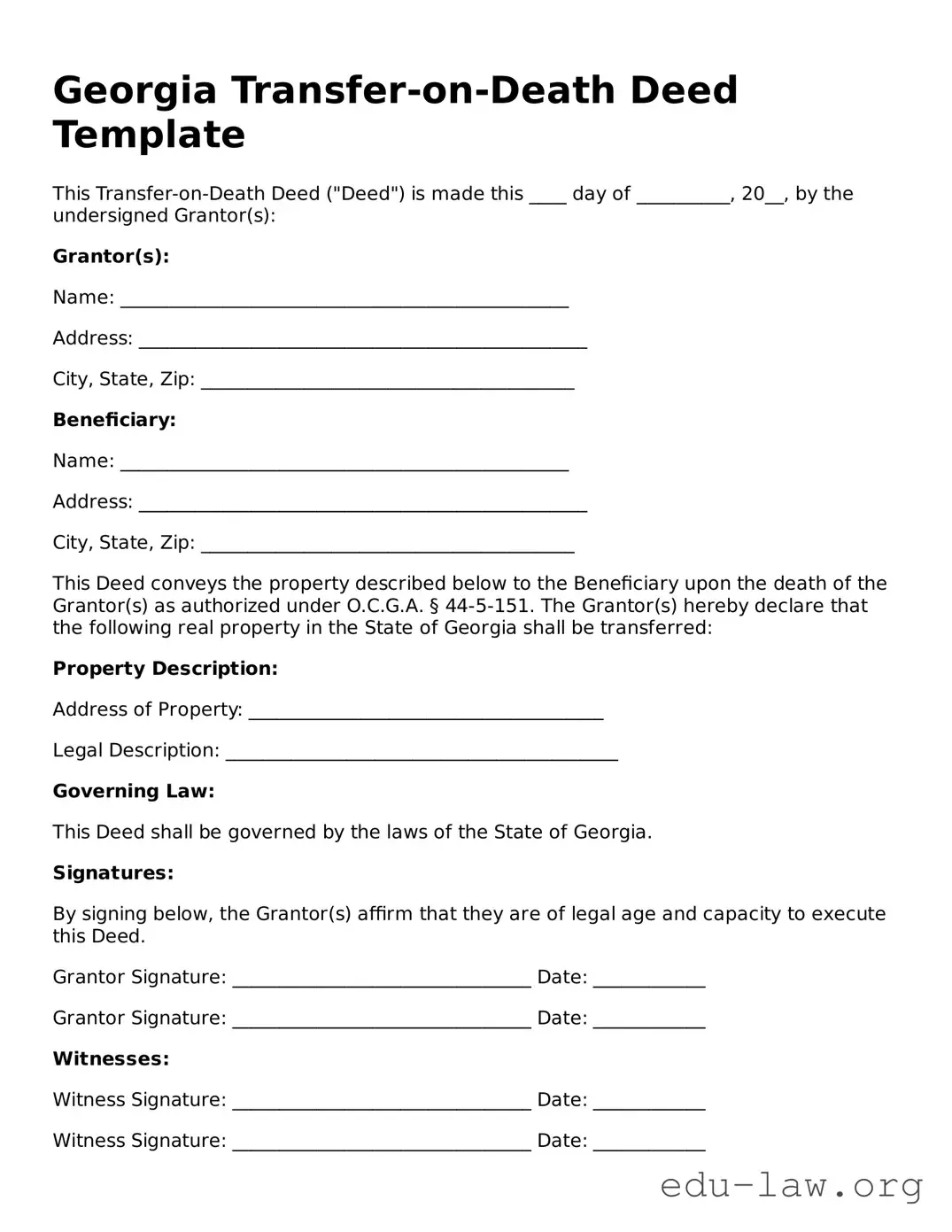

Georgia Transfer-on-Death Deed Template

This Transfer-on-Death Deed ("Deed") is made this ____ day of __________, 20__, by the undersigned Grantor(s):

Grantor(s):

Name: ________________________________________________

Address: ________________________________________________

City, State, Zip: ________________________________________

Beneficiary:

Name: ________________________________________________

Address: ________________________________________________

City, State, Zip: ________________________________________

This Deed conveys the property described below to the Beneficiary upon the death of the Grantor(s) as authorized under O.C.G.A. § 44-5-151. The Grantor(s) hereby declare that the following real property in the State of Georgia shall be transferred:

Property Description:

Address of Property: ______________________________________

Legal Description: __________________________________________

Governing Law:

This Deed shall be governed by the laws of the State of Georgia.

Signatures:

By signing below, the Grantor(s) affirm that they are of legal age and capacity to execute this Deed.

Grantor Signature: ________________________________ Date: ____________

Grantor Signature: ________________________________ Date: ____________

Witnesses:

Witness Signature: ________________________________ Date: ____________

Witness Signature: ________________________________ Date: ____________

State of Georgia, County of ________________

Subscribed and sworn to before me this ____ day of __________, 20__.

Notary Public: ______________________________________

My commission expires: ___________________________