What is the Louisiana Act of Donation Form?

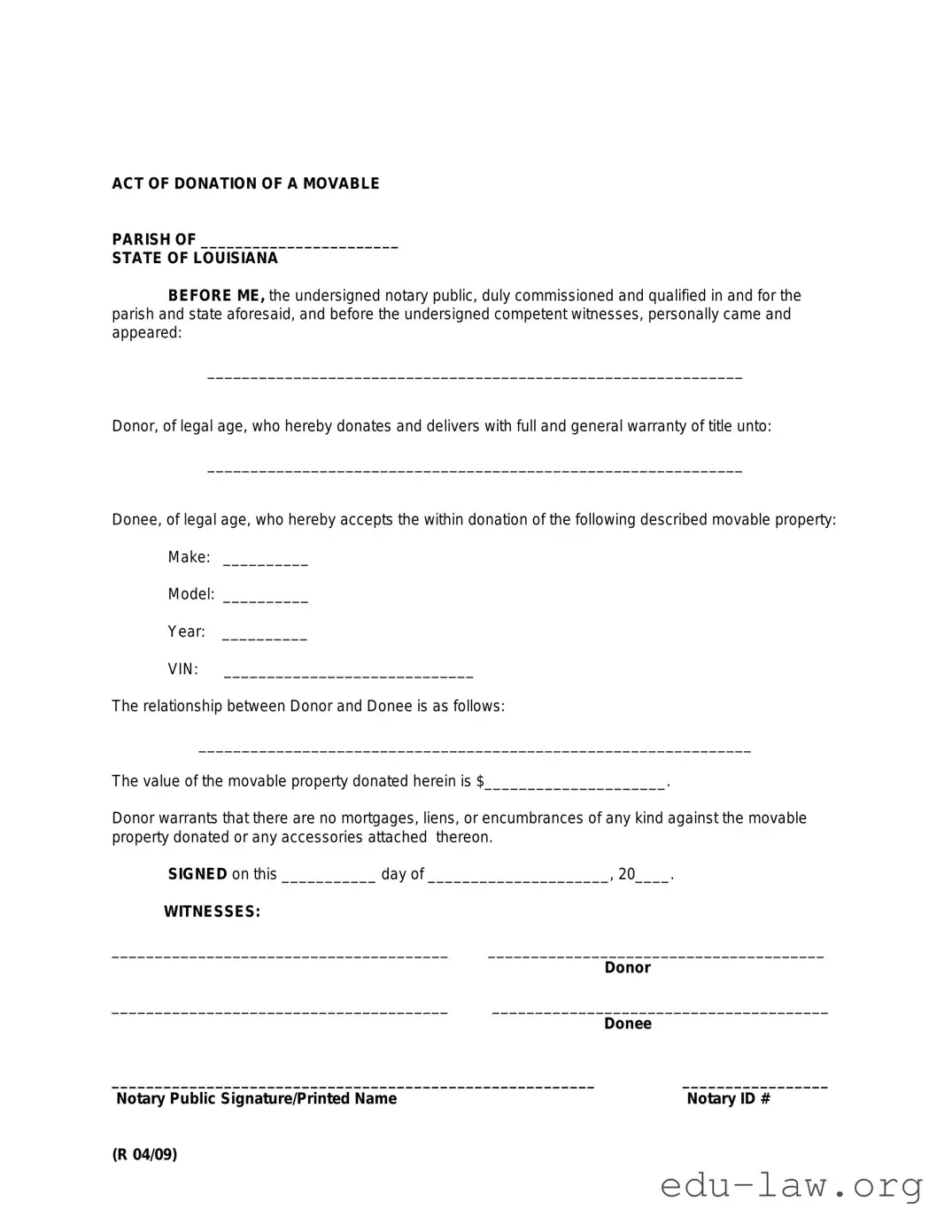

The Louisiana Act of Donation Form is a legal document used to formally transfer property from one person to another without any exchange of money. This form is particularly useful for individuals who wish to give gifts of real estate or movable property to family members or friends. By completing this form, the donor ensures that the transfer is recognized under Louisiana law.

Who can use the Act of Donation Form?

Any person who owns property in Louisiana can use the Act of Donation Form to donate their property. However, the recipient, known as the donee, must be a legal person capable of receiving gifts, which typically includes individuals, organizations, or corporations. It is important to ensure that the donee is of legal age and has the capacity to accept the donation.

What types of property can be donated using the Act of Donation Form?

Property that can be donated includes both immovable property, such as land and buildings, and movable property, including vehicles, bank accounts, and personal items. It is crucial that the property is clearly identified in the form to avoid any disputes regarding the donation.

Are there any limitations on making donations in Louisiana?

Yes, there are certain limitations. For instance, if the donor is married, the donation may require the consent of the spouse, especially if the property is considered community property. Additionally, major donations could have tax implications for both the donor and the recipient. It is advisable to consult a tax professional or attorney for guidance.

Is the Act of Donation Form required to be notarized?

Yes, the Act of Donation Form must be executed in front of a notary public to be legally recognized. Notarization adds a layer of authentication and helps verify the identities of the parties involved. This step is crucial to ensure that the document is binding and enforceable.

What happens after the Act of Donation Form is executed?

Once the form is filled out and notarized, the donor should provide a copy to the donee. Depending on the property type, it may also be necessary to record the donation with the appropriate local government office, especially for real estate. This recording helps protect the donee's interest in the property and provides public notice of the transfer.

Can the donor revoke the donation after signing the form?

In general, once the Act of Donation Form is signed and notarized, the donation is irrevocable. However, specific conditions or stipulations can be included in the form that may allow for revocation under certain circumstances. It is crucial to outline any desired conditions clearly in the document to prevent confusion later on.