What is an Investment Letter of Intent?

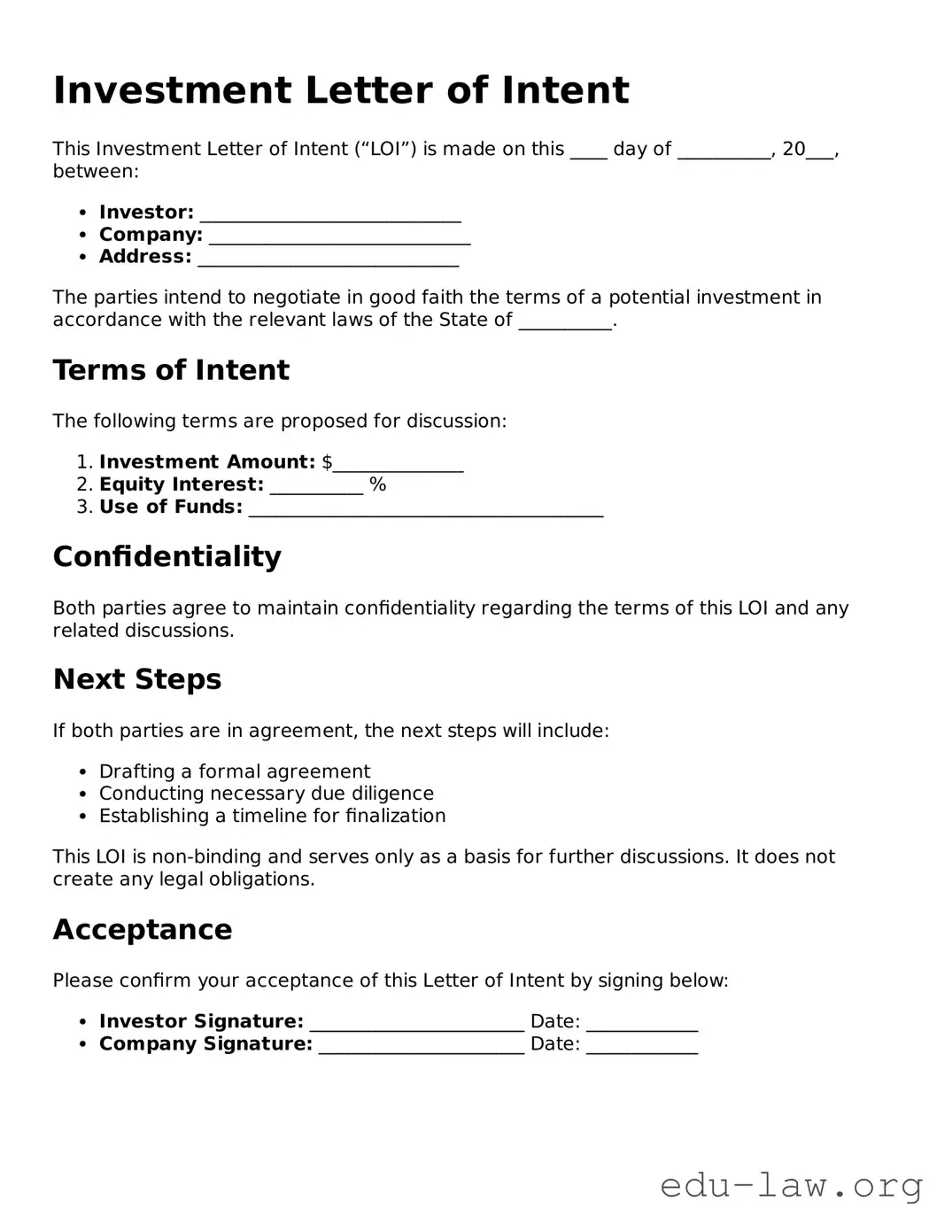

An Investment Letter of Intent (LOI) is a document that outlines the intention of an investor to commit capital to a specific investment. It serves as a preliminary agreement that details key terms and conditions before formal investment documents are executed. An LOI typically includes the amount of investment, the type of securities being considered, and other important conditions that will be part of the final agreement.

Who should use an Investment Letter of Intent?

Investors and companies looking for funding can benefit from using an Investment Letter of Intent. It is useful for startups seeking investments as well as established companies negotiating financial backing. The LOI provides clarity and establishes a mutual understanding of the investment terms before legal contracts.

Is an Investment Letter of Intent legally binding?

The Investment Letter of Intent is generally not legally binding, although some provisions may be binding if specified. It acts as an intention to agree to terms but is intended to guide further negotiations. Always review the specific language to understand which parts, if any, carry legal weight.

What are common components of an Investment Letter of Intent?

Common components include the amount of investment, valuation of the company, purpose of the funds, proposed timeline, and terms for due diligence. Some letters also specify confidentiality terms and non-binding clauses to protect both parties during negotiations.

Can changes be made to the Investment Letter of Intent after it is signed?

Yes, changes can be made to the Investment Letter of Intent. If both parties agree on modifications, they can simply draft a revised LOI. It’s important to communicate openly about any changes to ensure all parties are on the same page.

What should I do after signing the Investment Letter of Intent?

After signing the LOI, both parties should proceed with the due diligence process. This includes gathering necessary financial documents, reviewing the investment opportunity, and finalizing any remaining terms. After due diligence, a formal investment agreement can be drafted and signed.

How can an Investment Letter of Intent affect negotiations?

The Investment Letter of Intent can serve as a foundation for negotiations. It sets expectations and helps streamline the process by addressing key terms early on. However, if the LOI contains ambiguous language, it could complicate later negotiations, so clarity is essential.

Is legal advice recommended before signing an Investment Letter of Intent?

Yes, seeking legal advice is recommended before signing an Investment Letter of Intent. A legal professional can provide insight into the implications of the document and help ensure that your interests are protected. This step can prevent misunderstandings and potential disputes in the future.