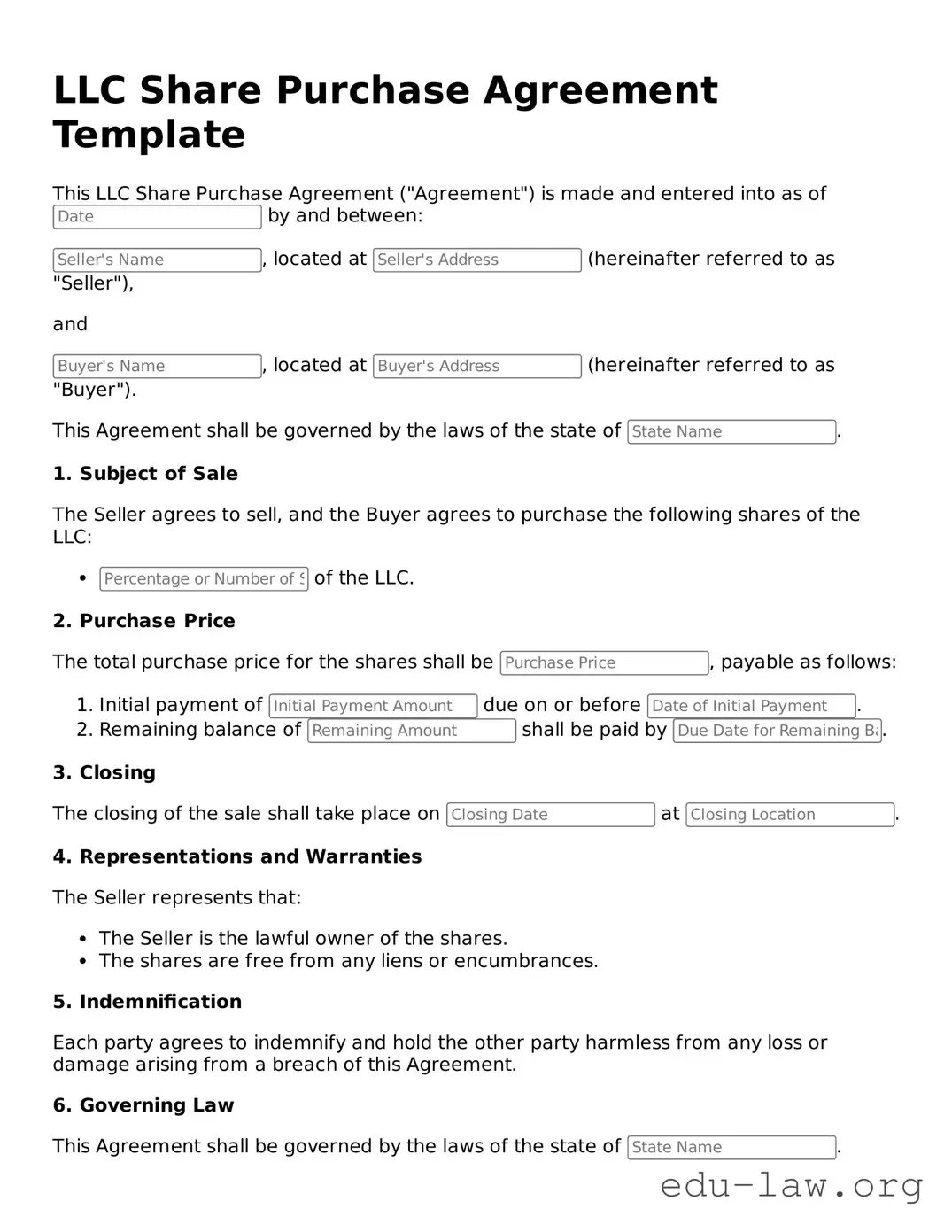

LLC Share Purchase Agreement Template

The LLC Share Purchase Agreement is a legal document that outlines the terms and conditions under which ownership shares of a limited liability company (LLC) are bought and sold. This agreement protects the interests of both the buyer and seller, ensuring a clear understanding of the transaction. It is a vital tool for facilitating smooth business transitions and promoting transparency in ownership transfers.