What is a Georgia Durable Power of Attorney?

A Georgia Durable Power of Attorney is a legal document that allows you to designate someone to manage your affairs if you become incapacitated. Unlike a standard power of attorney, this document remains effective even if you are unable to make decisions for yourself. It can cover financial matters, health care decisions, or both, based on your preferences.

Who can be appointed as an agent under this form?

You can appoint any adult you trust as your agent. This can be a family member, friend, or a professional like an attorney. It is important to choose someone who understands your wishes and is willing to act in your best interests. The agent will have the authority to manage your financial matters and make decisions as outlined in the document.

How do I create a Durable Power of Attorney in Georgia?

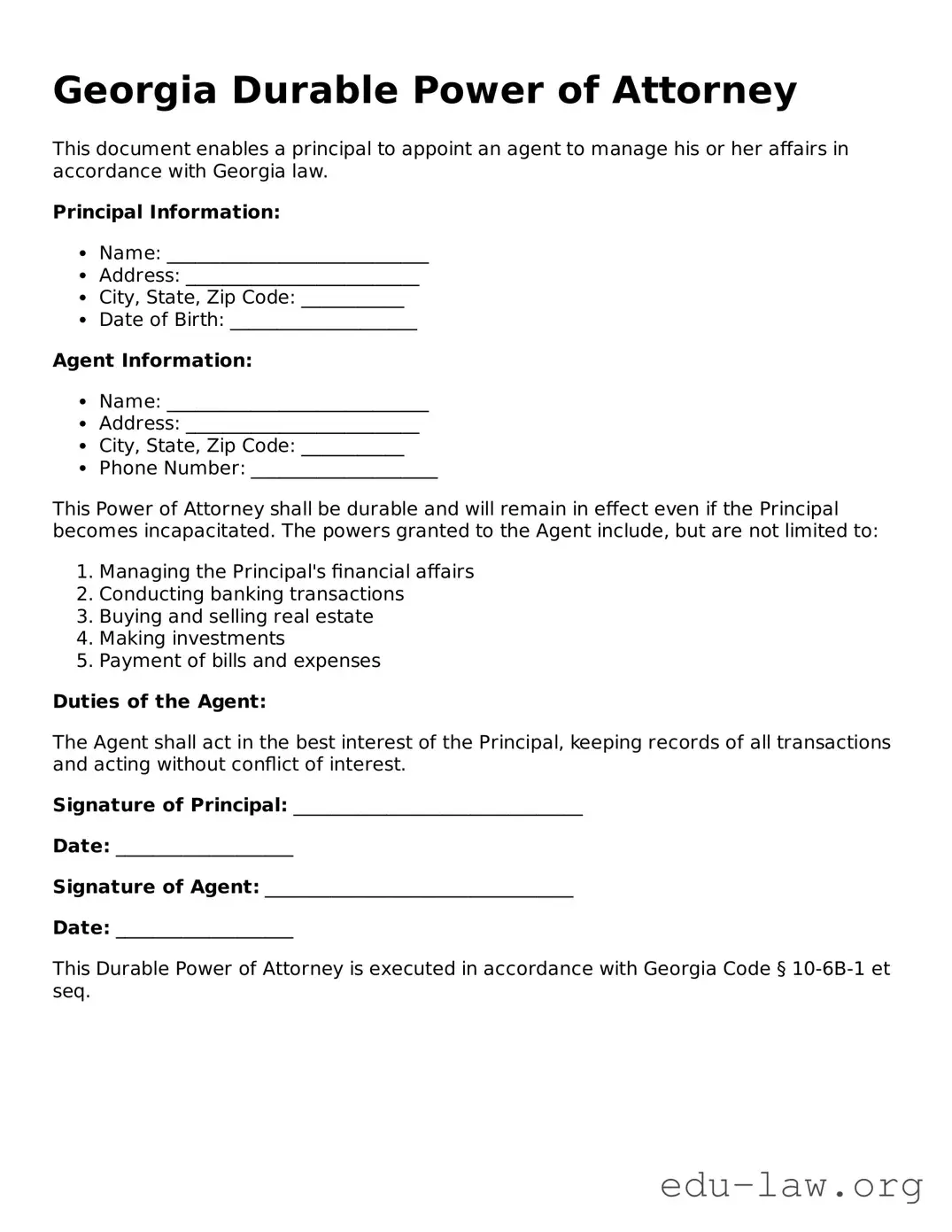

To create a Durable Power of Attorney in Georgia, you need to fill out the appropriate form. You must clearly state your wishes and designate your chosen agent. Once completed, you and the agent should sign the document in the presence of a notary public and, if required, witnesses. Make sure to keep copies in a safe place and provide copies to your agent and family members.

Can I revoke my Durable Power of Attorney?

Yes, you can revoke your Durable Power of Attorney at any time as long as you are still capable of making decisions. To revoke it, you should create a written statement that clearly indicates your intent to revoke the power of attorney. It is advisable to inform your agent and any institutions that may have a copy of the original document about the revocation to avoid any confusion.

What happens if I do not have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, your loved ones may face difficulty managing your affairs. A court might need to appoint a guardian or conservator, which can be a lengthy and expensive process. Having a Durable Power of Attorney allows you to choose someone you trust to handle your affairs without court intervention.

Is a Durable Power of Attorney effective immediately?

A Durable Power of Attorney can be designed to be effective immediately upon signing or to take effect only upon your incapacity. This second option is known as a “springing” power of attorney. You should clearly state your intention in the document to ensure that your wishes are followed regarding when the authority should begin.