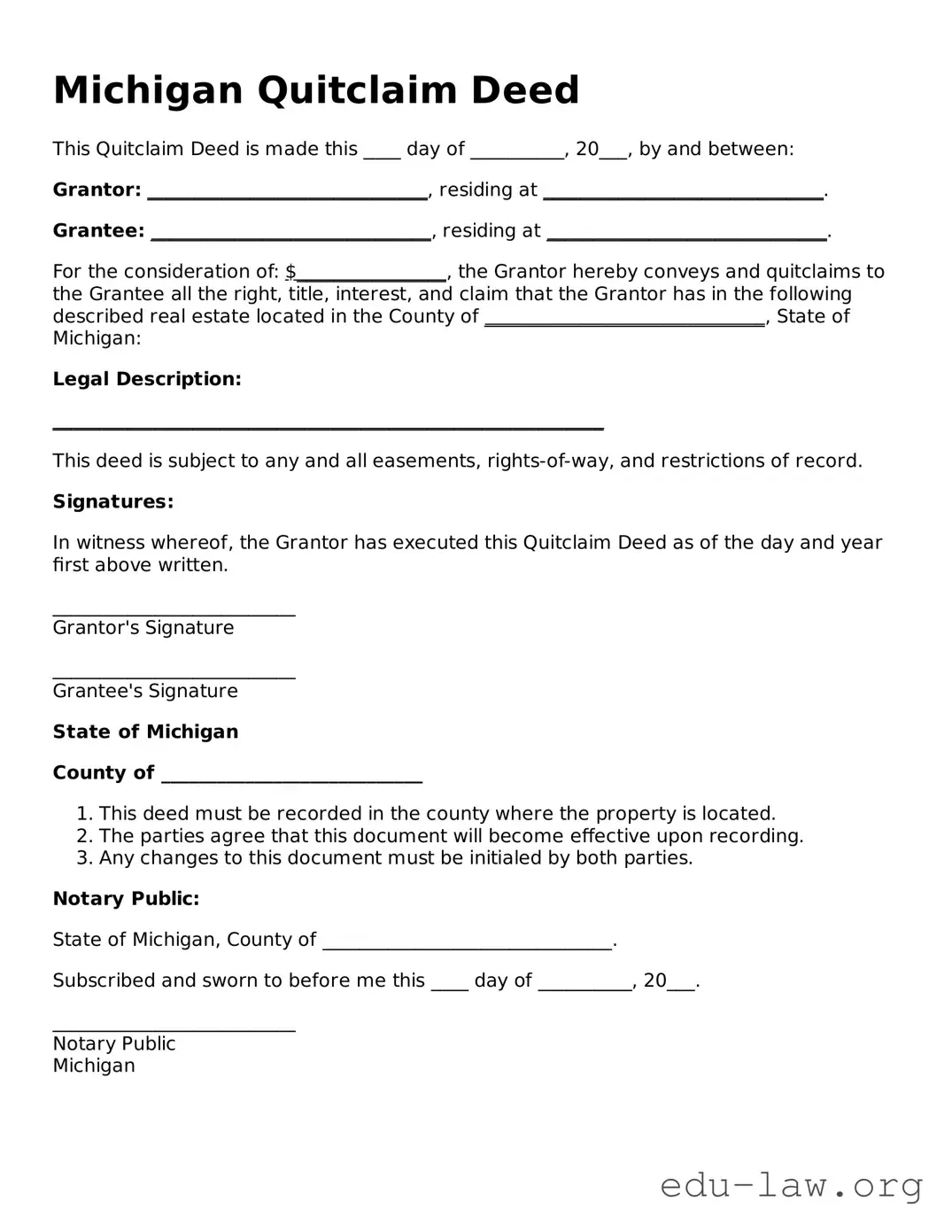

Michigan Quitclaim Deed

This Quitclaim Deed is made this ____ day of __________, 20___, by and between:

Grantor: ______________________________, residing at ______________________________.

Grantee: ______________________________, residing at ______________________________.

For the consideration of: $________________, the Grantor hereby conveys and quitclaims to the Grantee all the right, title, interest, and claim that the Grantor has in the following described real estate located in the County of ______________________________, State of Michigan:

Legal Description:

___________________________________________________________

This deed is subject to any and all easements, rights-of-way, and restrictions of record.

Signatures:

In witness whereof, the Grantor has executed this Quitclaim Deed as of the day and year first above written.

__________________________

Grantor's Signature

__________________________

Grantee's Signature

State of Michigan

County of ____________________________

- This deed must be recorded in the county where the property is located.

- The parties agree that this document will become effective upon recording.

- Any changes to this document must be initialed by both parties.

Notary Public:

State of Michigan, County of _______________________________.

Subscribed and sworn to before me this ____ day of __________, 20___.

__________________________

Notary Public

Michigan