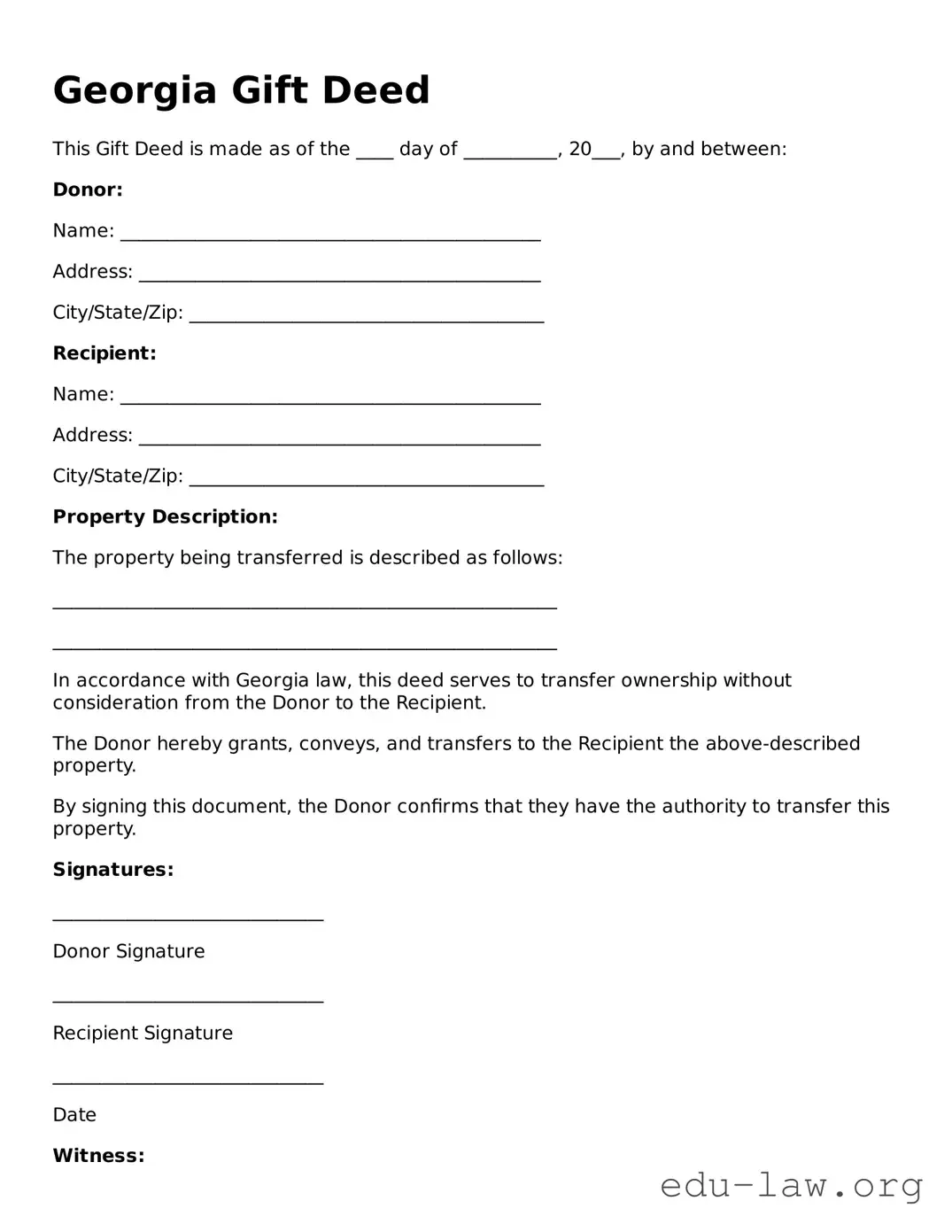

Georgia Gift Deed

This Gift Deed is made as of the ____ day of __________, 20___, by and between:

Donor:

Name: _____________________________________________

Address: ___________________________________________

City/State/Zip: ______________________________________

Recipient:

Name: _____________________________________________

Address: ___________________________________________

City/State/Zip: ______________________________________

Property Description:

The property being transferred is described as follows:

______________________________________________________

______________________________________________________

In accordance with Georgia law, this deed serves to transfer ownership without consideration from the Donor to the Recipient.

The Donor hereby grants, conveys, and transfers to the Recipient the above-described property.

By signing this document, the Donor confirms that they have the authority to transfer this property.

Signatures:

_____________________________

Donor Signature

_____________________________

Recipient Signature

_____________________________

Date

Witness:

Name: _____________________________________________

Address: ___________________________________________

City/State/Zip: ______________________________________

_____________________________

Witness Signature

Notary Public:

State of Georgia

County of ___________________________

On this ____ day of __________, 20___, before me, a Notary Public, personally appeared the Donor and Recipient, known to me to be the persons whose names are subscribed to this instrument and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I have hereunto set my hand and official seal.

_____________________________

Notary Public

My Commission Expires: _____________________________