What is a Gift Deed?

A Gift Deed is a legal document that facilitates the transfer of ownership of property or assets from one person to another without any exchange of money. Essentially, it allows the donor (the person giving the gift) to donate property to the recipient (the person receiving the gift). This deed must be executed voluntarily and can include various types of property, including real estate, vehicles, or personal items.

What are the essential elements of a Gift Deed?

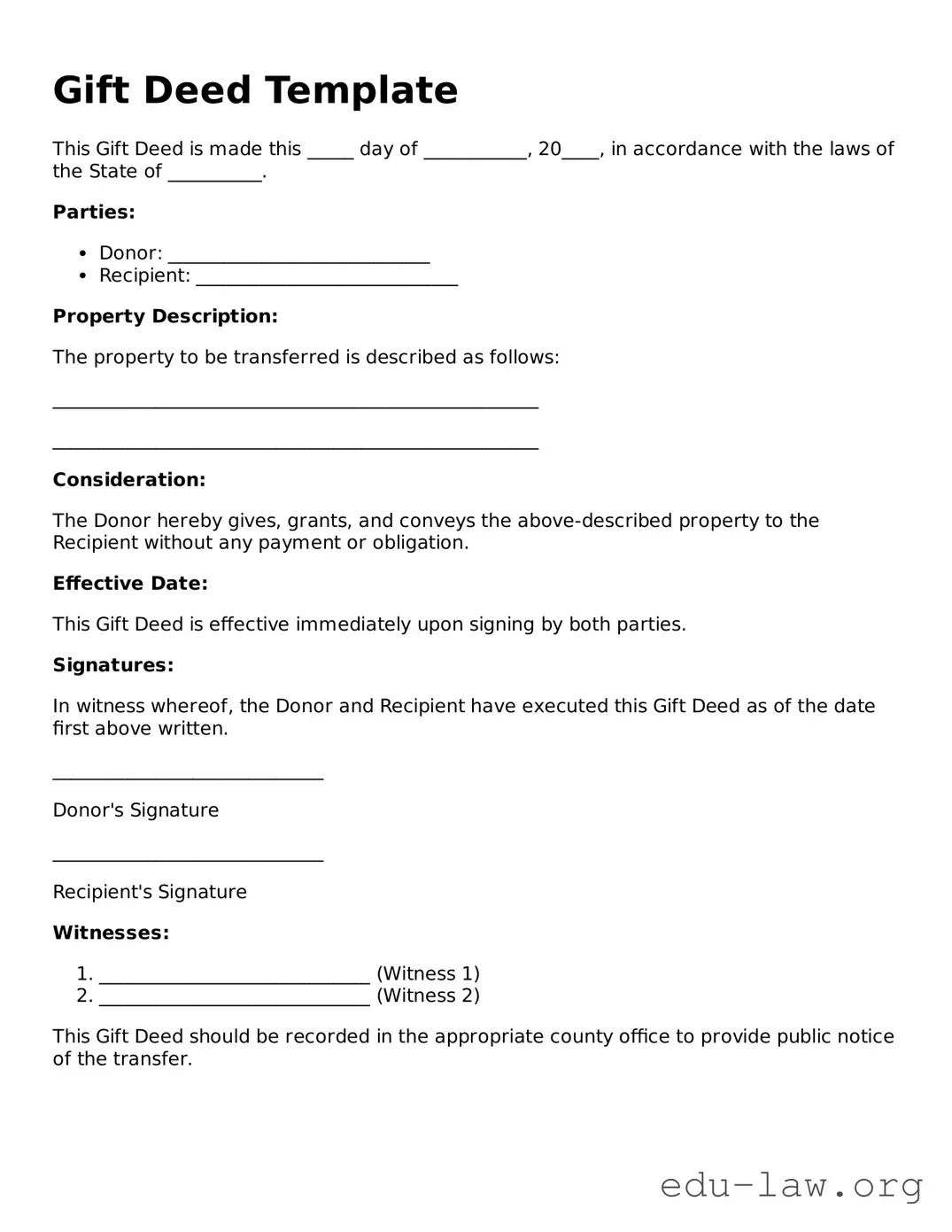

For a Gift Deed to be valid, it must typically include the following elements: a clear intention to give the gift, a description of the property being gifted, the names and details of the donor and recipient, and the signatures of both parties. Additionally, many states require the Gift Deed to be notarized and recorded, particularly when it involves real estate, to ensure that the transfer is legally recognized.

Are there any tax implications when using a Gift Deed?

Yes, there can be tax implications for both the donor and the recipient. The IRS allows individuals to gift a certain amount each year without triggering gift taxes. This limit is often updated, so it’s wise to check the current threshold. Gifts exceeding this amount may be subject to taxation. The recipient generally won’t face tax liabilities upon receiving the gift, but any future income generated from the gifted property could be taxable.

Can a Gift Deed be revoked?

Once a Gift Deed is executed and delivered, it is generally irrevocable. However, there may be exceptions based on state laws or if the deed contains specific language that allows for revocation. In some cases, if the donor retains some control over the property or does not fully transfer ownership, the courts may consider the deed void. It’s essential to consult legal advice if revocation is a concern.

What are the risks involved in executing a Gift Deed?

There are several risks associated with executing a Gift Deed. One potential issue is the possibility of disputes arising later, especially if family dynamics change. In other cases, the donor may not fully understand the implications of the gift, including tax liabilities. Additionally, if not properly executed, the Gift Deed could be challenged in court, which may result in delays or complications regarding property ownership.

Can a Gift Deed be used for real estate transactions?

Absolutely, a Gift Deed is commonly used for real estate transactions. When transferring property through a Gift Deed, it’s important to have the deed properly drafted and executed. As mentioned before, some states require that a Gift Deed be notarized and recorded with the appropriate local authority to ensure that the transfer is recognized legally. Always verify local requirements to avoid any issues.