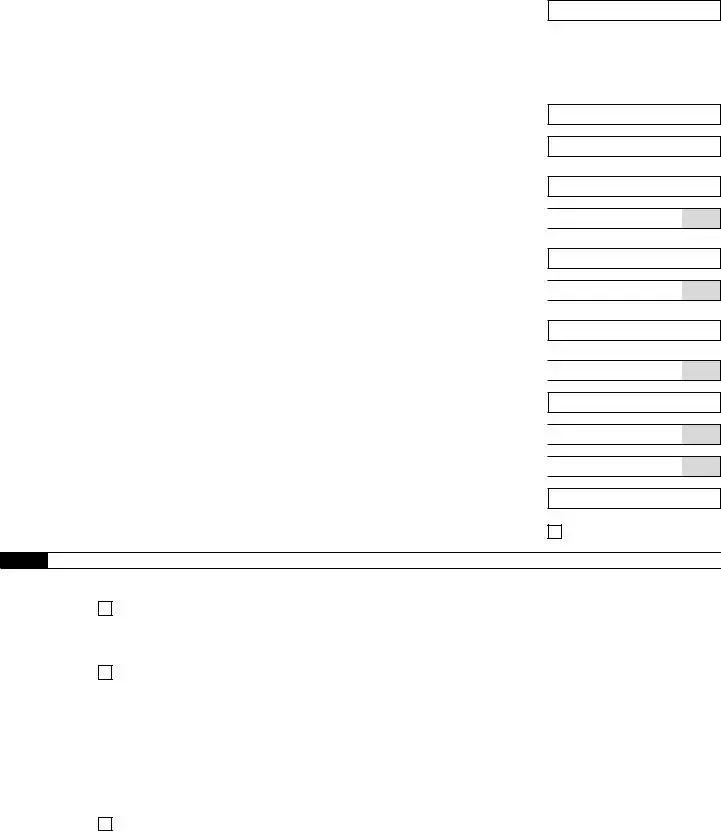

What is IRS Form 941?

IRS Form 941, officially known as the Employer's Quarterly Federal Tax Return, is a tax form that employers in the United States use to report income taxes, Social Security tax, and Medicare tax withheld from employees' paychecks. It also allows employers to report their share of Social Security and Medicare taxes. This form is filed quarterly, which means it needs to be submitted four times a year.

Who is required to file Form 941?

Employers who withhold income taxes, Social Security taxes, or Medicare taxes from their employees' wages must file Form 941. This includes businesses of all sizes, non-profit organizations, and individuals who pay wages to employees. If you are a sole proprietor without employees, you do not need to file this form.

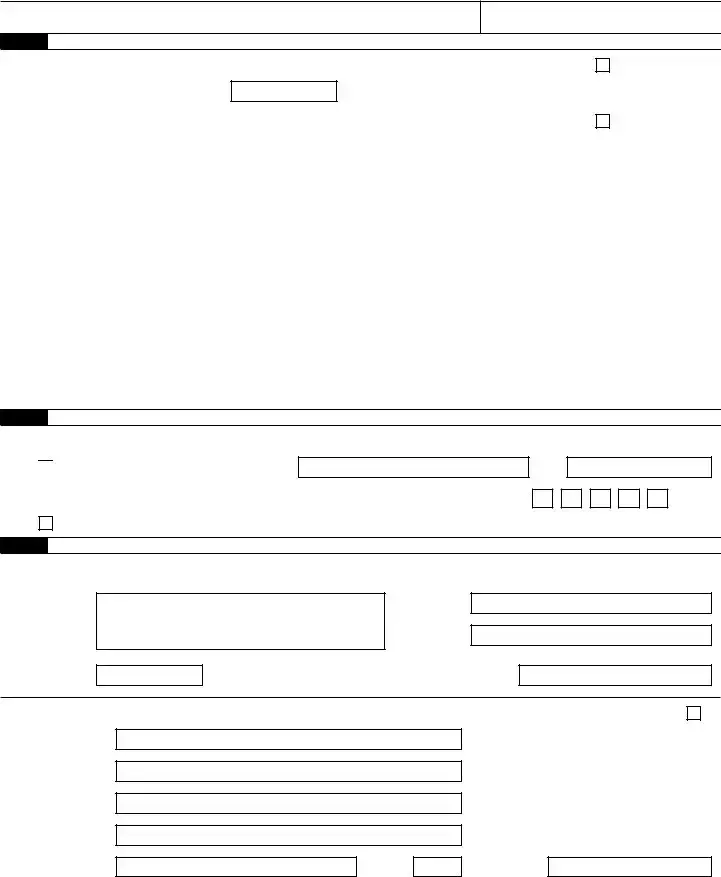

When is Form 941 due?

