What is a Power of Attorney in Michigan?

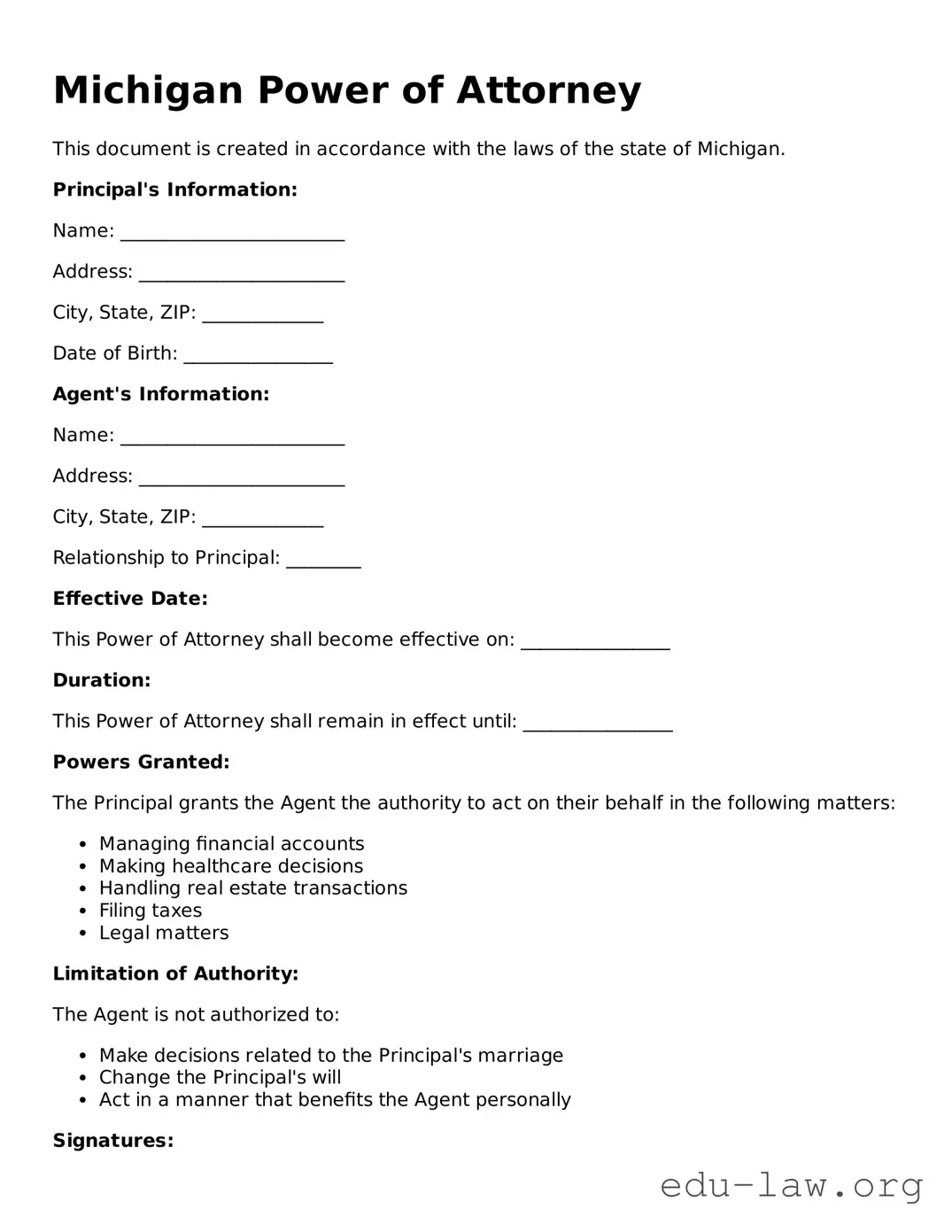

A Power of Attorney (POA) is a legal document that allows you to appoint someone to make decisions on your behalf. This can include financial decisions, healthcare choices, or other personal matters. In Michigan, a POA can be tailored to meet your specific needs.

Who can be my Agent or Attorney-in-Fact?

Your Agent, also known as Attorney-in-Fact, can be anyone you trust. This could be a family member, friend, or professional advisor. It's important to choose someone who will act in your best interest and is willing to take on the responsibility.

Do I need a lawyer to create a Power of Attorney in Michigan?

No, you do not necessarily need a lawyer to create a POA in Michigan. While legal assistance can be helpful, it is not required. You can use a form that meets state requirements and fill it out correctly to make it valid.

What types of Power of Attorney are available in Michigan?

Michigan recognizes several types of POA. The two most common are the Durable Power of Attorney and the Medical Power of Attorney. A Durable POA remains effective even if you become incapacitated, while a Medical POA specifically focuses on healthcare decisions.

How do I revoke a Power of Attorney in Michigan?

If you wish to revoke your POA, you must create a written revocation document. After creating it, you should distribute copies to your Agent and any relevant parties, and inform them that the previous POA is no longer in effect.

Is a Power of Attorney valid if it is not notarized?

In Michigan, a Power of Attorney does not need to be notarized to be valid. However, it must be signed by you and two witnesses, or it can be notarized if you prefer. Having it notarized can help with acceptance by third parties.

When does a Power of Attorney go into effect?

A Power of Attorney can go into effect right away or only under certain conditions. If you want it to take effect immediately, that can be specified in the document. Alternatively, you can set it to activate when you become incapacitated.

Can I set limits on what my Agent can do?

Yes, you have the ability to set limits on your Agent's authority. Your Power of Attorney can detail specific powers or exclude certain decisions. Clearly defining these limits helps ensure your wishes are followed.

What happens if I become incapacitated without a Power of Attorney?

If you become incapacitated without a POA in place, the court may need to appoint a guardian to make decisions for you. This process can be lengthy, costly, and may not reflect your wishes.

Can I use a Power of Attorney from another state in Michigan?

Yes, Michigan generally recognizes Powers of Attorney created in other states, as long as they comply with Michigan laws. However, it is advisable to consult with a legal professional to ensure its validity in Michigan.