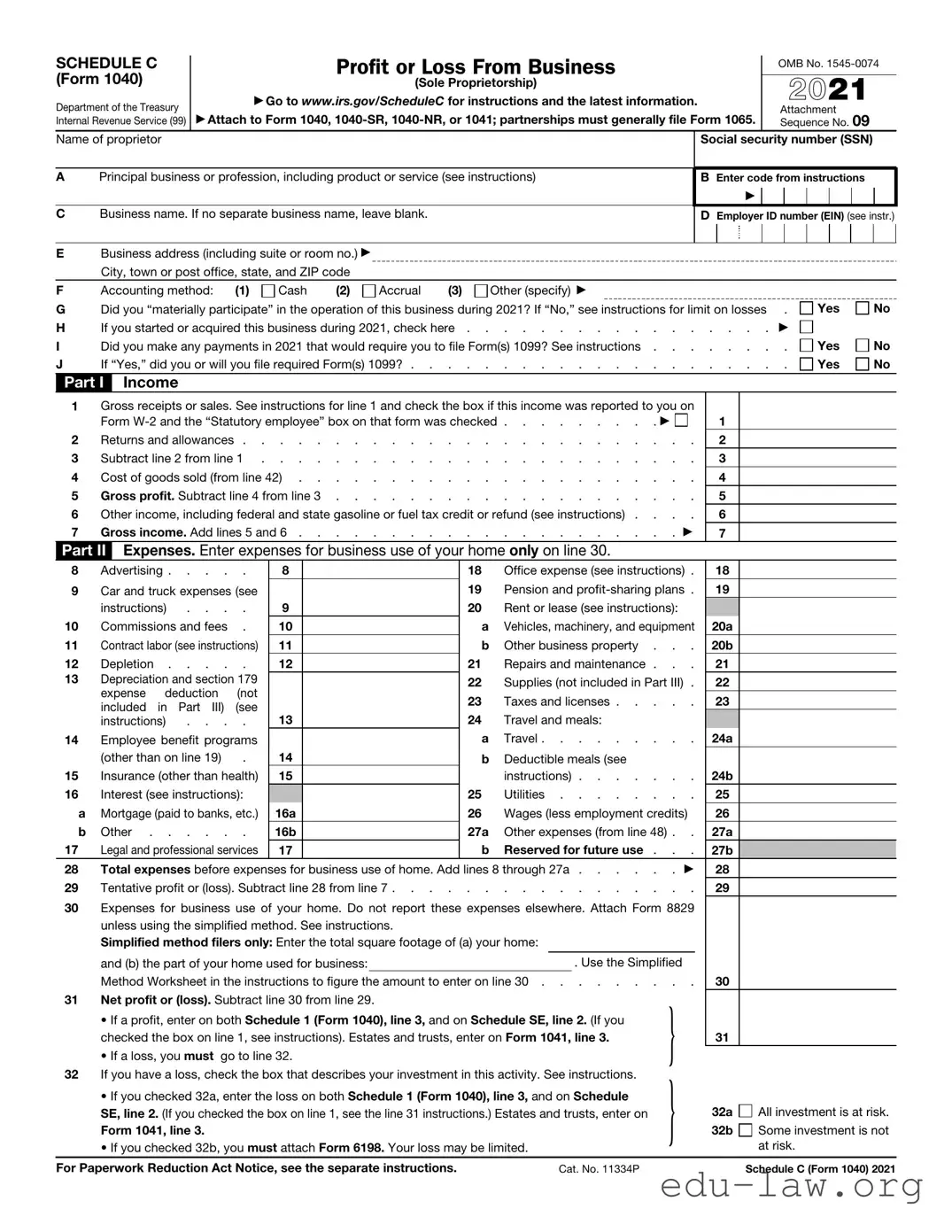

The IRS Schedule C form, utilized by sole proprietors to report their business income and expenses, shares similarities with IRS Form 1040 itself. Both documents are essential components of an individual's annual tax return. Just as Schedule C details the financial activities of a business, Form 1040 captures the individual's overall tax situation. Each form integrates into the broader picture of personal financial health, ultimately influencing one's tax liability based on the total income derived from various sources, including both employment and business operations.

Another document akin to Schedule C is the IRS Schedule E. This form is used for reporting supplemental income or loss from rental real estate, partnerships, S corporations, estates, trusts, and residual interests in REMICs. Like Schedule C, Schedule E requires the listing of income and associated expenses, albeit focused primarily on passive income streams. Both forms aim to provide a complete overview of the taxpayer's income sources, contributing to the accurate calculation of overall tax obligations.

IRS Form 1065 is also similar to Schedule C, designed for reporting income, deductions, and credits from partnerships. Just as sole proprietors must complete Schedule C, partnerships must file Form 1065, which aggregates the financial details for multiple stakeholders. Each partner then receives a Schedule K-1 summarizing their share of the partnership's income or loss, contributing to their individual tax returns. This interconnectedness highlights how both documents facilitate transparency in income reporting, whether for an individual entrepreneur or a group of partners.

IRS Form 1120S parallels Schedule C in the context of S corporations. This form allows S corporations to report their income, deductions, and credits. Similar to a sole proprietor's use of Schedule C, S corporation owners benefit from a pass-through mechanism that allows profits to be reported on their personal tax returns via Form K-1. The emphasis on accountability for income and expenses unites these forms in their role of ensuring accurate tax assessments for businesses of varying structures.

Another related document is the IRS Schedule F, utilized by farmers for reporting farm income and expenses. Much like Schedule C, Schedule F is tailored to capture the unique financial intricacies of farming, including various crops and livestock. Both forms require detailed reporting of revenue as well as deductible costs. This distinction illustrates the unique nature of agricultural businesses, while still functioning within the framework of overall income reporting for tax purposes.

The IRS Form 990 offers another parallel. Primarily used by tax-exempt organizations to disclose their financial information, it bears similarities to Schedule C in that it outlines revenues and expenses. Nonprofits file Form 990 to maintain transparency with the IRS and stakeholders. Both documents aim to accurately reflect financial health, although with differing implications based on the taxable status of the reporting entity.

IRS Form 941, which reports payroll taxes (including income tax withheld and Social Security contributions), is somewhat related as it highlights another dimension of income generation. Sole proprietors aren’t typically required to file this form unless they have employees. However, for those who do, Form 941 captures employment-related expenses, paralleling how Schedule C encapsulates the owner's business expenses and income. Both forms underscore the financial responsibilities to the IRS, although in different contexts.

Lastly, the IRS Form W-2 is frequently associated with Schedule C, even though it serves a different function. Employers issue W-2 forms to report an employee's annual wages and the taxes withheld. While Schedule C focuses on self-employment income without the employer-employee relationship, both forms ultimately contribute to understanding individual income in relation to tax obligations. This connection highlights the various pathways income can be reported, necessitating a complete and accurate tax return.