What is a Last Will and Testament?

A Last Will and Testament is a legal document that outlines how a person's assets and affairs will be handled after their death. It often includes provisions regarding the distribution of property, naming guardians for minor children, and appointing an executor to manage the estate.

Why do I need a Last Will and Testament?

Having a Last Will is essential to ensure that your wishes are respected after you pass away. Without a will, the state’s laws will determine how your property is distributed, which may not align with your preferences. A will gives you control over your assets and can help prevent disputes among family members.

Who can create a Last Will and Testament?

Generally, anyone who is at least 18 years old and of sound mind can create a Last Will and Testament. Being of sound mind means you understand the nature of the document and its implications. There are no specific legal qualifications needed beyond these criteria.

How do I create a Last Will and Testament?

You can create a will by writing it yourself, using a template, or working with an attorney. If you choose to write it yourself, make sure it complies with state laws. For clarity and to ensure all legal requirements are met, consulting an attorney is advisable.

What should be included in a Last Will and Testament?

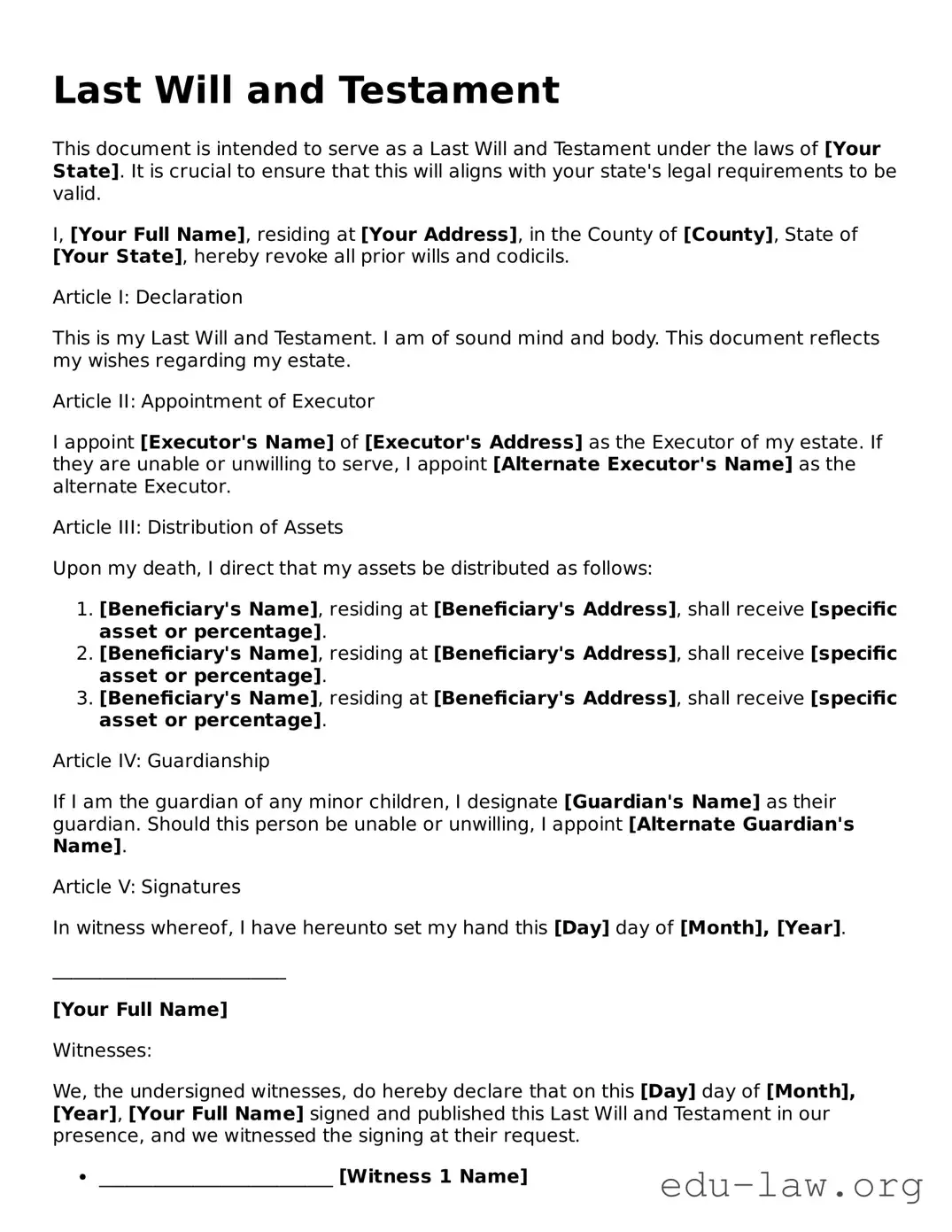

Key elements of a will include your identification, a declaration that the document is your will, details outlining asset distribution, guardianship instructions for minor children, and an appointed executor. It’s also essential to sign the document, and many states require witnesses to the signing.

Can I change my Last Will and Testament?

Yes, you can change your will at any time while you are alive, as long as you are of sound mind. This may involve creating a new will or drafting an amendment called a codicil. Make sure that any changes are documented properly to avoid confusion in the future.

What happens if I die without a Last Will?

If you pass away without a will, your assets will be distributed according to state intestacy laws. These laws vary by state and typically prioritize relatives such as spouses, children, and parents. This outcome may not reflect your wishes and can lead to complications or disputes among family members.

Can I revoke my Last Will and Testament?

You can revoke your will at any time. This can be done by creating a new will, clearly stating your intent to revoke, or physically destroying the document. After revocation, all assets will follow the terms of your most recent valid will or state intestacy laws, if no valid will exists.

Is a Last Will and Testament the same as a trust?

No, a will and a trust serve different purposes. A will outlines how your assets will be distributed after death, while a trust allows you to manage your assets during your lifetime and decide how they are distributed upon your death. Trusts can also help avoid probate, which is a process that validates the will.

Do I need a lawyer to create a Last Will and Testament?

While it’s not strictly necessary to hire a lawyer, it is highly recommended, especially if your estate is large or complicated. An attorney can ensure your will complies with legal requirements, addresses all necessary issues, and reflects your specific wishes accurately.