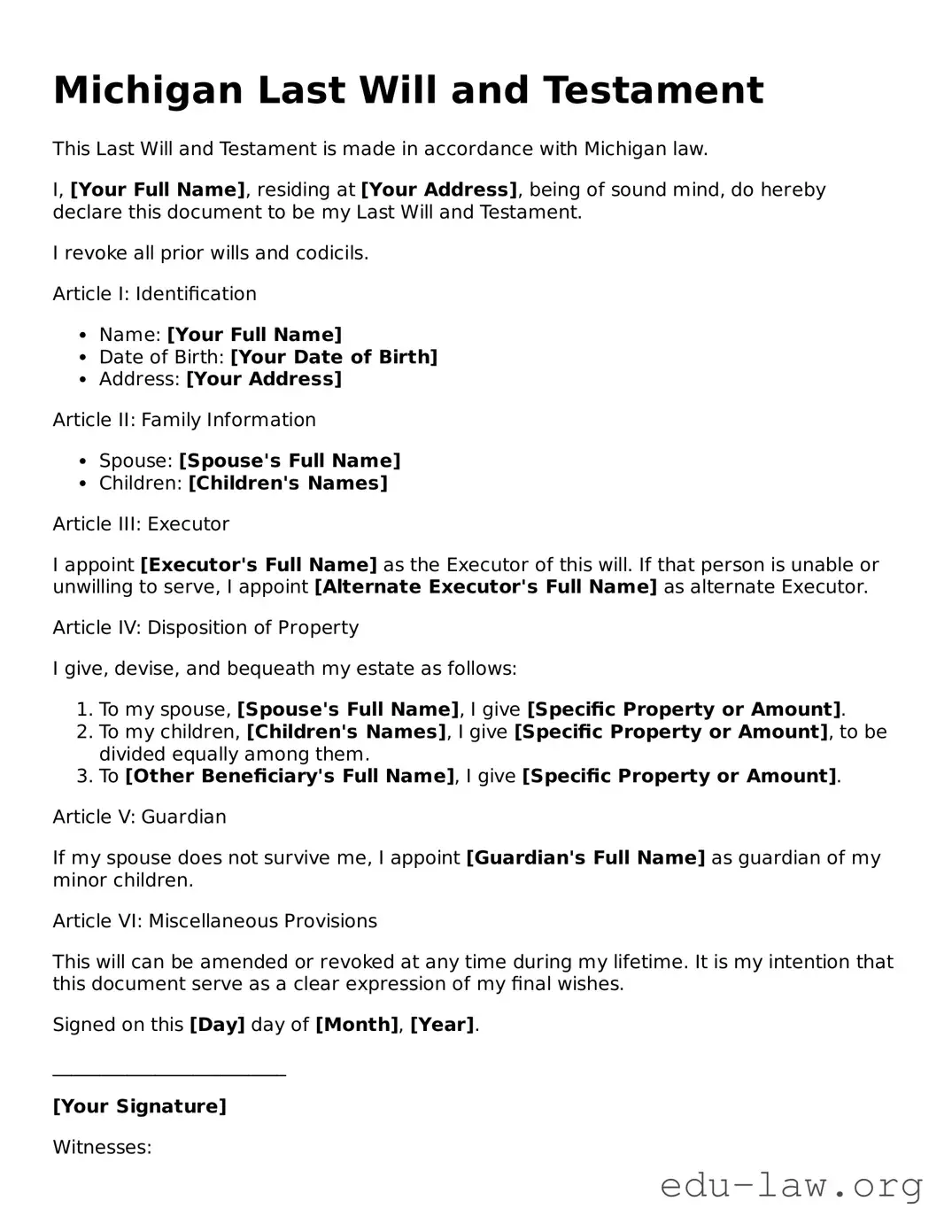

Michigan Last Will and Testament

This Last Will and Testament is made in accordance with Michigan law.

I, [Your Full Name], residing at [Your Address], being of sound mind, do hereby declare this document to be my Last Will and Testament.

I revoke all prior wills and codicils.

Article I: Identification

- Name: [Your Full Name]

- Date of Birth: [Your Date of Birth]

- Address: [Your Address]

Article II: Family Information

- Spouse: [Spouse's Full Name]

- Children: [Children's Names]

Article III: Executor

I appoint [Executor's Full Name] as the Executor of this will. If that person is unable or unwilling to serve, I appoint [Alternate Executor's Full Name] as alternate Executor.

Article IV: Disposition of Property

I give, devise, and bequeath my estate as follows:

- To my spouse, [Spouse's Full Name], I give [Specific Property or Amount].

- To my children, [Children's Names], I give [Specific Property or Amount], to be divided equally among them.

- To [Other Beneficiary's Full Name], I give [Specific Property or Amount].

Article V: Guardian

If my spouse does not survive me, I appoint [Guardian's Full Name] as guardian of my minor children.

Article VI: Miscellaneous Provisions

This will can be amended or revoked at any time during my lifetime. It is my intention that this document serve as a clear expression of my final wishes.

Signed on this [Day] day of [Month], [Year].

_________________________

[Your Signature]

Witnesses:

As witnesses, we declare that the testator, [Your Full Name], signed this will in our presence.

_________________________

[Witness #1 Name]

_________________________

[Witness #2 Name]