What is a Florida Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer ownership interest in real property from one party to another. It is often used in situations where the transferer is not guaranteeing clear title. This means that the person granting the deed does not promise the property is free of liens or other claims. The recipient receives whatever interest the grantor has, if any.

When should I use a Quitclaim Deed in Florida?

A Quitclaim Deed is commonly used in several scenarios. These include transferring property between family members, finalizing a divorce settlement, adding or removing a spouse's name from the property title, or when an estate is being settled. It is a quick way to transfer ownership without a formal sale process.

How do I complete a Quitclaim Deed in Florida?

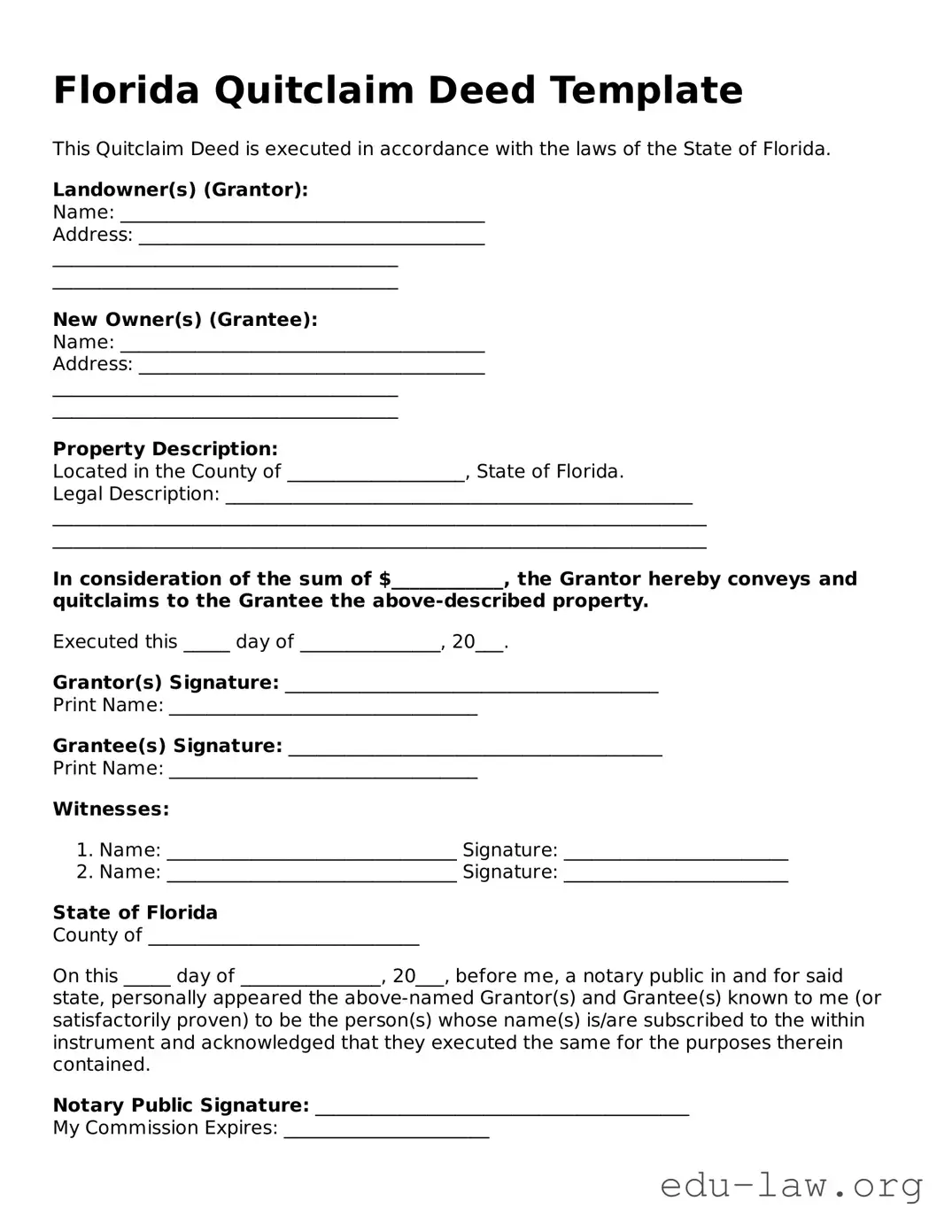

The Quitclaim Deed must include the names and addresses of both the grantor and the grantee, a legal description of the property, and the signatures of the grantor. It can be helpful to consult a real estate professional or an attorney to ensure all necessary details are included and correct.

Does a Florida Quitclaim Deed need to be notarized?

Yes, a Quitclaim Deed must be notarized in Florida. After the grantor has signed the deed in the presence of a notary, it should also be recorded with the county clerk's office where the property is located to give it legal effect and to notify the public of the change in ownership.

Are there any tax implications when using a Quitclaim Deed in Florida?

While a Quitclaim Deed itself does not incur taxes, certain situations can have tax implications. For example, transferring property may trigger documentary stamp taxes, especially in sales or exchanges. Consult a tax professional to understand how this may affect your individual circumstances.

Can a Quitclaim Deed be contested in Florida?

Yes, a Quitclaim Deed can potentially be contested. If a party believes there was fraud, undue influence, or lack of consent at the time of signing, they may challenge the validity of the deed in court. Legal advice is often recommended in such situations.

What is the difference between a Quitclaim Deed and a Warranty Deed?

A Quitclaim Deed offers no warranties about the property’s title, whereas a Warranty Deed guarantees that the grantor holds clear title to the property. If any issues arise with the title, the grantor is not liable in a Quitclaim Deed. In contrast, the grantor of a Warranty Deed is responsible for any claims against the title.

Is a Quitclaim Deed the same as a gift?

A Quitclaim Deed can be used to give property as a gift, but it is not inherently a gift in itself. When a property is transferred via a Quitclaim Deed without consideration, it is essentially a gift. However, it is crucial to document the intent clearly, as it can affect tax responsibilities.