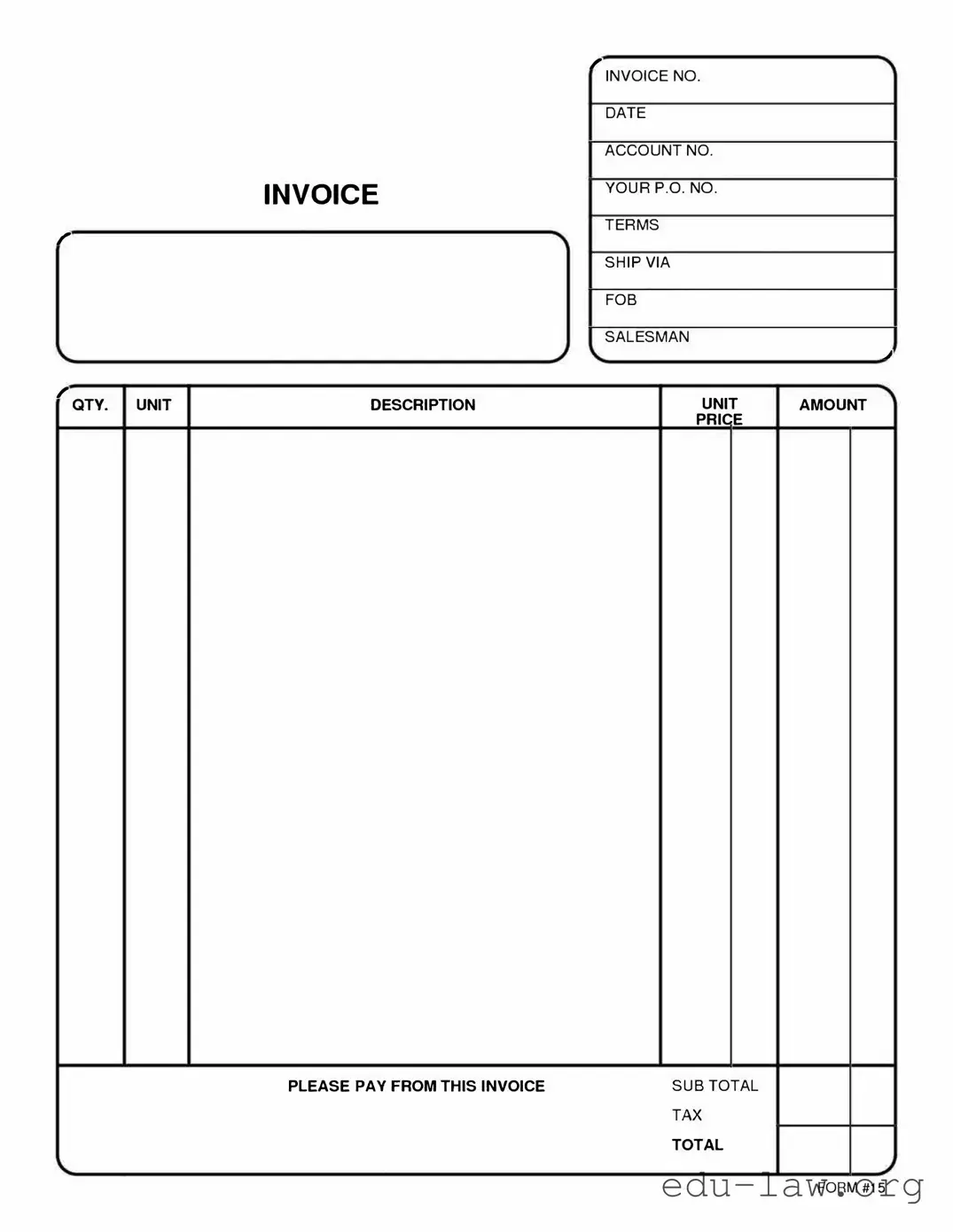

The Free And Invoice PDF form can be likened to a traditional invoice. An invoice provides a detailed list of goods or services provided, including the costs and payment details. Both documents aim to facilitate the billing process for businesses and customers, ensuring clarity on what is owed. The format often includes important fields like the date, the parties involved, and payment instructions, making it essential for accurate record-keeping.

Another document similar to the Free And Invoice PDF form is a receipt. Once payment is made, a receipt serves as proof of that transaction. Receipts typically include similar information found on invoices, such as the date, amount, and details of the purchase. Both documents are crucial for financial records but serve different purposes; invoices request payment while receipts confirm payment has been received.

Quotations share common ground with the Free And Invoice PDF form as well. A quotation outlines potential fees for services or products, allowing customers to gauge costs before making a commitment. Similar to invoices, quotations itemize services or goods, but they are not yet formal requests for payment. Both documents help streamline the purchasing decision process and set expectations regarding costs.

An estimate is a document that, like a quotation, provides potential costs for services or products. Estimates usually encompass rough calculations of expenses, allowing customers to budget accordingly. While invoices demand payment after the fact, estimates create a preliminary dialogue between service providers and clients, helping both parties align on expected financial commitments.

The purchase order (PO) functions in a similar vein as the Free And Invoice PDF form by acting as a formal agreement to buy goods or services. A purchase order is typically generated by the buyer and sent to the seller, outlining what is being purchased and at what price. Once accepted, it becomes a binding contract, just like an invoice is a binding document when it comes to payment obligations.

Credit memos also align closely with the Free And Invoice PDF form. A credit memo adjusts the record of a sale, indicating a reduction in the amount owed due to returns, allowances, or billing errors. While invoices request payment, credit memos reflect changes to the initial amount billed, demonstrating how both tools are vital for maintaining accurate accounting records.

Work orders are another document category similar to the Free And Invoice PDF form. A work order initiates the process of providing services and typically includes detailed descriptions of the work to be completed and the associated costs. Like invoices, they capture essential information about the transaction and set expectations between service providers and clients as work begins.

Contracts may also bear similarities to the Free And Invoice PDF form. Though primarily focused on the agreement terms between parties, contracts often involve payment schedules and service-related details. They serve as a legal framework for delivering services or goods, ensuring that all parties are on the same page regarding obligations, timelines, and financial arrangements, much like invoices do when billing for completed work.

Billing statements can be considered similar to the Free And Invoice PDF form as well. These documents provide a summary of charges incurred over a specific period. Billing statements may combine information from multiple invoices, giving customers a comprehensive overview of their account status. Both documents facilitate communication about financial exchanges, ensuring clarity in what is owed and promoting better financial management.

Finally, statements of account are akin to the Free And Invoice PDF form. These statements consolidate a customer's account activity over a set period, including all invoices, payments, and credit adjustments. They serve as a snapshot of financial health between a buyer and seller. Both documents aim to provide vital information for maintaining transparent financial relationships and ensuring obligations are fulfilled.