Form 941 is due on the last day of the month following the end of each quarter. The deadlines are as follows: April 30 for the first quarter (January - March), July 31 for the second quarter (April - June), October 31 for the third quarter (July - September), and January 31 for the fourth quarter (October - December). Late submissions may incur penalties and interest charges.

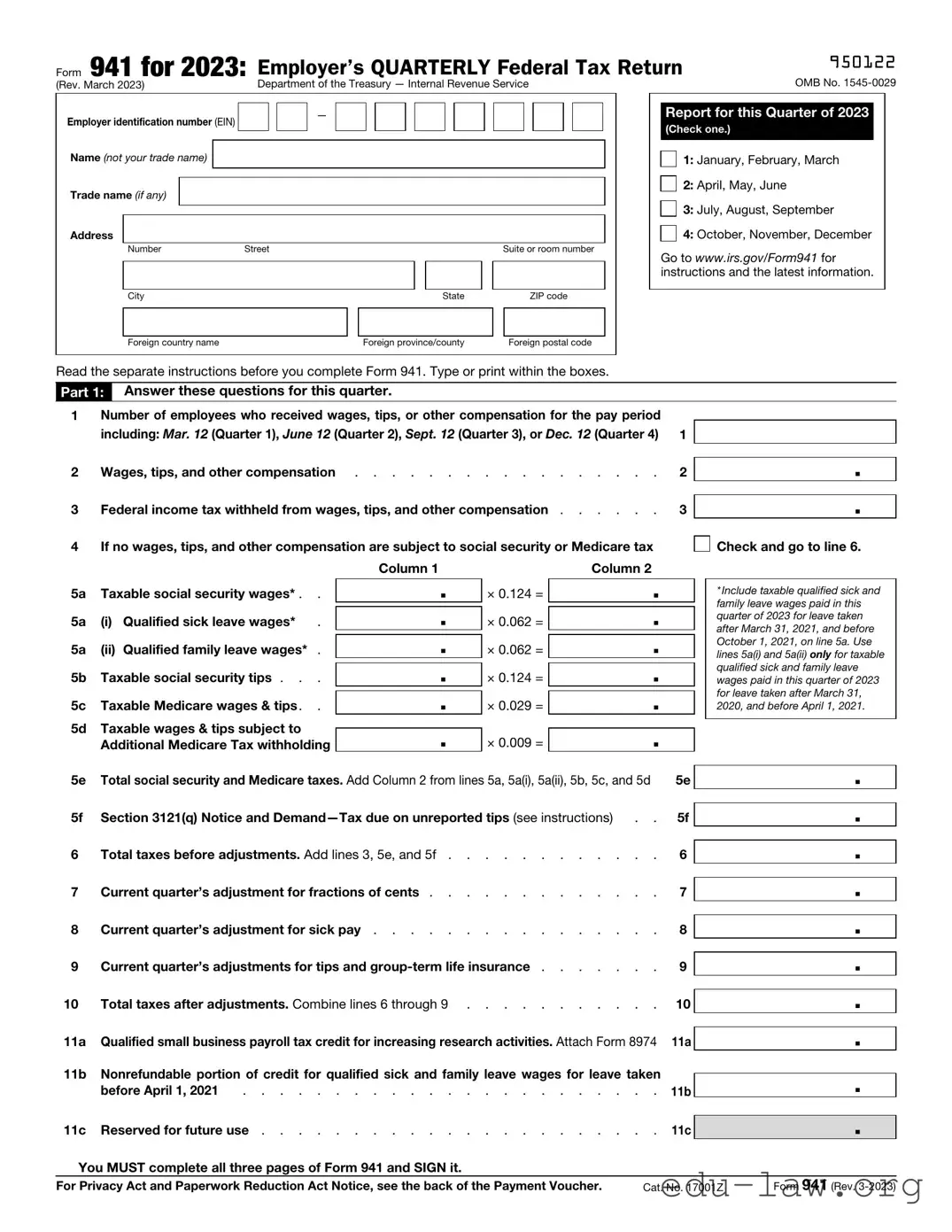

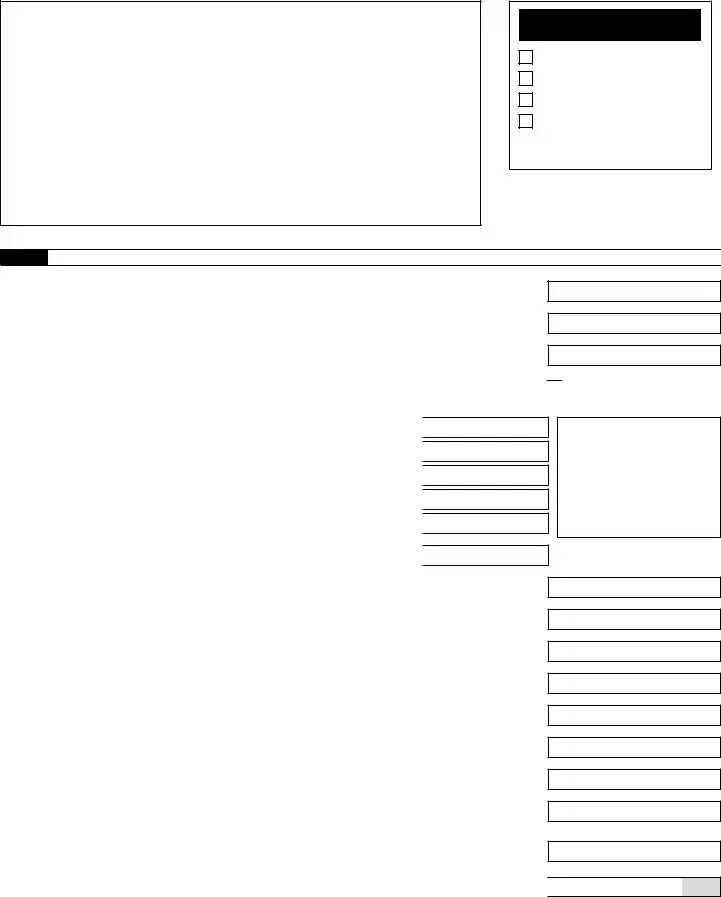

What information is required on Form 941?

Form 941 requires basic information such as the employer's name, address, and Employer Identification Number (EIN). Additionally, it needs the total number of employees, wages paid, and the amount of federal taxes withheld during the quarter. Employers must also calculate their share of Social Security and Medicare taxes, any advances received from the IRS, and any adjustments made from prior quarters.

Can Form 941 be filed electronically?

Yes, Form 941 can be filed electronically using the IRS e-file system. This option is often quicker and allows for faster processing. Additionally, many payroll software programs offer the capability to file Form 941 electronically, which makes the process more efficient for employers.

What if I make a mistake on Form 941?

If an error is discovered after submitting Form 941, employers can correct it by filing Form 941-X, Adjusted Employer's QUARTERLY Federal Tax Return or Claim for Refund. This form allows for adjustments to both the amounts reported and the explanations for the changes. It’s essential to act quickly to avoid any penalties or accrual of interest related to underreported taxes.

What are the penalties for failing to file Form 941?

Failing to file Form 941 on time can result in a variety of penalties. The IRS imposes a penalty of 5% of the unpaid tax for each month the return is late, with a maximum penalty of 25%. Additionally, if the form is filed more than 60 days late, the minimum penalty may be the lesser of $435 or 100% of the tax due. Interest may also accrue on unpaid taxes, increasing the amount owed over time.

Check and go to line 6.

Check and go to line 6.

.

. .

. .

. .

. .

.

Yes. Designee’s name and phone number

Yes. Designee’s name and phone number