What is the Michigan Articles of Incorporation form?

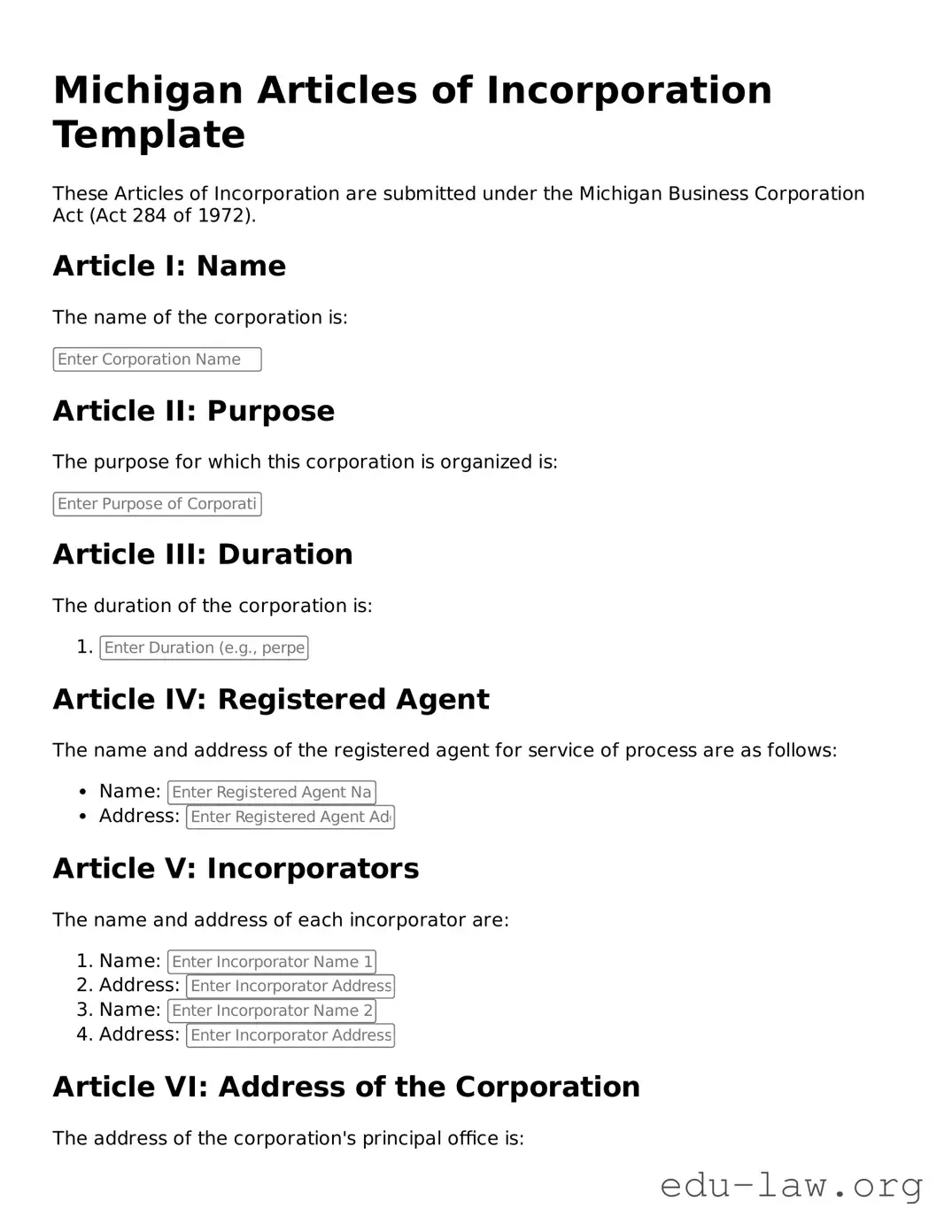

The Michigan Articles of Incorporation form is an official document that you need to file with the state to create a corporation in Michigan. This document outlines the basic details about your corporation, including its name, purpose, registered office address, and information about its shares. Filing this form is the first step in establishing your business as a legal entity recognized by the state.

Who needs to file the Articles of Incorporation?

If you are planning to start a corporation in Michigan, you must file the Articles of Incorporation. This applies whether your corporation will be for-profit or nonprofit. If your business isn’t structured as a corporation, then you don’t need to file this form. For example, partnerships or sole proprietorships have different requirements.

What information do I need to provide on the form?

When filling out the Articles of Incorporation form, you need to provide specific information. This includes the name of your corporation, which must be unique and not already in use in Michigan. You’ll also need to specify the purpose of your business, give the address of your registered office, and list the names and addresses of the initial directors and incorporators. Additionally, you'll need to indicate the number of shares the corporation is authorized to issue.

How do I file the Articles of Incorporation in Michigan?

To file the Articles of Incorporation, you can submit the completed form online or by mail. If you choose to file by mail, send the form along with the required filing fee to the Michigan Department of Licensing and Regulatory Affairs. Make sure you check for any updated fees and processes, as these can change. Filing online is often quick and may reduce processing time.

Is there a filing fee for the Articles of Incorporation?

Yes, there is a filing fee, which varies depending on the type of corporation you are forming. For-profit corporations usually have a different fee structure compared to nonprofit organizations. It’s essential to check the latest fee details on the Michigan Department of Licensing and Regulatory Affairs website before filing to ensure you include the correct payment.

How long does it take to process the Articles of Incorporation?

The processing time for the Articles of Incorporation can vary. Generally, once submitted, it can take anywhere from a few days to several weeks, depending on the volume of applications the state is handling. If you need your corporation to be established quickly, some states offer expedited processing for an additional fee.

What happens after I file my Articles of Incorporation?

Once your Articles of Incorporation are processed and approved, you will receive a certificate of incorporation from the Michigan Department of Licensing and Regulatory Affairs. At this point, your corporation is officially formed. You can then take further steps to set up your business, such as obtaining necessary licenses, establishing a bank account, and following any other regulatory requirements.

Can I make changes to the Articles of Incorporation later?

Yes, changes can be made to your Articles of Incorporation after filing. If you need to update information such as your corporation's name, purpose, or structure, you'll have to file an amendment with the state. This amendment outlines the changes being made. Again, there may be a fee associated with this process, so it’s wise to stay informed about any requirements or costs involved.