What is a Florida Transfer-on-Death Deed?

A Florida Transfer-on-Death Deed is a legal document that allows a property owner to pass their real estate assets to a designated beneficiary upon their death, without the property going through probate. This form of transfer helps to simplify the process and reduce costs associated with estate matters.

How does a Transfer-on-Death Deed work?

When the property owner dies, the beneficiaries named in the deed automatically receive full ownership of the property. The deed does not need to be probated, which can save time and money. However, the property owner retains all rights to the property while they are alive, including the ability to sell or mortgage it.

Who can be a beneficiary in a Transfer-on-Death Deed?

Any individual can be designated as a beneficiary in a Transfer-on-Death Deed, but it is often best to choose someone who is of legal age. Additionally, multiple beneficiaries can be named, in which case the property will be divided according to the specifications laid out in the deed.

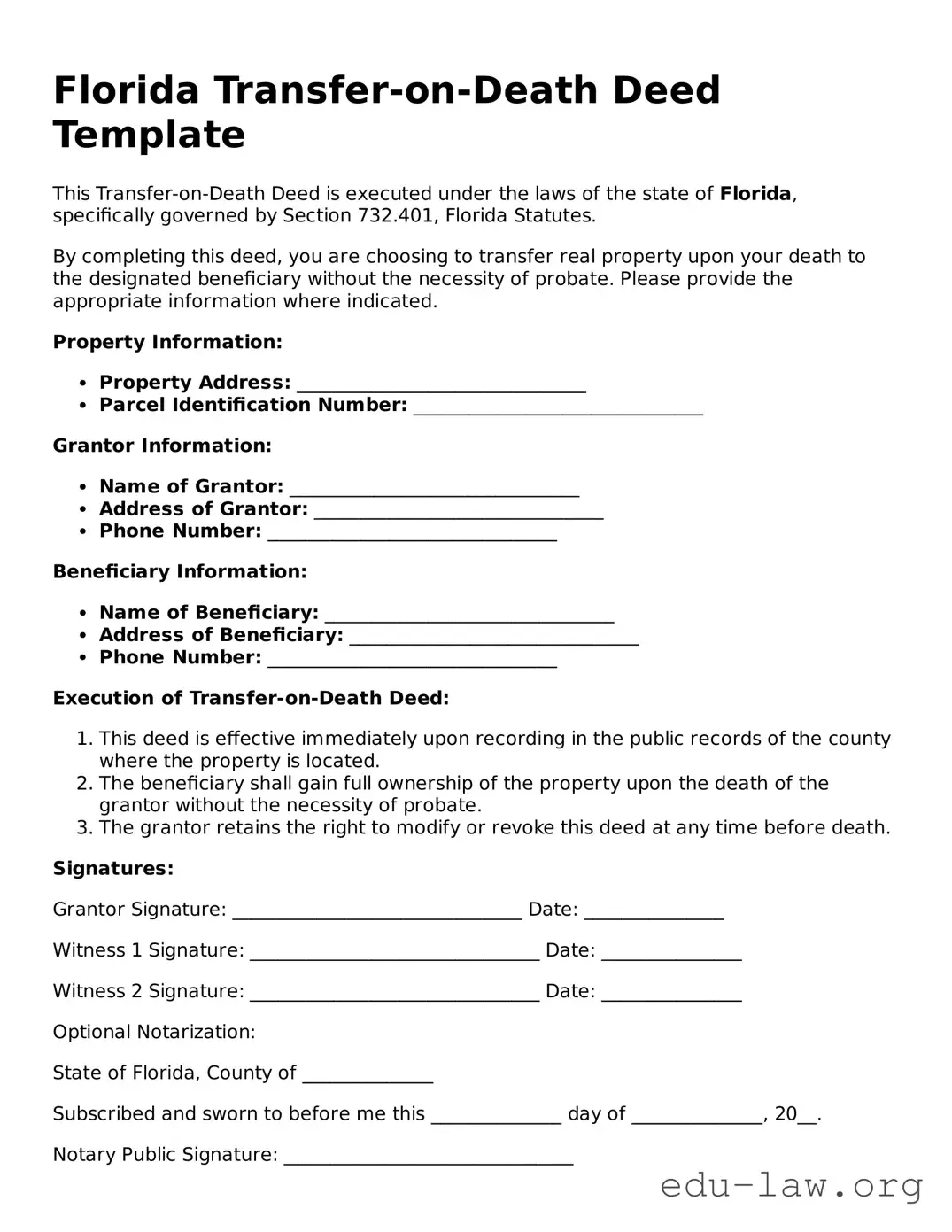

Are there any requirements to create a Transfer-on-Death Deed in Florida?

Yes, to create a valid Transfer-on-Death Deed in Florida, the document must be signed by the property owner and witnessed by two individuals. The deed should then be recorded in the county where the property is located to become effective.

Can a Transfer-on-Death Deed be revoked?

Absolutely. The property owner has the right to revoke or change a Transfer-on-Death Deed at any time before their death, provided they follow the correct legal procedures. This may involve recording a new deed or a specific revocation form.

What happens if a beneficiary dies before the property owner?

If a named beneficiary dies before the property owner, their interest in the property typically terminates. However, if multiple beneficiaries are named, the surviving beneficiaries may still inherit the property, or the deed can specify alternate beneficiaries in such cases.

Are there tax implications linked to a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not incur tax liability at the time of transfer. However, once the property is transferred to the beneficiary upon the owner's death, it may be subject to estate taxes. It’s advisable to consult a tax professional to understand potential implications.

Is a lawyer required to draft a Transfer-on-Death Deed?

While a lawyer is not strictly required to draft a Transfer-on-Death Deed, seeking legal advice can ensure that the document is properly completed and aligns with your wishes and state laws. This can help avoid any future disputes or complications.

What should I consider before completing a Transfer-on-Death Deed?

Before completing a Transfer-on-Death Deed, consider your overall estate plan and whether this method of transfer aligns with your goals. Factors like family dynamics, potential tax implications, and your intentions regarding the property should all be thoroughly evaluated.

Can a Transfer-on-Death Deed be used for all types of property?

A Transfer-on-Death Deed can only be used for residential real estate. It is important to note that it may not apply to other assets such as personal property or financial accounts. Always check specific regulations concerning your property type.