What is the IRS 1099-MISC form?

The IRS 1099-MISC form is used to report various types of payments made in the course of business to individuals or non-corporate entities. This may include payments for services, rent, royalties, and other income. It provides the Internal Revenue Service a record of income that may not be included on a W-2 form, ensuring that individuals report all taxable income on their personal tax returns.

Who is required to file a 1099-MISC form?

Businesses and individuals are required to file a 1099-MISC form if they have paid $600 or more to a service provider, independent contractor, or other payees in a tax year. This includes payments to freelancers, attorneys, and even certain types of rent payments. However, exceptions exist, particularly for payments made to corporations, which generally do not require a 1099-MISC unless for certain specific types of payments.

When is the 1099-MISC form due?

For the 2023 tax year: The deadline for providing the recipient with their copy of the 1099-MISC is January 31. Additionally, the form must be submitted to the IRS by the end of February if filed on paper, or by March 31 if filed electronically. Meeting these deadlines is crucial to avoid potential penalties.

What types of payments are reported on the 1099-MISC form?

The 1099-MISC form captures several types of payments. Common examples include payments made for services performed by independent contractors, rents, prizes, awards, and certain medical and healthcare payments. Payments for legal services also need to be reported regardless of the amount paid. Understanding what qualifies is key to accurate reporting.

How do I fill out a 1099-MISC form?

Filling out a 1099-MISC involves collecting specific information, including the payer’s and payee’s name, address, and taxpayer identification number. The payment amount will be recorded in the appropriate box based on the type of payment being reported—be it non-employee compensation or rent. The form can be obtained from the IRS website or standard office supply retailers.

What happens if I don’t file the 1099-MISC form?

Failure to file the 1099-MISC form could lead to penalties from the IRS. The penalties can vary based on the size of your business and how late the form is filed. If the form is not filed at all, the IRS may assess other penalties, as they rely on the information from these forms to ensure proper tax reporting. Staying compliant is beneficial for both the business and the recipient.

Can I e-file the 1099-MISC form?

Yes, e-filing the 1099-MISC form is allowed and is often recommended for those filing numerous forms. The IRS supports e-filing through several authorized providers. E-filing can streamline the process and help reduce errors, so this option is worth considering, particularly for larger businesses.

What if I make an error on the 1099-MISC form?

If an error occurs on a submitted 1099-MISC form, it is essential to correct it as soon as possible. A new corrected form should be filed with the IRS, and the payee should be notified of the correction as well. It’s important to indicate that it is a corrected form, as this helps the IRS accurately reconcile the information.

Where can I find additional resources regarding the 1099-MISC form?

The IRS provides numerous resources and instructions on their official website related to the 1099-MISC form. This includes detailed documentation and examples for proper filing. Additionally, consulting with a tax professional can provide further personalized guidance based on specific circumstances, ensuring compliance and accuracy in reporting.

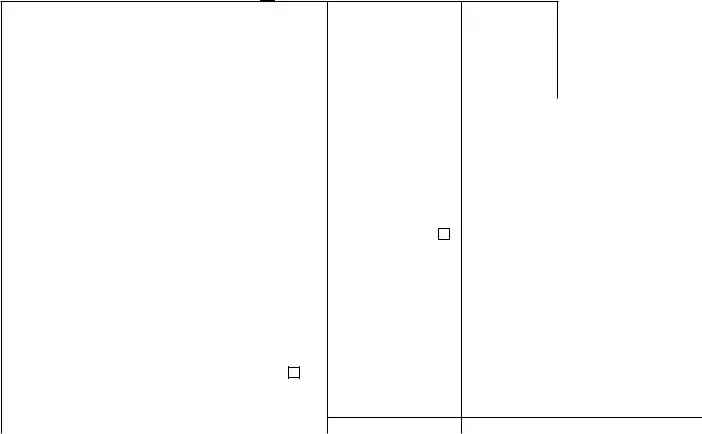

CORRECTED (if checked)

CORRECTED (if checked)

CORRECTED (if checked)

CORRECTED (if checked)