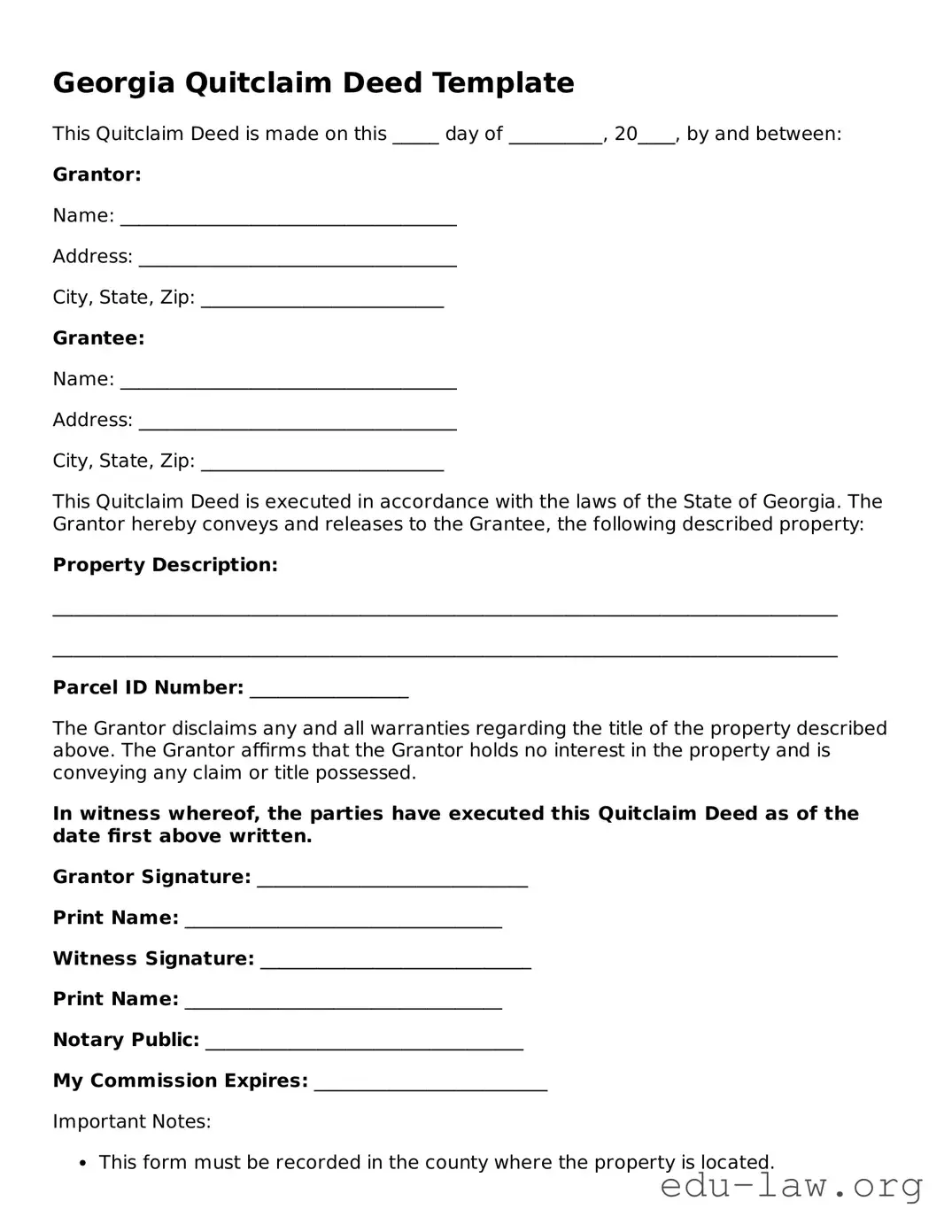

Georgia Quitclaim Deed Template

This Quitclaim Deed is made on this _____ day of __________, 20____, by and between:

Grantor:

Name: ____________________________________

Address: __________________________________

City, State, Zip: __________________________

Grantee:

Name: ____________________________________

Address: __________________________________

City, State, Zip: __________________________

This Quitclaim Deed is executed in accordance with the laws of the State of Georgia. The Grantor hereby conveys and releases to the Grantee, the following described property:

Property Description:

____________________________________________________________________________________

____________________________________________________________________________________

Parcel ID Number: _________________

The Grantor disclaims any and all warranties regarding the title of the property described above. The Grantor affirms that the Grantor holds no interest in the property and is conveying any claim or title possessed.

In witness whereof, the parties have executed this Quitclaim Deed as of the date first above written.

Grantor Signature: _____________________________

Print Name: __________________________________

Witness Signature: _____________________________

Print Name: __________________________________

Notary Public: __________________________________

My Commission Expires: _________________________

Important Notes:

- This form must be recorded in the county where the property is located.

- It is recommended to consult with an attorney for legal guidance specific to your situation.

- Check with local regulations regarding any additional requirements.